The Great Eastern Life Assurance Company Limited – A few weeks ago, a friend approached me and asked for advice on a whole life insurance plan that his agent was trying to sell him. He has no experience with finance or investing, so while I would love to tell him to “get some term insurance and invest the rest”, he certainly won’t be comfortable with that.

Another reason he’s more interested in whole life than getting laid off is because he wants to get the monetary value that comes with it. Most people want something in return after paying all their premiums for many years. Anyway, I convinced him to send me the policy/forecast document.

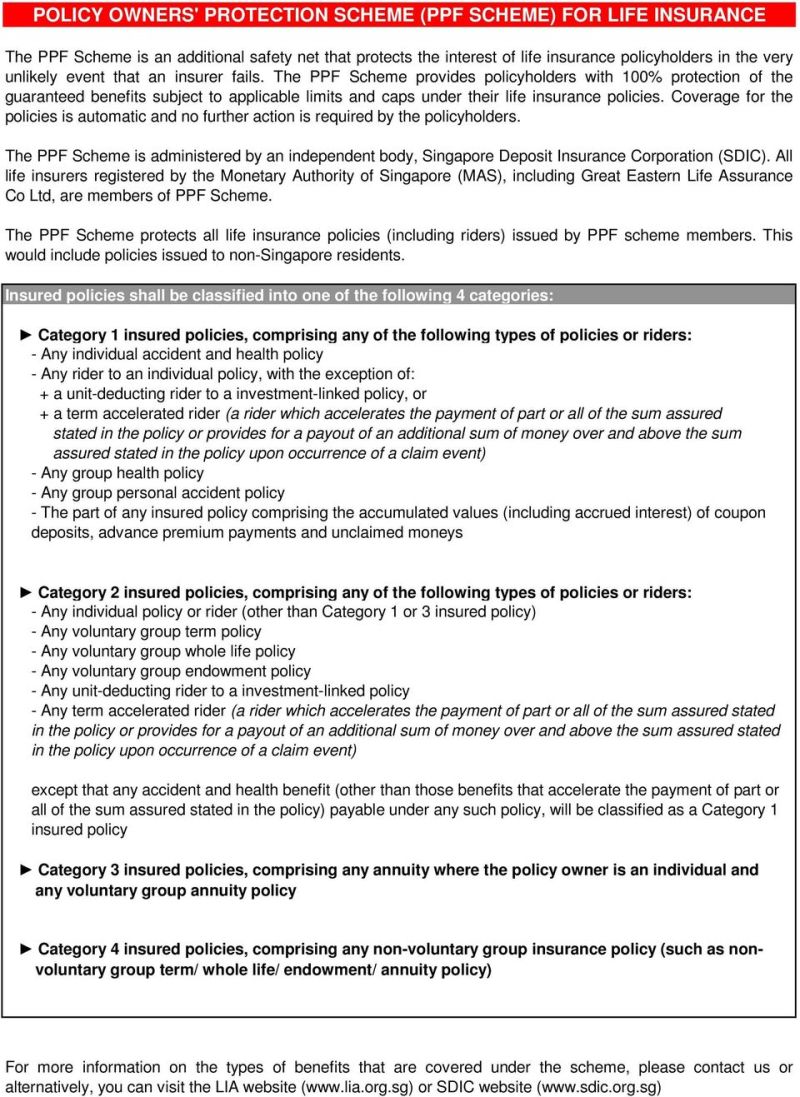

The Great Eastern Life Assurance Company Limited

The policy is that of the Great Eastern family3. My friend will have to pay an annual premium of $6,000 for the next 15 years, and the minimum insurance amount (death benefit) is $87,745. After the premium period ends, he will receive a guaranteed payment (2% of the sum assured) for the rest of his life.

Great Eastern Life Sg50 On Behance

Regardless, I have copied the above tables from the policy document into a spreadsheet for easy reference and comparison. When I looked at the performance shown after surrendering the policy, the performance is just poor. A thought then came to me at random: can we use CPF SA as a substitute for whole life insurance?

Anyway, I went ahead and predicted what my friend would get if he used his entire life insurance premium to top up his CPF SA. It should be noted that I have excluded the tax savings that can be made by funding a CPF SA account to facilitate calculations/comparisons. You can read this to know more -CPF RSTU – Is it worth it?

For the avoidance of doubt, I will also use the highest unguaranteed forecast (4.35%) for all comparisons.

From year one to year 12/13, whole life insurance offers better coverage, but once you move to year 12/13, you can expect to have more money by simply topping up your CPF SA account. In my opinion, the risk can be easily mitigated by purchasing term insurance at a fraction of the price of similar/higher coverage and canceling after 12/13 (totally optional) to provide death coverage for the entire duration . This particular insurance is interesting because the insured will receive an annual payment as a survival benefit (in the same way, there are guaranteed and unguaranteed insurances). However, even after adding all the survival benefits, CPF SA still offers higher guaranteed return/death protection.

Eguaras Vs Great Eastern Life Assurance

If you have ever been influenced by fake news and thought that you will never get your CPF back even after your death, read this: What happens to your CPF savings when you die?

If you are considering purchasing whole life insurance with the intention of surrendering it to recoup the cash value, don’t do it. You will almost entirely lose money because the comparison uses an unguaranteed “best case” scenario.

This may not be true for other whole life insurance policies, but I’m pretty sure the return will be higher with CPF. That said, don’t take my word for it, go ahead and calculate/design it yourself. Ultimately, the friend also decided not to purchase whole life insurance.

4. Instagram -KPO_and_CZM(Have you seen these delicious food photos on the right –> Unfortunately, they are not viewable on mobile.)

Kpo And Czm $$$: Whole Life Insurance

Great west life assurance company, great eastern shipping company limited, the new india assurance company limited, great eastern life assurance singapore, great eastern life insurance, standard life assurance limited, the great eastern life assurance, great west life assurance company phone number, great american assurance company, great eastern life assurance, great eastern life assurance berhad, great eastern life assurance company limited