What Is The Best Homeowners Insurance – Homeownership is a dream for many, if not most, Americans. And homeownership is probably one of the largest and most vital investments you will make in your lifetime.

One of the best ways to protect your important investment is to make sure you do your research and choose the best home insurance company for you and your needs. Let’s go over some simple steps to select the best homeowners insurance policy and which companies might be a perfect fit for you.

What Is The Best Homeowners Insurance

There are many factors that go into making a great home insurance company. Cost, coverage and customer service are just a few factors. With over 60 home insurance companies to review, we’ve compiled a list of the best home insurance companies in 2023 below.

Homeowners Insurance: Protecting Your Property With Hazard Insurance

Hippo is a great insurance option for homeowners. The company offers quick and easy online quotes, extensive coverage for home offices and electronics throughout your home, and excellent referrals to trusted contractors and home professionals through a program known as the Home-Care Expert Program.

State Farm is an incredibly popular insurance choice among homeowners across the country. It is the largest home insurance company in the country. Part of the reason why customers rave about this company is that it is available in all states unlike many of its competitors, it is affordable, and it offers the ability to bundle multiple policies to ensure more significant savings.

Lemonade Insurance provides customers with a streamlined process to access their relevant information online, ultimately enabling quotes and claims to be processed quickly. It also offers various coverage options for your home and offers reasonable premiums for policyholders. Lemonade is only available in certain states, but customers who use this insurance seem to like it.

Allstate is considered one of the highest-rated home insurance companies available nationwide. They offer a lot of discount opportunities, excellent customer service ratings and relatively affordable prices compared to other companies. Allstate is also available in all states, a huge plus for many policyholders.

Ocala Homeowners Insurance

Erie Insurance is another top choice for homeowners. It is one of the highest rated insurance companies in terms of customer satisfaction and claims satisfaction. Erie ranked 7th in 2022 in the JD Power Customer Satisfaction and Claims Satisfaction Study. It even offers guaranteed replacement cost coverage in its standard insurance coverage, which is rare among insurers.

Farm insurance is a great choice for homeowners who like the ability to add to their coverage. It provides guaranteed replacement cost coverage, which will cover the expenses of rebuilding your home, even if construction costs exceed your policy’s coverage limits. Farmers also offers more than a dozen discounts to policyholders, a benefit highly sought after by homeowners.

American Family is a great option for homeowners who want affordability, great customer service and love discounts. It is only available in a handful of states, but remains one of the largest home insurers in the country. In 2022, American Family Insurance ranked second in J.D. Power’s U.S. it. Home insurance study.

Homeowners insurance companies may be the best fit for customers based on specific situations. Financial strength, customer service, premium prices and coverage options all determine what makes the best home insurance company.

Questions To Ask Your Agent For The Best Homeowners Insurance Coverage

USAA is the best owner option for veterans in the United States. Veterans are not only eligible for insurance through USAA, but so are active military personnel and their family members. USAA is one of the highest rated insurance companies in the Digital Experience Study.

USAA also consistently ranks high in JD Power complaints and customer satisfaction studies. The insurance company offers comprehensive coverage policies that include coverages such as military uniform coverage, personal property replacement cost reimbursement, and higher coverage limits for valuable property.

Amica Insurance is the best home insurance company for customers who value excellent customer service. The company offers its customers affordable prices and many additional options to guarantee the highest levels of protection.

Amica has earned its reputation, ranking #1 in JD Power’s 2022 customer satisfaction and complaint studies and earning an A+ rating with AM Best. Amica has also received 20% fewer customer complaints through the National Insurance Association compared to other insurance companies of the same size.

Best Home Insurance Company For 2023

Chubb Home Insurance is considered the best home insurance company for high-value homes. Wealthy policyholders tend to like this insurer, as do customers who may be more exposed to cyberattacks or home invasions.

Chubb can offer its policyholders much higher coverage limits (up to 100 million) than other insurance companies. Chubb offers additional coverages such as cash settlement advice and extended replacement cost coverage.

Travelers Home Insurance is one of the oldest names in the insurance industry. This company is considered to be the best option for people who may have experienced a lapse in their insurance coverage.

Unlike other insurance companies, Travelers does not require policyholders to have prior insurance to be eligible for coverage. Most insurance companies do not insure customers who have a period without insurance, some even for a month without coverage.

Best Homeowners Insurance In Nevada: Top 5 Companies

It’s easy to feel overwhelmed when shopping for home insurance. And every homeowner will have different factors to consider when shopping. Some of the most important factors to consider when shopping for insurance include:

The location of your home is one of the most important factors that insurers use to determine the cost of premiums. For example, if you live in a place that experiences higher levels of natural disasters, like wildfires or hurricanes. You will find that you will pay more premiums than in other places.

