Which Area Is Not Protected By Homeowners Insurance – Buying homeowner’s insurance is a no-brainer. It is simply an indispensable financial product to protect your home and assets. The right home insurance policy can protect your home from damage caused by natural disasters, theft, and more. Although homeowner’s insurance can cover damage to your home, possessions, and belongings, there are a few things it may not cover.

Let’s start with the basics. If you buy a house, you need to take care of it. You cannot expect a house that is not properly maintained to protect itself from natural disasters such as hurricanes, typhoons, and fires. A well-maintained home can protect itself from the negative effects of dangerous situations. Most of the damage is caused by poor quality of buildings. In such cases, the homeowner’s insurance policy may not cover the loss. For example, if your roof isn’t properly maintained—regular inspections, maintenance, clean gutters, etc.—your homeowner’s insurance policy may not cover roof damage.

Which Area Is Not Protected By Homeowners Insurance

Home insurance may cover some of your expensive jewelry, but you may need additional coverage to protect any jewelry or other valuables. Jewelry is a dangerous item for insurance companies because it is easy to steal. Check your policy and get an additional rider to cover your valuables.

Why Are Floods Not Covered By Homeowners Insurance?

Home insurance does not cover flood, mold, pest damage, and other damage caused by dirty storage. Clean your gutters, plant greenery in your yard, and keep your gutter system updated so you don’t have gut-related problems that damage your home and aren’t covered by your insurance.

If you live in an area prone to earthquakes, you should know that most insurance companies do not cover this natural phenomenon. You will need to purchase separate insurance for this. Confirm your policy and get another policy with adequate earthquake cover.

A homeowner’s insurance policy cannot protect your home and property against the risks of government-ordered real estate, nuclear disasters, land seizures, war, and other acts.

Your homeowner’s insurance policy doesn’t cover accidents where you can’t leave your home, but there’s no damage beyond repair or replacement. These include tsunamis, severe earthquakes, and hurricanes.

Sinkhole Insurance Claim Adjuster

Here are 10 home insurance mistakes you should avoid from our story, how technology has simplified the insurance steps to buying life insurance, and what aspects of home insurance aren’t covered by most homeowners? Disadvantages of owning private property

6DQ Problem: LO.2 Ross wants to dispose of some land he acquired five years ago because he will…

12DQ Problem: In calendar year LO.3, taxpayer Reba owns an office building used for her business. The…

20CE Problem: LO.3 On June 5, 2019, 750,000 riyals were received…

Areas Not Protected By Most Homeowners Insurance

Problem 21: LO.3 Camilos’ property, with an adjusted basis of 155,000, is subject to state liability. Camilo gets…

Problem 34P: Ed’s investment property is adjusted for 35,000. Polly offers to buy land…

Question 47P: What is the maximum deferred gain or loss and the basis of the exchange?

57CP Issue: Devon Bishop, 45, is single. He resides at 1507 Rose Road, Albuquerque, NM 87131.

What Is Not Covered By Homeowners Insurance

3RP Problem: Taylor owns a 150-story motel built in the late 1960s, 10 acres…

2CPA Problem: Susie bought her first home on March 15 for $450. He sold on October 15, …

3CPA Problem: Chad has an office building that was destroyed in a hurricane. The area was declared a federal…

5CPA Problem: Marsha’s land used in her business in Florida has an FMV of 72,700 and her basis…

Insurers Withdraw From Riskiest Areas As Threats From Climate Change Grow

Translated Image: Question 9 of 10 What does homeowner’s insurance not cover? You may lose your personal property

Want to dive deeper into the ideas behind this app? Look no further. Learn more about this topic, finance, and other related topics by exploring similar questions and additional content below. 2017 comment

