What Is Loss Of Use On A Homeowners Policy – When homeowners are faced with a temporary displacement of their property, it can be a challenging and overwhelming experience. Whether due to a natural disaster, renovation work, or other unforeseen circumstances, understanding the implications of temporary displacement is critical for homeowners. In this section, we’ll delve into what temporary displacement means for homeowners, providing you with information, tips and case studies to help you navigate this difficult period.

Temporary displacement refers to the situation where owners are forced to leave their property for a limited period. This can be due to various reasons, such as extensive repairs, dangerous conditions or the need for renovations. It is important to recognize that temporary displacement is often a necessary step to ensure the safety and well-being of homeowners and their properties.

What Is Loss Of Use On A Homeowners Policy

Time displacement can bring a variety of emotions, from frustration and helplessness to anxiety and uncertainty. Homeowners may feel a sense of loss as their family environments and routines are disrupted. It is essential to recognize and face these emotional challenges, seeking the support of family, friends or professionals, if necessary.

Common Mistakes Filling Out A Proof Of Loss After An Insurance Claim

In many cases, homeowners who have experienced temporary displacement may be eligible for loss of use coverage through their insurance policy. It is essential to quickly notify your insurer of the situation and understand the extent of coverage available. Maintaining open and frequent communication with your insurer can help clear up any questions and ensure a smoother claims process.

When faced with temporary displacement, finding suitable temporary housing is a priority. Depending on the circumstances, options may include staying with family or friends, renting a furnished apartment, or seeking help from local organizations or government agencies. Research and planning ahead is recommended, taking into account factors such as proximity to work or schools, accessibility and cost.

Temporary displacement often forces homeowners to leave their property unattended for an extended period. Taking proactive steps to protect your belongings and valuables is critical during this time. This may involve securing windows and doors, installing security systems, or storing valuables in a safe and secure location. Also, documenting the condition of your property before you leave can be helpful for insurance purposes.

Examining real case studies of homeowners who have experienced temporary displacement can provide valuable insight and guidance. By understanding the challenges they faced, the strategies they used, and the lessons they learned, homeowners can better prepare for similar situations. These case studies can serve as a source of inspiration and practical advice for navigating time travel.

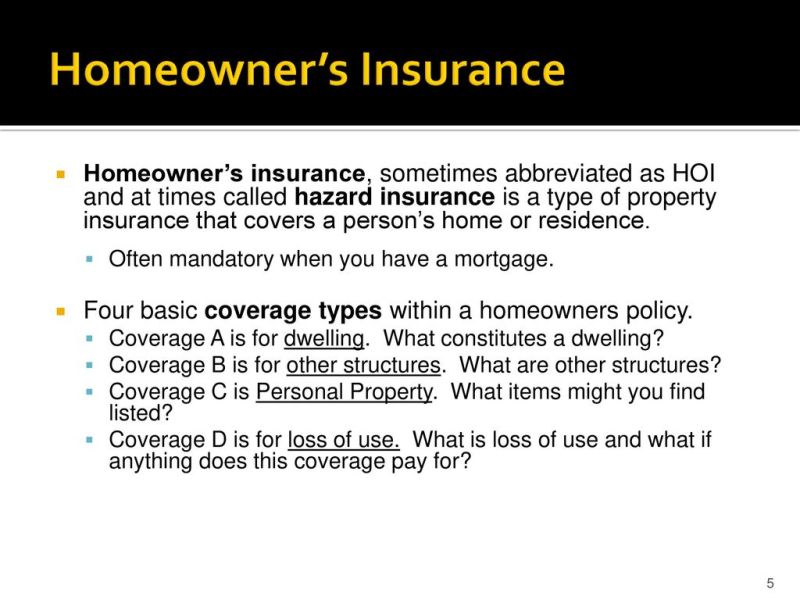

What Is Homeowner’s Insurance?

In some cases, seeking professional help can be beneficial when dealing with temporary relocations. Working with public adjusters, contractors, or disaster restoration specialists can help streamline the process, ensuring that necessary repairs and renovations are completed efficiently. These professionals can also provide guidance on insurance claims, safety measures and other relevant aspects.

Finally, it is important to maintain a positive mindset throughout the temporary period. Although it can be challenging, viewing this experience as an opportunity for growth, renewal, or an opportunity to create a better living environment can help homeowners cope. Remembering that temporary displacement is only temporary can provide reassurance and motivation to overcome the challenges they face.

By understanding the implications of temporary displacement, homeowners can better navigate this difficult period. By assessing the impact, managing emotional challenges, exploring housing options, protecting your property, and seeking professional help when needed, homeowners can effectively cope with temporary and anticipated displacement.

