What Is Loss Assessment Coverage On A Homeowners Policy – In most apartment communities, the homeowner’s association (HOA) is equipped with an insurance policy that provides coverage for incidents that occur outside of the homeowner’s personal unit. This is often known as a master policy, and some apartment owners mistakenly assume that it is good to consider all incidents that occur in a common area of the property, such as the lobby, stairs, pool and outdoor space.

However, in the event that damages from an incident exceed the HOA owner’s policy limits, all condo residents may be required to pay out-of-pocket for any losses, even if they were not at fault. To avoid this, appraisal loss coverage is a critical addition that every condo owner should consider.

What Is Loss Assessment Coverage On A Homeowners Policy

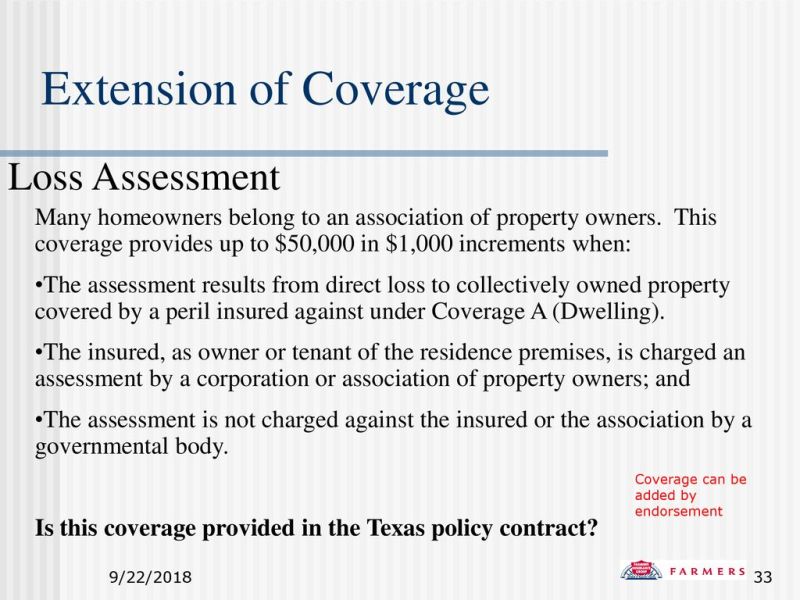

Loss appraisal coverage is an add-on to the standard condo policy. It provides much-needed protection in cases where the owners of a common property are responsible for a significant portion of the costs associated with a covered incident. Examples of these may include the following:

Understanding Homeowner’s Insurance In Missouri: What’s Covered?

Simply put, loss assessment coverage provides a safety net for condo owners, ensuring they don’t have to pay for incidents that occur on common property that exceed the limits listed in the HOA’s master policy. In addition, loss assessment coverage may apply to property damage, liability, residential property damage, or deductibles.

The amount of insurance coverage you need will depend on the limits set forth in your HOA’s master policy. To learn more and secure a policy that’s right for you, contact Christensen Group Insurance today.

© 2019 Zywave, Inc. All rights reserved. The Know Your Insurance document is not intended to be complete, nor should any discussion or opinion be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

Founded in 1952 and 100% employee-owned, Christensen Group is Minnesota’s largest local independent insurance and employee benefits agency. Our focus is to connect you with the solutions and expertise you need to effectively manage risk and protect your future.

Loss Of Use Coverage: Explaining This Aspect Of Home Insurance

Build a strong safety net for life’s unexpected twists and turns. Contact us today to explore the range of insurance options that ensure your safety.

