Dental Insurance Ppo Vs Hmo – When you research your medical options in Florida and Texas, you may find that you can choose a Medicare Advantage plan (Part C) as a private alternative to Parts A and B. The programs can that provide health care services that Original Medicare does not have. t coverage – and sometimes prices as low as $0.

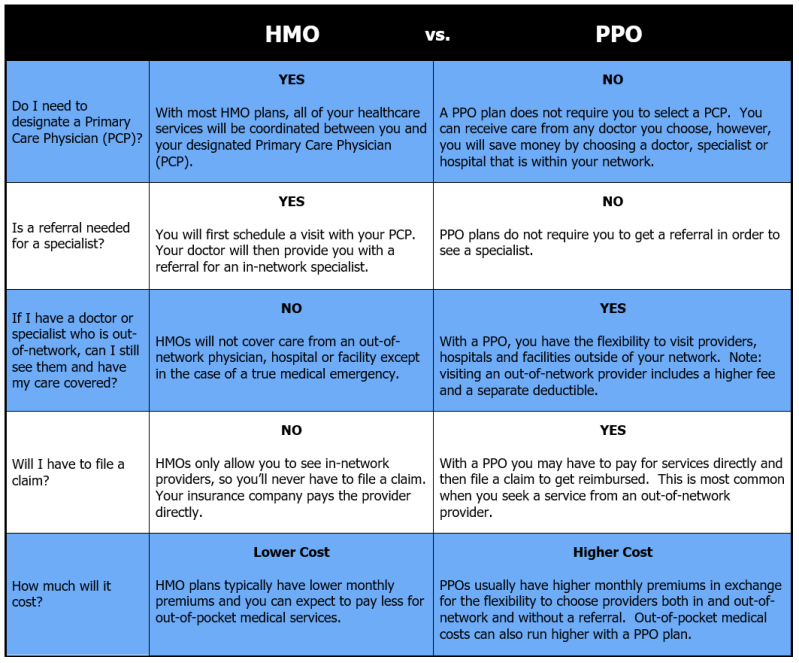

With that in mind, every Advantage plan has specific rules that you must follow. There are different plans that have different limits. The two most popular types of Medicare Advantage plans are HMOs and PPOs. It’s important to understand how the costs and coverage differ between the two programs so you can determine which one is right for you.

Dental Insurance Ppo Vs Hmo

Medicare beneficiaries in Florida can get their services through health maintenance organizations (HMOs). The insurance company contracts with specialty doctors and physician networks in your area. When you join a Medicare HMO, you agree to get your care through the plan’s network unless it’s an emergency. If you use an out-of-network provider, you usually pay the full cost of the service yourself.

Hmo Vs Ppo: How To Choose The Best Health Insurance Plan

A primary care physician (PCP) coordinates your health care and refers you to specialists. If your doctor is not part of the plan’s network, consider switching to another doctor. Because you must use health care services in a specific network, HMO plans may not be available in some areas.

Like an HMO plan, a Preferred Provider Organization (PPO) plan has a network of providers. You can go to any Medicare approved provider you want, but it costs less to stay in network and use the provider you prefer.

However, Medicare PPOs give you more flexibility than HMOs. You do not need a PCP and can coordinate your own health care services. In most cases, you do not need to see a specialist. With PPO plans, you have more choice of providers – ensuring that PPOs are widely available in most places.

Both HMOs and PPOs use a network of health care providers. The main difference is how you, the policyholder, can use the networks.

Metlife Dental Insurance Plans

Both types of plans can include additional services such as dental, vision and hearing. Additional benefits may increase your premium or other costs. Here’s a comparison chart to help you:

**Important Note: If you enroll in an HMO or PPO, you cannot enroll in an individual prescription drug plan. Make sure your plan includes drug coverage if you need it.

If you want a little more freedom and like the idea of being able to manage your own care, a PPO plan may be perfect for you.

If you want to pay lower premiums and like your care more manageable, an HMO can be a good option for you.

Health Maintenance Organization

Each type of plan has advantages and disadvantages. When looking for an HMO or PPO plan, you should consider which type will be best for your needs, location and budget.

Choosing a Medicare Advantage plan is an individual decision. The right plan for your neighbor or relative may not be the right choice for you. If you are interested in joining a PPO or HMO but can’t decide which option is best, contact Lacayo Group Insurance today.

We specialize in Florida and Texas Medicare products. And we can help you consider variables specific to your situation, such as whether your doctor is in-network and whether the plan has a prescription drug formulary that lists your drug- medicine. You will find the lowest prices for health care coverage. Depending on your income and family size, you may also qualify for government subsidies through the Affordable Care Act. Our rates can’t be beat.