Premiums tend to cost policyholders less in rural areas than in large metropolitan areas because crime rates tend to be higher and housing is much more expensive to build in highly populated areas. If you are concerned about premium costs, consider where you are buying or building a home.

You will need to consider the safety and overall features of your home when deciding on the best insurance coverage option. If you own an older, deteriorated and outdated home, it may be considered a higher risk home, which will increase your premiums. The size of the house also comes into play, as the bigger the house, the more money you may need to have on hand in case something goes wrong.

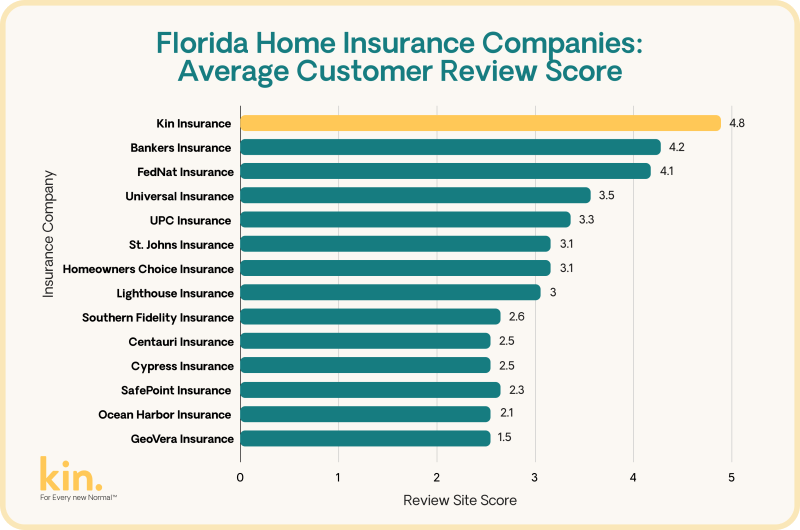

Best Homeowners Insurance In Florida 2023

Coverage levels are an important factor to consider when choosing an insurance company. Pay close attention to coverage limits and consider whether they would realistically work for your home and all your belongings. Some things to consider that would directly relate to coverage limits include:

Policy premiums vary among customers based on their location, credit score, driving history, marital status, etc. And for most people, policy premiums are the most important factor when getting homeowners insurance. Everyone has a specific budget they can work with each month or year. It is therefore essential to find an affordable insurance plan.

Accessibility is a popular factor among customers across the country. When there is a problem with almost anything, you want easy access and the ability to talk to someone to solve the problem.

The same goes for home insurance. It’s worth it to find a company with 24/7 customer service, fast complaint handling and helpful agents.

Best Homeowners Insurance In California January 2024

Amica is the home insurance company with the highest customer satisfaction rates compared to other insurance companies. Amica has achieved first place in customer satisfaction for 19 out of 20 years.

State Farm Insurance is the nation’s largest homeowners insurance company. It is also one of the most popular companies because it is easily accessible in all states.

Auto Owners Home Insurance is the best overall home insurance company. It offers various coverage options, extensive insurance coverage and affordable rates.

Erie Insurance offers the cheapest home insurance available to customers. On average, policyholders pay about $1,284 per year with Erie Insurance. Keep in mind that rates vary depending on many different factors.

Best Home Insurance Plans In Singapore 2023

Some insurance companies benefit from excellent financial ratings. State Farm, Travelers, USAA and GEICO all earn the highest grades of A++ with AM Best.

Finding your new home will probably be one of your most treasured memories. Don’t let the fun slip away with the stress of finding home insurance. We can provide multiple quotes in moments, which can allow you to focus on what you should, enjoy and create memories in your new home.

By Mark Romero Mark Romero is the home insurance expert for. Since 2016, he has worked diligently to educate others about the importance of homeowners insurance by keeping homeowners informed about all things homeowners insurance. Looking to grow your portfolio and make more money? Get a property management software demo to learn more.

Living in Big Sky country can be a wonderful thing. You can experience various wildlife, natural beauty and much more. However, as a property owner or manager, your goals go far beyond that. In fact, there are real issues to consider, such as wildfires, earthquakes and floods.

How To Choose The Best Homeowners Insurance Policy

You need to protect your real estate investment, and home insurance in Montana can be very beneficial. This guide will guide you through everything. We have researched the best companies to help you search for a suitable insurance product. Let’s go ahead and start now!

Is home insurance compulsory? This is the question that worries everyone, and the state does not force you to do it. However, many lenders will want you to carry Montana homeowners insurance for the entire term of the loan. It can

Which homeowners insurance is the best, what is the average homeowners insurance, which is the best homeowners insurance company, what is the average homeowners insurance cost, what is the cheapest homeowners insurance company, what is the cheapest homeowners insurance, what company has the best homeowners insurance, is usaa the best homeowners insurance, the best homeowners insurance, who is the best homeowners insurance company, what is homeowners insurance, what is the cost of homeowners insurance