The Cost Of Homeowners Insurance – Expert advice from Bob Vila, the most trusted name in home improvement, home improvement, home improvement, and DIY. Demanded, real, reliable town council

How much is homeowners insurance? Homeowners insurance protects against loss and destruction from covered perils, but how much is homeowners insurance? Costs range from $378 to $3,593 per year, with an average of $1,383.

The Cost Of Homeowners Insurance

Most homeowners understand why they need homeowners insurance to get a mortgage. Lenders take a risk in lending large sums of money, and they need to know that the home is protected against the eventuality that the borrower defaults and the lender has to sell the home to recoup the loss. So what is homeowners insurance? In short, it is a policy that allows homeowners to fully protect their investment as lenders protect theirs. Fabio Fassi, a licensed insurance agent who leads the partnership with Counterpart, notes, “While many homeowners typically purchase homeowners insurance to check off a box on their laundry list of things they need have to complete a check to buy a home. are vital to their success. what their policy will cover and what it will cover.

How To Calculate Your Home Insurance Premiums? 5 Contributing Factors.

Buying a home is expensive, so it’s important for homeowners to save money whenever possible while protecting this large investment. So how much does homeowners insurance cost? This depends on many factors, some of which are proven, such as the age and condition of the home or the history of claims on the home in the past. Others depend on the homeowner, such as how much coverage is needed and what deductibles to choose. Lifestyle choices determine many factors: owning a specific breed of dog, running a home business, and even marital status can affect the cost of coverage. “These are all factors that may require a more sophisticated policy option, and your agent should be able to navigate that based on the information you provide,” Fashi says.

Is the house near the beach? The fault line? How is the home owner’s credit? These are all factors that affect the cost of homeowners insurance. While the national average cost of homeowners insurance is $1,383 per year, the exact cost can vary greatly by region and home value. It is important for homeowners to consider the style and location of the home, and then various optional factors, before seeking a homeowner’s insurance estimate. A homeowners insurance calculator can help homeowners calculate each of these potential costs.

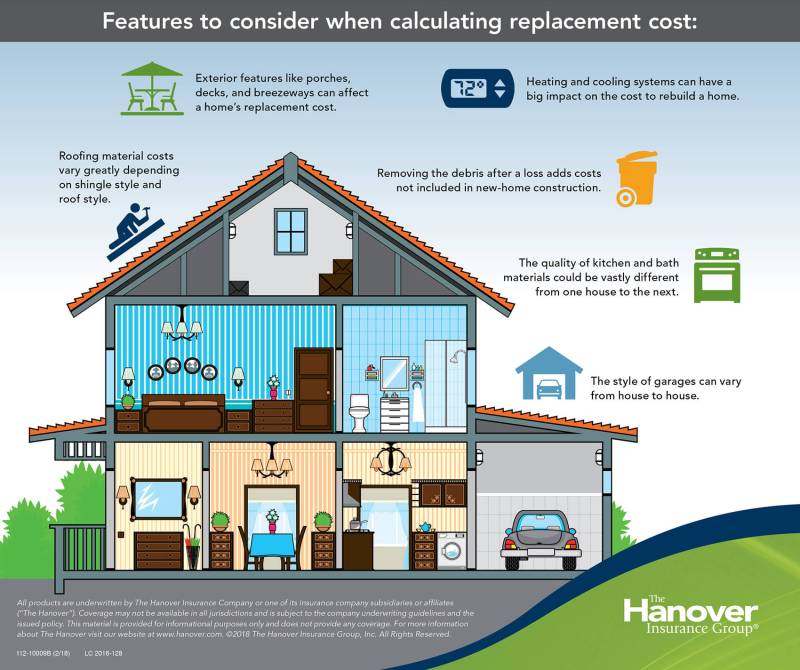

In case of total loss of the house, the house will be rebuilt from the ground up. Homeowners insurance rates are largely based on how much they charge for restoration. Although the renovation may include some improvements to ensure it meets current building codes, replacement cost is the price of rebuilding the home to match the size, quality, and materials of the lost home. This is not equal to the market value of the home, including the value of the land, so home insurance based on market value will result in higher premiums than necessary. Instead, homeowners are advised to work with an insurance agent to determine how much it will cost to rebuild the home and use that number to estimate the replacement cost of the home.