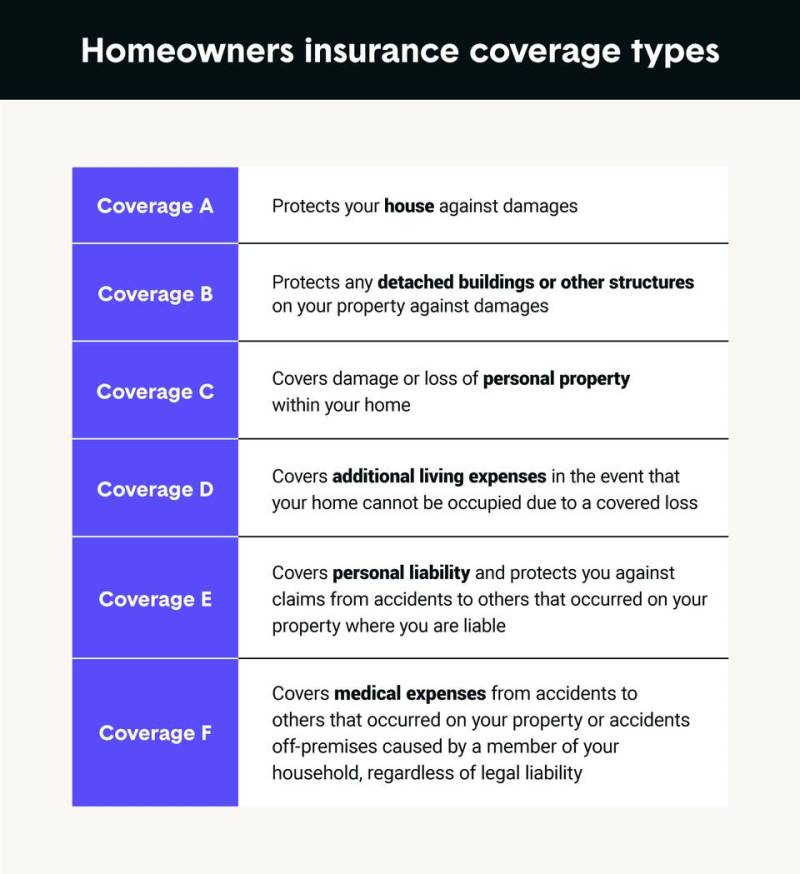

After filing a claim with the homeowner’s insurance company, many people find that what they thought was coverage was not included in their current homeowner’s policy. Avoid surprises by knowing what is and isn’t covered in the homeowner’s policy you choose. There are a variety of policies that cover the basics of homeowners insurance. Learn more about damages not covered by your Old Town Alexandria home insurance policy.

Homeowners should take the time to find out what damages are covered under a regular homeowner’s insurance policy when purchasing and insuring a home. In a recent survey, 81% of policyholders knew that flooding was not covered by their policy. Floods and earthquakes are two perils that can cause significant damage but are not included in most policies. It’s not too late to get the coverage you need. If homeowners don’t expand on the specifics of the damage to their home, homeowners’ claims can be thousands of dollars or more.

Homeowners Insurance And Water Damage

Before relying on your basic homeowners insurance policy, find out if additional coverage is necessary for a home in a particular area. Homes in areas that experience frequent thunderstorms, floods or storms may need additional coverage. A standard home insurance policy does not usually cover the following risks.

Mold is a serious problem that affects the homeowner’s health and lowers the value of the home. However, in most cases, mold damage coverage is limited or excluded. Homeowners must pay extra and get approval to extend the limit.

Sewage can occur in homes due to old and outdated sewage. Rain-soaked pipes and tree roots can cause problems. Dirt can damage electrical systems, floors, walls and furniture.

Sinkholes have been known to swallow cars and others. This sudden gap is causing problems in states like Pennsylvania, Tennessee, Kentucky, Missouri, Alabama, Texas and Florida. A ground motion exclusion is included in standard insurance policies in all states except Florida.

Service Line Warranties (slwa)

Termites are a known problem that cost Americans $5 billion each year. This policy is not known to cover periodic loss. Early intervention is the best way to prevent serious structural damage.

A nuclear accident can be a problem for Americans who live near active nuclear power plants. A standard policy does not cover claims if the property becomes uninhabitable due to an accident. The Price-Anderson Act provides compensation for injuries or damages caused by commercial nuclear accidents. Covered claims include property damage and loss, fatal illness, disease and bodily injury.

“Acts of war” and terrorism are generally not covered by insurance. However, damage caused by smoke, fire or explosion is covered.

Homeowner’s insurance covers loss and damage to the homeowner’s home and property. Homeowners often know that this policy is necessary to avoid injury to their property. However, many homeowners don’t read the fine print and get the proper coverage they need for the risks in their area.

What Is Dwelling Coverage?

Avoid the stress of a denied property damage claim. As with green car insurance, you should get the type of coverage you need and be aware of any exclusions or limitations before accepting a policy.

All Categories Alexandria Events & Entertainment (47) Home Buying (114) Events (24) Vacations (3) Home Improvement (38) Local News (11) Major (45) Market Trends (13) Real Estate Information 10) Moving Guides (42) News You Can Use (6) Open Houses (3) Homes for Sale (19) Honors (1)

October 2023 (1) July 2023 (3) June 2023 (4) May 2023 (3) April 2023 (2) November 2022 (11) , 2022 (7) October 2022 (6) September 2022 (3) August 2022 (4) 4) March 2022 (5) February 2022 (3) 2022 January (9) December 2021 (5) November 2021 (5) May 2021 (3) April 2021 April 2021 April 1) August 2020 (4) July 2020 (3) June 2020 (4) May, (4) March 2020 (3) November 2019 (7) October 2019 (4) September 2019 (2) August 2019 (3) July 2019 (3) February 2019

:max_bytes(150000):strip_icc()/Homeowners_Insurance_Color-72186b7c102d42a99e973c0fb144029a.jpg?strip=all)

Which area is not protected by most homeowners insurance loss of use, which area is not protected by most homeowners insurance the home your view loss of use, which area is not protected by most homeowners insurance framework, which is not protected by most homeowners insurance, homeowners insurance in my area, which area is not protected by most homeowners insurance the view, which are is not protected by most homeowners insurance, which area is not protected by most homeowners insurance, what area is not protected by most homeowners insurance, which area is not protected by most homeowners insurance your view loss of use, which area is not protected by most homeowners insurance view, which area is not covered by homeowners insurance