State Farm Car Insurance Florida Quote – Bloomington, IL, February 25, 2022 – In 2021, State Farm insurance companies posted record growth in auto, home and life insurance policies. While reporting record growth in auto policies, State Farm saw a year-over-year decline in earned auto premiums. The decline in car premiums reflects a focus on returning value to customers in the form of lower premiums, where appropriate. State Farm’s life insurance companies paid nearly $600 million in dividends to policyholders and issued a record $116 billion in new policy volume, bringing the value of individual life insurance to $1.1 trillion at the end of 2021. Major US As a leader in auto and home insurance and individual life insurance, State Farm strives to serve its policyholders and remains a strong choice for insurance and financial services.

“For nearly 100 years, State Farm has been helping our customers prepare for and recover from the unexpected. Last year was no different. We helped clients recover from another year of catastrophic events, and insurance companies continue to support our clients,” said Jon Farney, senior vice president, treasurer and chief financial officer. “We enter our 100th year in business with financial strength and record growth in our auto, home and life insurance businesses. We are very happy that more customers are choosing State Farm as we continue to focus on helping more people in different ways.

State Farm Car Insurance Florida Quote

The State Farm PC group of companies earned $66.9 billion in premiums, gross underwritten losses of $4.7 billion and paid $401 million in dividends to policyholders of State Farm Mutual Automobile Insurance Company. That compares to an underwriting profit of $1.9 billion on $65.1 billion in premiums earned in 2020, with a $1.9 billion dividend for state farm mutual automobile insurance company policyholders. 2021 underwriting results reflect higher auto insurance claims volume and lower premiums. Homeowners insurance results reflect another year of significant disasters across the country. The 2021 underwriting loss, along with policyholder dividends and investments and other income of $4.4 billion, resulted in PC’s pre-tax operating loss of $301 million, down from a profit of $4.4 billion. A record $5 billion in 2020. Total revenue, which includes premium income, earned investment income and realized capital gains (losses), was $82.2 billion in 2021 compared to $78.9 billion in 2020. State Farm reported net income of $3.7 billion in 2021, compared to net income of $3.7 billion in 2021. In 2020. The state farm mutual automobile insurance company’s net worth rose to $143.2 billion at the end of the year, compared with $126.1 billion at the end of 2020. The change included a significant increase in the value of the portfolio of shares of unrelated PC companies, which resulted from the rise in the US stock market.

State Farm Homeowners Insurance

State Farm’s insurance activities include 13 property insurance companies and two insurance companies, each of which is managed at the level of an individual affiliate. PC companies are primarily engaged in the automotive, healthcare, homeowner, commercial multi-peril (CMP) and reinsurance industries. Life insurance companies mainly deal in individual life insurance and annuities. State Farm Group provides third party investment funds and third party banking products through its 2 affiliated State Farm companies, which act as intermediaries between third parties and State Farm clients. State Farm offers insurance products and financial services with more than 87 million policies and accounts.

Auto-motor insurance conducted by State Farm accounts for 61 percent of PC companies’ total net written premiums. Earned premiums were $41.2 billion. Losses and claims settlement costs were $34.4 billion, and all other insurance costs were $10.2 billion. Underwriting losses were $3.4 billion, and dividends to policyholders of State Farm Mutual Automobile Insurance Company were $401 million.

Comparable figures for 2020 are: Earned premiums, $41.3 billion; Claims incurred and loss adjustment expenses – $27.6 billion; all other insurance costs, $10.1 billion; guaranteed benefits, $3.5 billion; $1.9 billion in dividends to State Farm Mutual automobile insurance company policyholders.

Home Owners, CMP, Other – Net written premiums for State Farm’s remaining P-C business represent 38 percent of the total net written premiums of P-C companies. Premium earnings were $24.7 billion. Incurred losses and claims settlement costs were $19.5 billion, and all other insurance costs were $6.3 billion. Insured losses were $1.1 billion.

I’m Here To Help You Bundle Your Home & Auto, Spencer Gaille

Comparative figures for 2020 are: Premium Earnings – $22.9 billion; Claims incurred and loss adjustment expenses – $18.6 billion; all other insurance costs, $5.9 billion; Insured losses, $1.6 billion.

Health – The individual health insurance business for State Farm Mutual Automobile Insurance Company recorded an underwriting loss of $75 million, excluding the change in premium deficiency reserves. Net written premium is USD 719 million.

Life – In 2021, State Farm Life Insurance Company and State Farm Life & Accident Insurance Company reported $5.7 billion in premium income and $593 million in dividends to policyholders. Net profit for 2021 was $929 million. At the end of 2021, the value of individual life insurance policies was $1.1 trillion. Comparable figures for 2020 are: premium income, $5.5 billion; Dividends to policyholders – $584 million; net income, $339 million; Applied individual life insurance, $994 billion.

Investment Planning Services – Total assets under management for Investment Planning Services at the end of 2021 were $15.3 billion. Vice President of State Farm Management Corporation Dr. And State Farm Investment Management Corporation posted a total net loss of USD 38 million in 2021. Comparative figures for 2020 are: Total assets under management – USD 13.9 billion; Net loss, $41 million.

Home & Auto. Easy & Affordable., State Farm: Brad Spry, Walker, Mn

GAINSCO, INC. – In 2021, net income was $327 million, net loss was $8 million, and total assets were $405 million. Comparable figures for 2020 were as follows: gross revenue – $335 million; net income, $5 million; Net worth, $421 million.

Although the financial information is presented by business group/line, State Farm Mutual Automobile Insurance Company and each of its affiliates are subject to solvency and compliance with regulatory requirements on an individual entity basis, regardless of the solvency or financial condition of any other affiliate. should do

State Farm VP Management Corporation is a separate entity from PGR entities offering banking and insurance products. Neither State Farm nor its agents provide investment, tax or legal advice.