We have simplified the process as much as possible. Get accurate quotes in seconds without entering your email or phone number. Use online tools to help you quickly find the plan that fits your needs. And, register in minutes on your computer or mobile device using our quick and easy online process.

Dental Insurance Cost: Learn How To Pay Less For More

Everyone must have health insurance now that the Affordable Care Act is in place, but that doesn’t mean health care has gotten any worse. We tend to go with what we know, or what we’ve always been when it comes to insurance coverage, but the truth is that you have options.

In California, health insurance plan options primarily include a Health Maintenance Organization (HMO) and a Preferred Provider Organization (PPO). There is also a third option, the Exclusive Provider Organization (EPO), which is very popular in California.

While all of these plans can provide the coverage you need, it’s important to understand each one individually and compare them. Not understanding the differences between HMO, PPO and EPO plans can lead to large unexpected costs and frustration due to changes in insurance coverage when changing doctors. These plans provide coverage, but there are significant differences in how they work and how much they cost.

If you don’t have insurance and want to buy a plan on short notice, or are just exploring your options as a Californian, we’ve provided some information about HMOs, PPOs, EPOs, and Kaiser Permanente.

Hmo Vs. Ppo

Of the three plan types—HMOs, PPOs, and EPOs—you have HMOs and PPOs at opposite ends of the spectrum, with EPO plans somewhere in the middle. First, you need to recognize the difference between HMO and PPO plans. Then you can see where EPO fits as a combination of the other two.

HMO plans usually revolve around a primary care physician (PCP). Your PCP is the doctor you see for an annual physical or when you are sick. You can choose your PCP, but they must be part of the HMO’s local network of health care providers. Here are some more details about HMOs:

But what if your PCP doesn’t think you need more treatment? Or does your condition not allow you to visit a specialist? These situations can happen and you should be aware of them. As long as you choose a PCP you trust, this is unlikely to be a problem.

All of your health care is provided in the local network – if you see an out-of-network provider, you are responsible for paying the out-of-pocket cost. If you have a doctor you like, are waiting to change your insurance coverage, and are considering an HMO plan, make sure your doctor is in the HMO plan’s network. If not, you will need to change doctors until you have a PCP that is in your plan’s network.

Differences Between Hmo And Ppo (comparison Chart)

There is one exception to the HMO network rule. You might be wondering – what if I’m on vacation and have an emergency? In this case:

Overall, HMO networks are small, but there are two benefits to an HMO plan – both in the financial department. Because you work in an HMO network, you may never need to file a claim. Instead, your insurance company works directly with your health care providers. Also, HMO plans almost always cost less—they usually have lower monthly premiums and lower out-of-pocket costs.

Yes, that means PPO plans that fall on the other end of the spectrum are almost always more expensive—but with the added cost comes added flexibility and freedom. There is still a network, but you have the freedom to switch to providers outside your network if you want to:

With a PPO plan, there is also more flexibility in choosing a PCP and seeing specialists. If you have a PPO plan, you don’t need a PCP and can go to any provider you choose, but choosing an in-network doctor will ultimately save you money.

Hmo Vs Ppo: Choosing Your Health Insurance

You also don’t have to see your PCP if you need to see a specialist—that’s a decision you’re free to make without seeing your PCP first. You can also choose to see a specialist outside of your network, as a PPO plan allows you to do so.

All of this flexibility and freedom comes with a higher price and a higher level of involvement in your health care because you’ll often be scheduling and coordinating appointments, while the A PCP takes care of most of that in an HMO plan. If you choose to see a doctor outside of your network, you may need to gather information and file a claim with your insurance company to cover some of the cost.

There are several critical differences between HMO and PPO plans, and there is no one-size-fits-all solution. Which one is best for you will ultimately depend on your preferences.

There is a third option that is becoming increasingly popular in California – the Exclusive Provider Organization (EPO). This third option is a combination of HMO and PPO plans. You will have many of the same freedoms as a PPO plan. Here is a list of EPO plan features:

Important Steps For Choosing Dental Insurance

Since you are limited to using a specific network with an EPO plan, this

Dental hmo ppo, humana dental hmo vs ppo, cigna dental hmo vs ppo, publix dental hmo vs ppo, aetna dental hmo vs ppo, hmo vs ppo dental, ppo and hmo dental insurance, guardian dental hmo vs ppo, delta dental hmo vs ppo, dental insurance hmo or ppo, hmo v ppo dental, dental insurance hmo vs ppo