:max_bytes(150000):strip_icc()/Primary-Image-how-much-is-homeowners-insurance-7483743-df56fa114f1d4aec994c0e6445e0518e.jpg?strip=all)

Losing the use of your property can be an incredibly challenging experience, both practically and emotionally. Whether due to natural disasters, renovations, or unforeseen circumstances, being temporarily displaced from your home or business can significantly affect your mental well-being. In this section, we’ll explore some of the common emotions and struggles that arise from the loss of use of your property and provide helpful tips for dealing with this difficult situation.

Does Homeowners Insurance Cover Plumbing?

When faced with the loss of use of your property, it is natural to experience a sense of loss and grief. After all, your property is not just a physical structure, but also a place where cherished memories were made. It could be where you raised your children, celebrated milestones or built your business from the ground up. The sudden disruption of this familiar environment can leave you disoriented and nostalgic for what once was.

Loss of use can also lead to feelings of anxiety and uncertainty about the future. You may be concerned about the extent of the damage, how long it will take to restore your property, or the financial implications of being displaced. These uncertainties can be particularly difficult to navigate, often requiring patience and resilience to overcome.

Dealing with the loss of use of your property also brings practical problems and frustrations. Finding temporary housing, moving things and adapting to a new environment can take a long time. The disruption of daily routines and the need to adapt to an unfamiliar environment can leave you feeling stressed and tired.

Although the emotional toll of losing the use of your property can be difficult to fully overcome, there are strategies that can help you navigate this difficult time:

What Is A Covered Loss?

Find support: Reach out to friends, family or support groups who can listen and offer guidance. Sharing your feelings with others who have experienced similar situations can be incredibly comforting.

Focus on self-care: Take care of your physical and emotional well-being by engaging in activities that bring you joy and help you relax. This can include exercise, meditation, hobbies, or spending time in nature.

Stay informed, but limit exposure: While it’s important to stay informed about the progress of the restoration or recovery process, be aware of the impact that overexposure to news or updates can have on your emotional well-being. Set limits and take breaks from constant information consumption.

Practice Gratitude: Cultivating a mindset of gratitude can help shift your focus from what you’ve lost to what you still have. Take time each day to reflect on the things you are grateful for, no matter how small they may seem.

Farm: Homeowners Insurance

Sarah, a small business owner, suffered a devastating fire that resulted in the loss of her property and her life. Initially overwhelmed by grief and anxiety, Sarah sought support from her friends, family and local community. He joined a support group for entrepreneurs who faced similar challenges and found comfort in sharing his experiences with others who understood his struggles. By practicing self-care and focusing on gratitude, Sarah gradually regained her resilience and was able to rebuild the business stronger than ever.

The emotional toll of losing the use of your property can be profound. It is critical to recognize and address the feelings of loss, anxiety, and frustration that may arise during this time. By seeking support, practicing self-care, and using a mindset of gratitude, you can navigate this challenging period with resilience and ultimately find a path to recovery and restoration.

Manage the loss of use of your property – Loss of use: manage the temporary displacement of your property

When you’re faced with a temporary displacement of your property due to unforeseen circumstances such as fire, natural disaster or extensive renovations, it’s critical to understand how your insurance coverage can help you get through this difficult time. Insurance policies often include loss of use provisions, also known as supplemental living expenses (ALE), which can provide financial assistance for temporary lodging, meals, and other necessary expenses. In this section, we’ll delve into the complexities of navigating the insurance process and maximizing coverage for temporary displacement.

Renewing Annual Home Insurance

The first step in understanding your temporary travel insurance coverage is to carefully review your policy. Look for specific provisions related to loss of use or additional maintenance expenses. These provisions describe the maximum amount of coverage available, the duration for which it is applicable, and any limitations or exclusions that may apply. Familiarize yourself with the terms and conditions to ensure you have a clear understanding of what your policy entails.

To ensure a smooth insurance process, it is essential to document all expenses related to your temporary move. Keep proof of accommodation, meals, transport and other essential expenses incurred during this period. Keeping a detailed record will help you support your claim and maximize your refund. In addition, it is advisable to communicate regularly with your insurer, keeping them informed of your situation and reporting your expenses.

While temporary travel insurance coverage typically includes reimbursement for lodging, it’s essential to explore all available options to get the most out of your coverage. Depending on your policy, you may be eligible for a comparable temporary residence, such as a rental or hotel. However, it is worth noting that insurance policies may have limitations on the amount of cover provided for alternative accommodation. Therefore, it is critical to weigh your options and choose the most cost-effective solution that meets your needs while staying within your coverage limits.

While insurance coverage can help ease the financial burden of temporary travel, it’s wise to take cost-saving measures everywhere.

What Is Loss Assessment Coverage?

What is loss assessment coverage on a homeowners policy, what is loss of use on a homeowners policy, what is a homeowners policy, what is loss of use homeowners insurance, what is the cost of homeowners insurance, equipment breakdown coverage on homeowners policy, personal liability coverage on homeowners policy, homeowners insurance loss of use, what is homeowners policy, what is loss of use coverage on homeowners insurance, loss of use homeowners, what is homeowners insurance based on