Older homes cost more to repair than newly constructed homes, which can increase the cost of homeowners insurance. Replacing old floors and tiles, restoring plaster walls, and patching canvas ceilings all require specialists and expensive materials, which insurers will point to increased costs in the event of a claim. Additionally, older home construction may not meet current building codes. By law, a home being renovated by a licensed contractor must be brought up to code, which can add thousands of dollars in materials and labor. Standard homeowners insurance policies do not cover this cost, but many companies will offer the opportunity to purchase a separate endorsement to cover the cost of code updates after the home is damaged by a covered peril.

How Inflation And Supply Chain Issues Impact Home Insurance Rates

Policy deductibles are one of the few things that can be controlled when choosing a homeowners insurance policy. “Once your [coverage] is set up, the last consideration is the amount of deductible (the amount you will pay out of pocket in the event of a claim) that you want to put on the policy, knowing that there will be an inverse. Always The relationship between the deductible and the price you pay annually for your insurance,” Fashi says. In other words, it is an opportunity for the home owner to save money against the possibility of a claim in a given year.

If the home is in good condition and not located in a high-risk area, it may make sense for homeowners to choose a higher deductible in exchange for a lower premium. If a homeowner needs to make a claim, the money they didn’t pay for the premium can help meet their deductible. On the other hand, paying a higher premium to keep the deductible low means that in the event of a covered loss, the homeowner will have more out-of-pocket expenses.

Dog teeth are at the heart of significant insurance claims, so insurers will ask homeowners if they have dogs. If the dog is not on the list of restricted breeds on the insurance list, the premium increase is likely to be less. If the dog is considered an “aggressive” breed, such as a Doberman, Rottweiler, or pit bull, the insurance company may cover damage or injuries caused by the dog, or the homeowner may need to purchase a separate rider. Policy. at additional cost. A homeowner whose dog is considered an “aggressive” breed can ask potential insurance providers if there are any limitations or restrictions on certain dog breeds to make sure the company’s policy will provide that coverage. that they need and will not exclude damages or injuries. Caused by their livestock.

Wood stoves can be an economical and energy efficient way to heat a home. But basically they sit in the middle of the house, burning day and night. Insurers see them as a greater risk and usually raise insurance costs as a result. This increase can be met with some companies installing a smoke detector near the wood stove and providing evidence that it was installed by a licensed contractor and regularly maintained.

Valued Policy Law Vs: Homeowners Insurance: Understanding The Differences

A basic homeowners insurance policy does not cover equipment and supplies that are kept in the home and used for home business, but these equipment will still be covered. Many insurers offer the option of purchasing a business endorsement to supplement your home insurance policy. Another option is to buy a completely separate business policy. Either will provide better protection, but both will increase the total cost of insurance. Depending on the type of business, homeowners may be able to claim the cost of insurance on their taxes if the location is designated as a home office. Homeowners may want to consult a tax professional or financial advisor to determine if they qualify for a tax deduction for this expense.

Sometimes rebuilding comes with lower insurance premiums. Updates and upgrades to electrical or plumbing systems reduce the likelihood of fire and leak damage and increase home value, which insurance can reward the homeowner with. Falling with other home features, such as outside steps and railings, reduces the risk of someone being liable for injury and may reduce the cost of the policy.

Liability coverage, which is a standard part of homeowners insurance policies, pays for injuries or property damage that the homeowner (or the homeowner’s family members or pets) are legally responsible for. The cover includes the cost of defending in court and any fines or disbursements required by the court after trial. Homeowners must decide which limits to choose for their coverage: a higher limit will result in higher premiums, but also increased coverage. Most policies have a minimum coverage limit of $100,000, but many insurers offer limits of $300,000 to $500,000. If the owner of the house has a lot of personal assets that someone can try to buy, it would be wise. Set the limit even higher, but every increase in the limit also increases the cost of insurance.

An insurance score is a combination of credit score and insurance claim history. Unlike a credit score, it’s higher than bankruptcy, lien, and total debt on time and number of accounts. This is because a homeowner is statistically more likely to file an insurance claim, either because they can no longer afford their credit for maintenance work or because they have a history of paying problems.

Average Cost Of Homeowners Insurance (2024)

Annual cost of homeowners insurance, monthly cost of homeowners insurance, what's the average cost of homeowners insurance, estimate cost of homeowners insurance, cost of homeowners insurance, approximate cost of homeowners insurance, what is the cost of homeowners insurance, cost of homeowners insurance calculator, avg cost of homeowners insurance, cost of homeowners title insurance, average cost of homeowners insurance, cost of homeowners insurance nj