Sep Ira Employer Contribution Rules – Benefits that an employer can provide – medical and dental insurance, retirement and personal leave – we have to provide ourselves.

If you’ve worked as an employee in the past, a 401(k) plan may have been one of your benefits. 401(k) plans allow you to save money for retirement and defer paying taxes until you withdraw, most likely after you retire. 401(k) plans have several potential benefits:

Sep Ira Employer Contribution Rules

Many staffing firms and compliance providers offer their own version of the 401(k). These companies and their corporate partners may even list them as an advantage for giving up your independent status and signing for their W-2 payroll.

Sep Ira Vs. Traditional Ira: Key Differences & Benefits

First, retirement plans offered through staffing agencies are often not as robust as the plans that top corporations create for their employees, plans that may offer profit sharing, matching employee contributions, or even your help managing your investments. . More importantly, as independent contractors, we have access to better retirement planning methods that can reduce our tax bill by thousands per year.

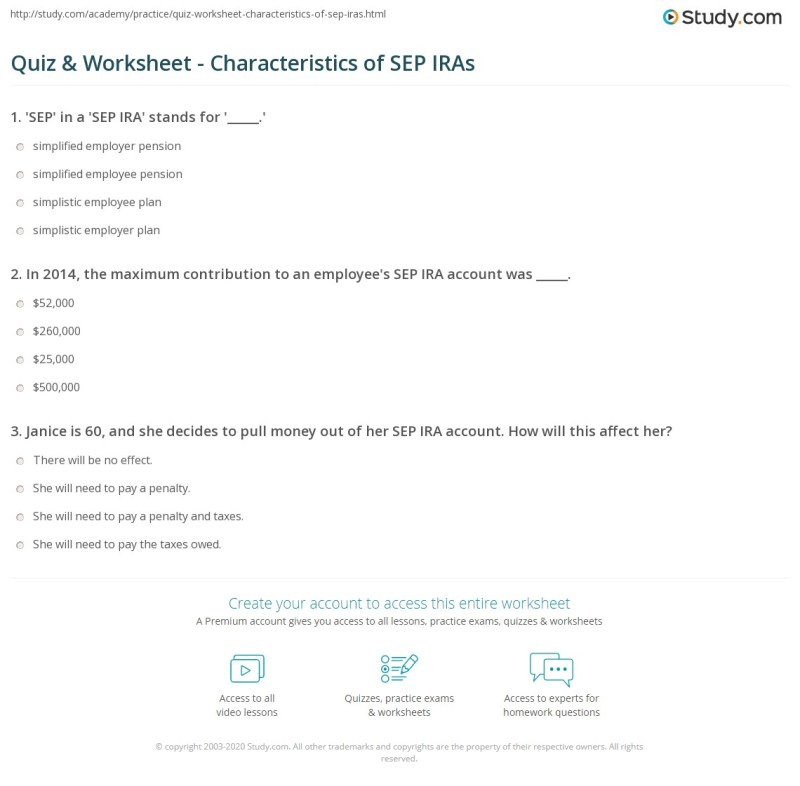

These options are the Simple Employee Pension (SEP-IRA) and the Individual 401(k), sometimes called the Solo 401(k). Like a company 401(k) plan, the SEP-IRA and Solo 401(k) reduce your net income for the current tax year (often significantly) and allow you to earn decades of ongoing compounding growth tax-free. (See related story, “1099 vs. W-2” for an example.) However, unlike a company 401(k), retirement plans available to the self-employed have higher contribution limits and a wider range of investment options. (See table below.)

Additionally, a SEP-IRA offers many more choices if you want to take more control over your investments, and a Solo 401(k) opens up the opportunity to set aside even more money than the high limits allowed with a SEP-IRA.

Figuring out the best option can be complicated. You can get a rough idea of your options by running different scenarios through tax preparation software, but it’s best to consult your tax advisor about your specific situation. Here’s a quick summary of the differences between the plans (or download a PDF here).

Sep Ira Eligibility Rules: What You Need To Know

A better alternative to a traditional 401(k) through a staffing company. Also, in most situations you can contribute more to an individual 401(k) than you could to a SEP-IRA, although actually getting that much money to contribute can be a challenge.

When you transitioned from corporate employment to self-employment, you probably faced sticker shock the first time you paid your self-employment taxes. So it can be tempting to start letting a staffing company pick up that portion of the employer’s taxes. Using Self-Employed Retirement Plans, SEPs or Solo 401(k), can more than offset that cost. Enrolling in one of them might just be your secret sauce to wealth creation.

To compare the maximum deduction amounts of individual 401(k), SEP-IRA or Simple IRA plans and which plan would provide the best benefit for you, we suggest using Bankrate.com’s self-employed calculator. Are you self-employed or running a small business? And if so, do you want to cut your taxes and save for retirement? Have you considered a SEP IRA vs a SIMPLE IRA? In this article, we share two great ways you can do this and the difference between a SEP and a SIMPLE IRA. First through a SEP IRA, and second, through a SIMPLE IRA. Finally, we’ll show you a comparison of SEP IRAs and SIMPLE IRAs to help you decide which one might be best for you.

