What Is The Difference Between Hmo And Ppo Health Insurance – Get 24/7 care via video chat from the comfort of your home or wherever you are. Join today and experience primary care designed for real life, in the office and in the app.

Most people with health insurance get it through their employers through open enrollment, although only a small minority understand the intricacies of insurance well enough to feel they’ve made the right choice. This handy guide will help you understand the key differences between PPO and HMO plans and help you make the right choice.

What Is The Difference Between Hmo And Ppo Health Insurance

HMO prices are fixed (you only pay for services covered by insurance), but there are a few restrictions; you must contact your network provider and select a primary care provider (PCP). PPOs offer more flexibility because you can see out-of-network providers, but prices can vary significantly depending on a variety of variables, including who you see, whether the visit is covered by your deductible, and whether the provider you see is in-network.

How To Choose A Health Insurance Plan That’s Right For You

If you have a preferred PCP and/or location, be aware that you may need to change if you choose an HMO plan. HMOs require that you designate one PCP on your insurance to be responsible for managing and coordinating your health care. An HMO plan may limit your ability to see doctors you’ve seen before if they’re out of network.

PPO plans offer more flexibility in this regard, as you can book appointments with providers that are in the PPO network as well as with out-of-network providers (although you may pay a higher rate if you choose the latter).

If you have an HMO plan, you’ll need a referral from your PCP if you need to see a specialist, even for routine services like seeing a dermatologist for a mole check. PPO plans often don’t require referrals, meaning you can make an appointment with a specialist directly without consulting your PCP.

While the freedom of a PPO plan may seem appealing, remember that PCPs play a valuable role in helping you evaluate the best plan of action for your health goals. In addition to evaluating treatment options, your PCP can help you avoid expensive and unnecessary tests and procedures that your specialist might otherwise order. Whether you choose a PPO or an HMO, we recommend that you get into the habit of consulting with your PCP before making any medical decisions.

Medicare Advantage Plans

Most PPO plans allow you to contact a provider outside of your home region with little or no interruption in coverage. HMO plans usually limit where you can be seen, although you can get emergency care in other cities. If you travel a lot, a PPO plan may be a better option because it’s more flexible – which can be especially useful if something unexpected happens and you need to seek help urgently.

HMO plans are great for many people because they can use them over time without paying anything more than a co-pay. There are exceptions to this rule, so it’s important to understand how your coverage works and what services you may need that aren’t covered by your plan.

With a PPO plan, you have the freedom to choose the health care providers and specialists you want to see. But even if you go to the doctor as often as someone on an HMO plan, you may end up paying a lot more because you’ll have to cover the costs until you meet your deductible. Most PPO plans require you to meet a deductible before your insurance will pay for your health care.

As you consider these decisions when choosing a health plan during open enrollment, you will be making decisions based on your lifestyle and access to health care. If you feel you didn’t pick the right plan last year, use this as an opportunity to learn and plan ahead for the current open enrollment period to make sure you make the right choice this time. The reference guide below can help you quickly determine which plan is best for you, based on your preferences.

Medicare Hmo Vs. Ppo

Kevin Potter is a member of the billing team at One Medical Group, where he works as an insurance specialist in the New York office. Kevin spends time working directly with each insurance company to ensure claims are processed appropriately. When he’s not busy helping to streamline the ever-evolving healthcare system, Kevin enjoys giving new names to dogs he spots on the street, napping, discussing string theory, and building forts. Learn more about One Medical Group and our convenient locations in San Francisco, New York, DC, Boston and Chicago.

The One Medical Blog is published by One Medical, a national, modern primary care practice that combines 24/7 virtual care services with engaging and convenient in-person care at over 100 locations across the United States. One Medical’s mission is to transform healthcare for patients through a people-centered, technology-enabled approach to care for people at every stage of life.

Any general advice posted on our blog, website or app is for informational purposes only and is not intended to replace or replace any medical or other advice. 1Life Healthcare, Inc. and One Medical entities make no representations or warranties and expressly disclaim any liability regarding the treatment, action or effect on any person as a result of the general information offered or available on the blog, website or application. If you have specific concerns or a situation arises where you need medical advice, you should consult an appropriately trained and qualified healthcare professional. There you will find the lowest available health insurance rates. Depending on your income and household size, you may also qualify for government rebates under the Affordable Care Act. Our rates are unbeatable.

We have made this process as simple as possible. Receive accurate offers in seconds, without having to enter your email address or phone number. Use online tools to help you quickly find the plan that best suits your needs. Register in minutes on your computer or mobile device using our quick and easy online process.

Hdhp Vs. Ppo: What’s The Difference?

Now that the Affordable Care Act is in place, everyone must have health insurance, but that doesn’t mean health care has become any less confusing. When it comes to insurance, we tend to go with what we know or what we’ve always had, but the reality is that you have options.

