Insurance Meaning Deferred – At first glance, life insurance and annuity may seem like opposites. Life insurance is primarily used to pay your heirs when you die. Annuities grow your savings and provide you with income for as long as you live. However, some life insurance policies allow you to build savings while you are still alive,

And annuities can include death payments. Here’s how the two options compare and when each makes sense.

Insurance Meaning Deferred

An annuity is a type of insurance contract designed to convert your money into future payments. You buy an annuity with a single payment or multiple payments over time. You can set the growth period year that will build the stock. The return depends on the type of year. For example, fixed annuities pay a guaranteed interest rate. A variable annuity allows you to invest in mutual funds.

Deferred Tax Assets And Liabilities

When you’re ready, you can start collecting income from your annuity. You can set up these payments over a period of time or guarantee that they will continue for the rest of your life. For this reason, an annuity can be a form of insurance for a very long life without money.

You can create a death benefit in an annuity contract. With this feature, the annuity will pay your heirs based on the terms of the contract and your balance. For example, if you bought an annuity for $500,000 and accumulated $300,000 in income, the death benefit could pay the remaining $200,000 to your heirs.

With a life insurance policy, you sign up for a death benefit. If you die while under protection, your heirs receive this death benefit. There are different types of life insurance policies. Only term life insurance provides a death benefit. It is also temporary and expires after a few years.

A life insurance policy can last your entire life. A term policy also creates cash value, withdrawing money while you are alive. The value of your money provides a return that can grow over time. The refund depends on the type of policy. A whole life insurance policy pays a fixed rate of interest. A variable life insurance policy allows you to invest in sub-accounts, such as mutual funds, and your growth depends on how your investments perform.

What Are Deferred Tax Assets And Liabilities?

With cash value, you can use life insurance for future purposes, such as retirement. You can withdraw or borrow the cash value through a policy loan.

The younger you are, the lower your premium, but older people can still buy life insurance.

Most life insurance policies require you to undergo a medical examination and undergo a health insurance policy to get the policy. If you have health problems, life insurance is more expensive. Your policy may even be denied. For this reason, building savings through life insurance premiums is more effective if you purchase a policy when you are young and healthy.

Age does not require medical compensation. You will surely satisfy. You just have to have the money to buy the deal.

Life Insurance As A Funding Mechanism For Deferred Compensation Plans: Tax Traps For The Unwary

Life insurance is more effective in creating a legacy for your heirs. Your premium may turn into a larger death benefit. Your heirs also receive a lifetime benefit with no death tax. The annual death benefit is less compared to life insurance. Your heirs will also have to pay tax on the investment income every year.

Annuities provide better investments and income while you are alive. Your income is higher because you are not paying life insurance premiums. Instead, all the money is invested. Annuities also offer more income options, such as guaranteed income for life. There is no life insurance.

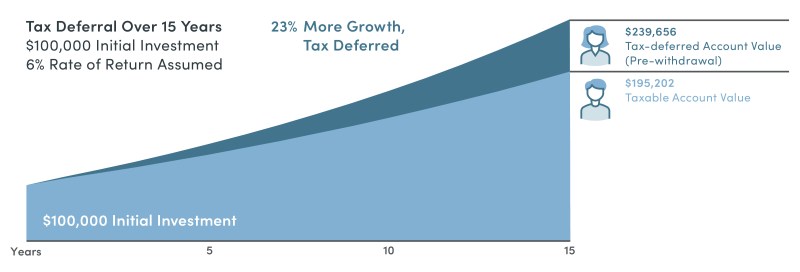

Both life insurance and annuities defer taxes on your income while the money remains in the contract. With life insurance, you can withdraw your premium tax-free. If you withdraw your earnings, you must pay taxes on them.

You can also get the amount through a loan. You pay no tax on the policy loan. However, the insurer will pay interest on your unpaid loan. You can decide to never pay off the policy loan with the plan, but the death benefit will pay it off when you die. That way, you don’t have to pay income tax on the cash value.

Deferred Payment Meaning

The annual fee depends on how you bought the contract. If you purchased an annuity using pre-tax retirement funds such as a 401(k) or Individual Retirement Account (IRA), you will pay 100% of your future taxes.

If you purchased an annuity using after-tax dollars, your future income is the sum of premiums and taxable income on your tax-free return. Your insurance company will tell you how much you will pay in premiums each year.

Life insurance is better for early access to your money, especially if you may need the money before retirement. Once you have the funds, you can withdraw or borrow as much as possible. There is no requirement when you can withdraw money.

With an annuity, you agree to keep your money in the contract for at least one year. If you transfer large amounts or cancel before the agreed date, the insurance company will waive the large transfer fee. Annuities may allow you to withdraw some amount without penalty, such as 10%, but not the rest.

Deferred Charge: What It Is, How It Works, Example

If you are under age 59½ when you cancel or take a lump sum withdrawal, the IRS will charge you a 10% early withdrawal penalty and tax on your withdrawal. Because of these fees and penalties, annuities are best used as long-term investments in retirement plans.

You can convert your life insurance into an annuity if your life insurance has a cash value. An annuity invests money and earns income based on your balance in the value of the money. For more income and investment insurance, you withdraw the death benefit for life. However, you cannot convert an annuity into life insurance.

Annuities can have expensive liabilities if you cancel early. Fees can be 7% or more of your account balance. Annuities lock in your money for many years. They can also charge high annual fees for their investments and income security. Finally, annuities based on stock market investments can be complex and difficult to understand.

Whether the annuity remains on death depends on the income option you choose. Payments stop at your death unless the income is based on your life expectancy. You can also ask for a minimum number of payments, such as 20 years. If you die before age 20, the remaining amount will go to your heirs. Adding collateral for additional income will lower your monthly payment.

Annuity Vs. Life Insurance: Similar Contracts, Different Goals

Financial life insurance and annuities can help you achieve many goals. However, these strategies can be difficult and require a lot of money. Consider discussing these strategies with a financial advisor before purchasing any financial products.

Authors are required to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also refer to original research from other reputable publishers where appropriate. You can learn more about our standards for producing accurate and unbiased content in our Editorial Policy. It is then classified as an expense in the current accounting period.

There are two accounting systems: financial basis and accrual basis. A cash account, often used by small businesses, records income and expenses when money is received or paid.

Accrual accounting records income and expenses as closely as possible, regardless of currency exchange. If the income or expense does not exist at the time of exchange/payment, it is recorded as deferred income or deferred tax. The accrual method is required for businesses with average annual revenue of $25 million or more during the previous 3 tax years.

Lic’s New Jeevan Shanti Plan 2023: Lic Modifies Annuity Payouts For Policyholders

Deferred tax accounting ensures that a company’s accounting practices are consistent with generally accepted accounting principles (GAAP) by equating revenues with monthly expenses. Companies can benefit from underwriting fees on corporate bond issues as a leveraged fee and then write off the fee over the life of the bond.

On the other hand, deferred revenue refers to money received by a company as payment before the product or service is delivered. For example, a tenant who pays a year’s rent in advance may have a happy landlord, but that landlord must manage the rental income for the duration of the lease, but not in a single currency. Each month, the owner uses a portion of the amount received from the deferred income and recognizes this portion as income in the financial statements. As with deferred taxes, deferred income ensures that a month’s income matches that month’s expenses.

In order to get a discount, some companies pay themselves

Tax deferred exchange meaning, deferred life insurance, deferred insurance, deferred annuity insurance, deferred meaning, deferred annuity meaning, tax deferred annuity meaning, tax deferred life insurance, deferred tax liability meaning, nationwide insurance deferred comp, deferred annuity life insurance, meaning of tax deferred