A SEP is an Individual Retirement Account (IRA) that can be set up by a self-employed person or an employer. With a SEP IRA, only the employer can make contributions to the account. If you are self-employed or run a small business, you can set up a SEP IRA with almost any financial brokerage firm out there. Examples of this are Vanguard, Fidelity, TD Ameritrade, Schwab, E-Trade. SEP stands for Simple Employees’ Pension. Here are five great features of a SEP IRA.

K) Vs. Simple Ira: Which Retirement Plan Is Best?

1) Taxable. If you put $10,000 into a SEP IRA, you can deduct $10,000 of your taxable income on your tax return, which equals a lower tax bill.

2) Choice of investments. This is the real beauty of a SEP IRA compared to a 401(k). With a 401(k), you generally get to choose from 10 or 15 funds that your employer has chosen for you. With a SEP IRA, once set up, you can pretty much invest in any ETF or mutual fund publicly available to retail investors out there. So if you want, you can even buy individual stocks like Amazon or Tesla.

We don’t suggest using your SEP IRA to buy individual stocks, but your investment options are much broader with a SEP.

3) A SEP IRA is tax deferred. This means you don’t have to pay taxes now on any dividends your investments generate each month or quarter. Also, let’s say you bought GameStop for $10 a share and sold it for $200 a share, you don’t have to pay capital gains tax on the gain you just made because it’s in a tax leveraged account. You will have to pay taxes when you take it out during retirement.

Self Directed Individual 401k Plan: Advantages, Eligibility & Contributions Limits

4) You do not need to report anything to the IRS. If you set up a separate account, like a 401(k), you have to do a bunch of paperwork and non-discrimination testing every year. There aren’t the same requirements for a SEP IRA.

5) A SEP IRA has flexibility in how much you can contribute each year. Let’s say last year you invested $10,000 and then this year, you feel like hey, you know what? I want to go to Finland and check out the Northern Lights and maybe bring and pay for my brother or my girlfriend. And I might put $1,000 into my SEP IRA this year. It really depends on you. It gives you a lot of flexibility.

Find out where it allows you to open an account. You may need to select the option to view all available account types to find the SEP IRA. Since not everyone can contribute to one, it may not be on the main options screen. Then follow the instructions to open the account.

2. The other important thing you need to do to create a SEP IRA that many people forget is that you need to fill out what is called Form 5305-SEP.

Simplified Employee Pension: Sep: Iras: Irs Pub 939 Guidelines

You are probably thinking now, I thought there would be no documents. What is this form you are asking me to fill out? Well, it’s only half a page, and pretty simple. Don’t worry about it. You will need to sign and date it. You don’t even need to send it to the IRS. You submit it for your documentation, so in case you are audited, you have it.

Now, if you read the official IRS website, it will tell you that you can contribute up to 25% of your total salary, up to the IRS maximum. In our experience, it actually comes down to roughly 18% after adjustments. All you have to do is enter exactly how much you can contribute if you want to max out your SEP IRA.

👉 Wondering if you should set up a SEP IRA or SIMPLE IRA plan for your small business? Find out now!

The main caveat of SEP IRAs is that contributions are technically made by the employer. If you are self-employed, you are both an employee and an employer, so it should not be a problem. But if you have a W2 employee and let’s say you put 18% of your salary into your SEP IRA. Under the rules, you as an employer will also be required to contribute 18% of your employee’s total W2 wages to their SEP IRA. For many small business owners, that’s probably too high an employee benefit. This is where the SIMPLE IRA comes in.

What Is A Sep Ira And How Much Can You Contribute?

A second small business retirement plan option is the Employee Savings Incentive Matching Plan (SIMPLE IRA). Employers (including the self-employed) can contribute if they have no more than 100 employees earning more than $5,000 in the previous year. Employee contributions can be deducted from their pay and that money will grow tax-free until they retire. If you are a small business owner and have a W2 employee, a SIMPLE IRA may be attractive to you. There are five great features of a SIMPLE IRA, which is very similar to a SEP IRA.

3) It has flexible investment options. If you open it at the right institution, you can buy any ETF or mutual fund you want.

4) The really cool feature here is that you can offer this as a retirement to your W2 employees. And you might ask, what’s so great about that? Well, there are actually 40 million private sector workers in this country who do not have access to a pension plan. So setting up a retirement plan is a big deal

Sep ira contribution rules, sep contribution rules, sep ira rollover rules, sep ira contribution deadline, sep ira contribution, calculate sep ira contribution, sep ira contribution rules for employees, sep ira employer contribution, sep ira employer contribution limits, simple ira employer contribution, sep ira employer rules, simple ira employer contribution rules