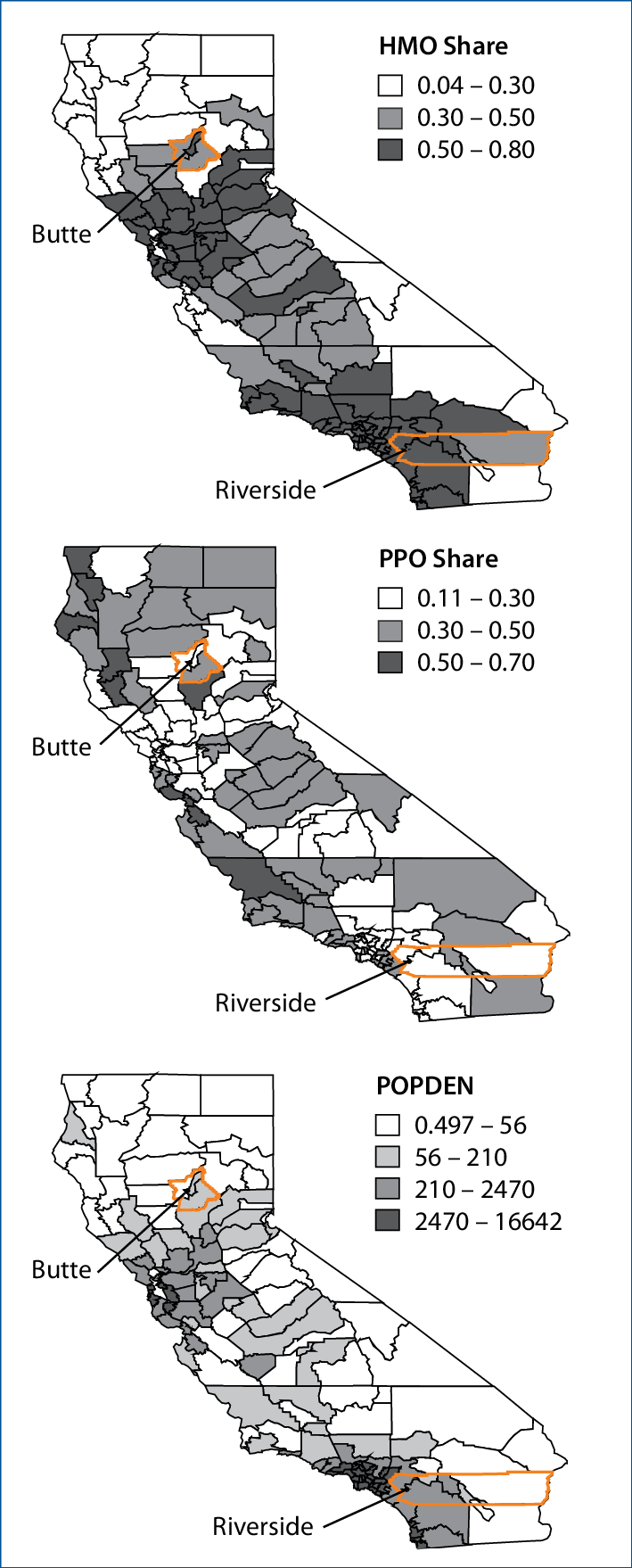

In California, health insurance plan options primarily include health maintenance organizations (HMOs) and preferred provider organizations (PPOs). There is a third option, the Exclusive Provider Organization (EPO), which is becoming increasingly popular in California.

While all of these plans can provide the protection you need, it’s important to understand each one individually and then compare them to each other. Not understanding the differences between HMO, PPO, and EPO plans can lead to significant unexpected costs and the disappointment of switching doctors due to insurance changes. These plans provide coverage, but there are significant differences in how they work and how much they cost.

Whether you’re uninsured and looking to buy a plan soon or simply exploring your options as a Californian, we’ve provided some information about HMOs, PPOs, EPOs, and Kaiser Permanente.

What’s The Difference Between Hmo And Ppo Plans?

Of the three types of plans—HMOs, PPOs, and EPOs—HMOs and PPOs are at two opposite ends of the spectrum, and EPO plans fall somewhere in the middle. First, you should recognize the difference between HMO and PPO plans. Then you can see where EPO fits in, as a hybrid of the other two.

HMO plans primarily focus on the primary care physician (PCP). Your PCP is the doctor you go to for annual checkups or when you’re sick. You can choose your PCP, but he or she must be part of the local HMO provider network. Here are more specs on HMOs:

But what happens when your PCP decides you don’t need additional treatment? Or maybe your condition does not require a visit to a specialist? These situations can happen and should be taken into account. If you choose a PCP you trust, this probably won’t cause any problems.

All health care is provided in-network – if you find an out-of-network provider, you are responsible for paying out-of-pocket costs. If you have a doctor you like, anticipate a change in insurance, and are considering an HMO plan, make sure your doctor is in the HMO plan’s network. If not, you will need to change doctors to have a PCP in your plan’s network.

Hmo Vs Ppo: How To Pick Your Health Insurance Plan

There is one exception to the HMO network rule. You might be wondering – what if I’m on vacation and something urgent happens? In this case:

Generally, HMO chains are small, but an HMO plan has two advantages – both in the financial category. Because you work in an HMO network, you’ll probably never need to make a claim

What is the difference between medicare hmo and ppo, difference between hmo and ppo insurance plans, what is the difference between ppo and hmo medicare plans, what is the difference between an hmo and ppo plan, what is difference between hmo and ppo health insurance, what is the difference between humana hmo and ppo, what is the difference between cigna hmo and ppo, what is the difference between hmo ppo and epo, difference between ppo and hmo insurance, what is the difference between medicare advantage ppo and hmo, difference between hmo & ppo insurance, what the difference between ppo and hmo health insurance