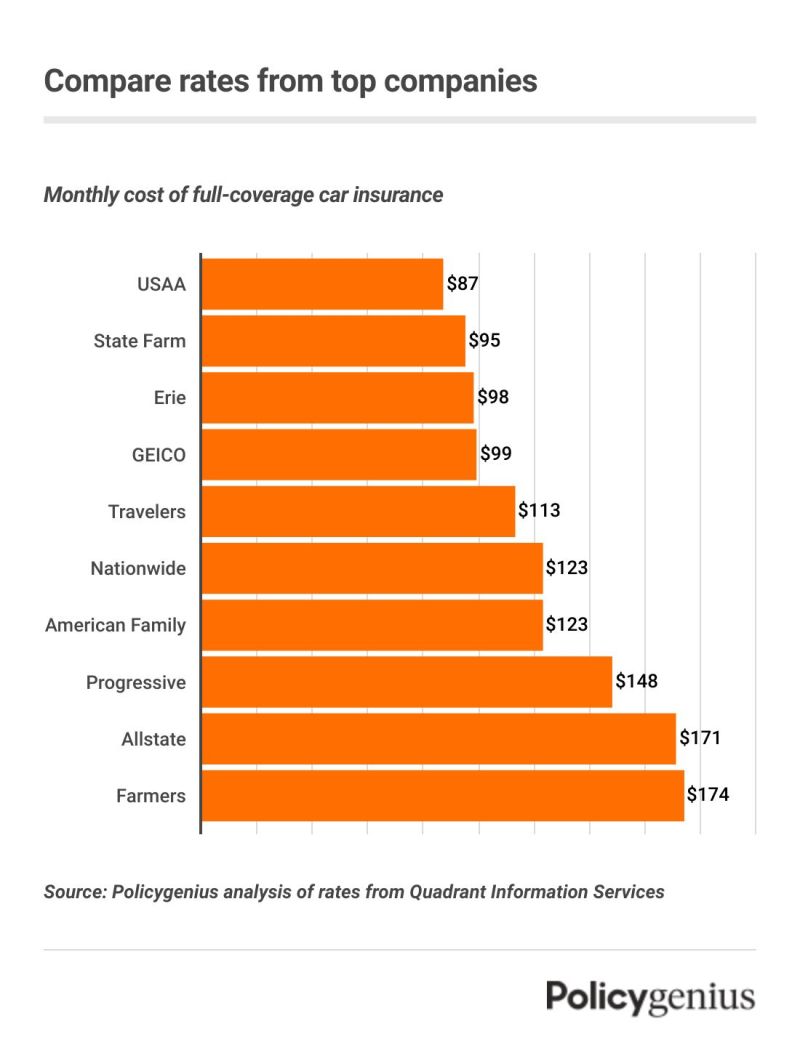

For more than 100 years, State Farm’s mission has been to help people manage the risks of everyday life, overcome the unexpected and make their dreams come true. State Farm and its affiliates are the largest providers of auto and home insurance in the United States. More than 19,400 agents and 67,000 employees service more than 91 million policies and accounts – including auto, fire, life, health, commercial and financial services accounts. Commercial auto insurance is also available with coverage for renters, business owners, boats and motorcycles. State Farm Mutual Automobile Insurance Company is the parent of the State Farm family of companies. State Farm is ranked 44th on the 2023 Fortune 500 list. For more information, visit http://www.statefarm.com. There are thousands of licensed insurers in the United States, but the top 10 insurance companies represent 74% of the auto insurance market. Although all of these major insurance companies are well known, they have different costs, customer service ratings, and insurance options. We have discussed the differences between them below.

Drive Safe & Save™

The nation’s largest auto insurance company is State Farm, which has the only U.S. Auto insurance accounts for 16% of the market. According to the most recent data from the National Association of Insurance Commissioners, State Farm issued $40.4 billion in premiums — about $7 billion more than the second-largest insurer, GEICO.

Collectively, the 10 largest auto insurers collected $184 billion in written premiums in 2020, the most recent year for which data is available. That same year, the industry as a whole issued $250 billion in premiums. The most popular insurance companies received 74% of this amount themselves.

Seven of the 10 largest insurance companies wrote at least $10 billion in auto premiums in 2020, and all earned at least $1 billion. In fact, none of the nation’s 28 largest insurers earned less than $1 billion this year.

Ratings How we rate: Ratings are determined by our editorial team. Our methodology takes into account several factors, including price, financial ratings, customer service quality and other product-specific characteristics.

Farmers Vs. State Farm: Cost And Coverage Comparison (2023)

State Farm is not only the nation’s largest auto insurance company, but is also known for affordable insurance and top-rated customer service.

Covering 16% of the entire motor insurance market, Państwowe Gospodarstwo Rolne is the number one car insurance company in the country. The company was founded in 1922 and currently employs more than 18,000 agents throughout the United States.

Along with being the largest company, State Farm is one of the best companies in America due to its low insurance costs. The company is one of the cheapest insurance options for young and older drivers as well as those who have had previous accidents.

State Farm also has a history of highly rated customer service, which is rare among large auto insurance companies. State Farm’s strong local presence helped make this happen

State Farm Insurance Review: Great Quotes & Coverage

State farm car insurance quote number, state farm car insurance quote phone number, state farm car quote, get a state farm car insurance quote, state farm car insurance quote, state farm non owner car insurance quote, state farm insurance quote, state farm car insurance quote florida, state farm quote for car insurance, state farm home insurance quote florida, state farm online quote car insurance, state farm free car insurance quote