Minnesota Legislation New Earned Sick Time and Safe Time (ESST) Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere. Employee benefits

Mistakes to avoid when applying for auto insurance Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Secure your personal property Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Loss Assessment Explained For Condo Insurance

Shoplifting Loss Prevention Checklist Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Benefits of commercial auto insurance Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

General liability insurance market outlook for 2024 Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

The qualifying transport benefit limit will increase in 2024 Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere. Employee benefits

What’s The Difference? Condo Insurance Vs. Homeowners Insurance

Health FSA cap increases in 2024 Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere. Employee benefits

CMS publishes cost-sharing limits for plan year 2025 Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh and just cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere. Employee benefits If you’re on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

Advertising Disclosures Many of the offers that appear on this site come from companies that Motley receives compensation. This offset may affect how and where products appear on this site (including, for example, the order in which they appear), but our ratings and reviews are not affected by the offset. We do not include all companies or all offers available on the market.

Many or all of the products here come from our partners who compensate us. That’s how we make money. But our editorial integrity ensures that our expert opinions are not influenced by compensation. Terms may apply to offers on this page.

Fire Insurance: Definition, Elements, How It Works, And Example

Most people know they need homeowner’s insurance if they own a single-family home, but knowing what type of coverage an apartment owner needs isn’t always simple. One of the lesser known types of protection worth considering is credit rating protection. In this article, we’ll look at what it is, how it works, and when it makes sense for apartment owners.

Loss appraisal coverage serves as a bridge between a homeowner’s association (HOA) homeowner’s policy and an individual homeowner’s insurance policy. Helps the apartment owner reduce or avoid out-of-pocket expenses due to damage to common areas. For example, it pays for damaged stairs, swimming pools, gyms and other services, as well as liability claims if someone is injured in one of these common areas.

A typical homeowner’s or condo insurance policy does not offer this coverage, nor does umbrella coverage for condo owners.

Loss appraisal coverage in a condo insurance policy is designed to protect condo owners from paying for claims related to damage to the homeowner association’s common areas.

The 8 Types Of Homeowners Insurance Explained

It’s usually optional, but condo owners who skip it can face unexpected bills if someone is injured on the property or if a natural disaster damages common facilities.

Homeowners associations typically have a homeowner’s insurance policy that provides liability coverage and coverage for the buildings themselves. But these policies don’t always cover everything. If the damages cost more than the policy limit, the HOA can call the homeowner to help cover the rest.

Condo owners may also have to pay a portion of the cost if the damages are less than the HOA owner’s policy deductible. Expenses are usually split equally among HOA members, but every HOA is a little different.

If an HOA bills the homeowner for damages due to one of the reasons listed above, the homeowner can file a claim with their insurance provider. The insurance company will pay up to the policy limit to cover the homeowner’s portion of the bill.

What Is Loss Assessment Coverage? Here’s Why It Matters

All a homeowner has to do is file a claim, just as they would for a fire, theft or natural disaster. Submit a copy of the bill showing the amount of damage and the home insurance provider must pay for it or reimburse the homeowner for the cost.

A damage assessment is done when there is damage to a common area, such as a pool or gym for HOA members. It can also cover stairs and other areas used by residents in many separate apartments. If the HOA owner’s policy won’t cover the full cost of repairs, condo owners may have to step up.

If someone is injured in a common area and the HOA is successfully sued, the HOA may split some of the costs among the condo residents.

Deductible assessments occur when the HOA requires condo owners to pay a portion of their homeowner’s policy deductible to help cover the cost of a claim.

Hurricane Ian Recovery

Loss appraisal insurance does not cover all appraisals. It depends on the owner’s plan and what risks are covered. For example, if damage to the home occurred due to a flood or an earthquake and the homeowner does not have coverage for those perils, then insurance companies will not pay for a loss assessment claim.

Apartment owners are not required

What is loss assessment coverage on a homeowners policy, personal liability coverage on homeowners policy, loss assessment coverage condo, loss assessment coverage homeowners, homeowners insurance policy coverage, state farm homeowners policy coverage, homeowners insurance loss of use coverage, loss assessment coverage, homeowners policy coverage, equipment breakdown coverage on homeowners policy, what is loss assessment coverage homeowners insurance, homeowners insurance loss assessment coverage