Private Student Loans Interest Rates Comparison – Refinancing is when you repay your existing home loan in full or transfer your loan to a rival lender (usually because of a lower interest rate). This article lists some of the best refinancing rates in Singapore in 2023.

Amid the low interest rates that prevailed last year, banks in Singapore are trying to outdo each other by offering the most attractive deals on home loans. With mortgage rates set to increase in 2023, now is the best time to refinance your home loan. Here’s our ranking of the best fixed and floating rate mortgages around:

Private Student Loans Interest Rates Comparison

In the current low interest rate environment, floating rates (as benchmarked against SORA) may be the preferred package for private property owners with a higher risk appetite.

Student Loans: Pros And Cons

Most bank spreads based on the SORA rate have a relatively short lock-in period, which reduces the cost barrier to switching to a different interest rate package (also known as repricing or switching). This is useful when you are faced with the prospect of interest rate hikes soon.

HSBC’s SORA 1M package (not in the table above) now offers this feature completely free of charge. This provides a significant advantage over other options, all of which have at least a 1-year lock-in period. In general, HSBC also offers the highest cash rewards at all loan levels, which can fully offset all refinancing fees.

Right after that, there are conveyance (legal) fees (usually from $1,800 to $3000) and appraisal fees (about $160 to $1,000). There is also a chance that you may also pay a penalty on your current loan.

If you are a HDB home owner and do not plan to move to a new place anytime soon, you may consider refinancing your HDB loan. This can help you save a little as we have described below:

Outlook: When Will Mortgage Rates In Singapore Drop?

For example, you take out a loan of $350,000 with a loan term of 25 years. With an HDB loan at 2.6% per annum, you will pay back about $1,604 a month, of which about $758 could be interest. By the end of the loan term, you will have paid about $126,353 in interest alone.

Keeping the loan amount and term the same, a bank loan at 1.3% per annum would result in a monthly repayment of about $1,3677, of which about $379 would be interest. At the end of the term, you will only pay about $60,138 in interest. That’s a lot of savings!

You then have to deduct your transportation fees, but the overall savings are still significant. Of course, the numbers may not be the same in your case, so consider the costs and benefits of refinancing in your own case carefully before deciding whether refinancing is worth it.

The cheapest bank for refinancing HDB loans at the moment is DBS, with one of the lowest interest rates accompanied by a cashback of $2,000 for loan amounts of $200,000 and above. The cash report fully offsets all previous refinancing fees. Since the total down payment for HDB refinancing may be up to $1,800 or $1,900 while all other banks usually provide subsidies between $1,400 to $1,800, the DBS package takes the cake by a small margin. margins

Student Loans 101: Ultimate Guide To Student Loans

As a general rule, you should consider refinancing your HDB loan when interest rates are now lower. This frees up more of your money for other priorities.

Typically, refinancing is done every 2-3 years (based on your lock-in period). However, if you’ve measured the costs, you don’t have to wait for the lock-in period before refinancing. We would suggest you start the refinancing process about 3-4 months before your foreclosure ends.

Another good time to consider refinancing is: if you plan to live in the same apartment for a few more years; or if your financial situation has changed and you may need a little extra disposable income to pay off loans faster or pay off other important things.

One of Singapore’s leading comparison aggregators and independent loan marketplaces. We compare a wide range of products including banking, insurance, investment and utility products. We also facilitate loan applications for borrowers and loan partners.

How Do Student Loans Work?

We strive to ensure that all product information is accurate and up-to-date, but the information published on our website should not be considered financial advice and does not take into account personal needs and financial circumstances. Although the information on our website provides users with factual product information and general advice, it should not be considered a substitute for professional advice from a licensed financial advisor. Users should consider whether the products and/or services presented are suitable for their personal needs.

Products marked as “Sponsored” are prominently displayed at the top of each page or listing. As a result of commercial advertising agreements may receive remuneration from financial institutions, service providers or certain product websites when users click to review links, make purchases or inquire about products. A “sponsored” product cannot be considered the best in its category or suitable for one’s personal needs.

When our site is linked to a specific product, we may receive a referral fee, affiliate commission or payment when a user clicks on our site, applies and successfully registers for the product.

The products listed in the comparison table are sorted by various factors including price, fees, promotions, features, reviews and popularity. provides various comparison tools and filters to help users sort through these and highlight the benefits.

What Is A Private Student Loan?

Takes an open and transparent approach to comparing its loan application products and services. Users should be aware that although we operate independently, our comparison and loan application services do not include all products available in Singapore.

Some financial institutions, service providers or certain product websites may offer their services and products through multiple channels, brands and or related companies, which can make it difficult for us and users to constantly find, compare and analyze them. strives to enable consumers to better understand it through unbiased and well-researched product information.Domino Media: Student Debt Blog How Private Student Loans Widen the Racial Gap in the Student Loan Market

Nationwide, about 45 million borrowers owe a collective $1.7 trillion in student debt, including more than $140 billion in private student debt. Private student loans—made by banks and other private lenders without the involvement of the federal government—are taking on an increasingly important role in the broader student loan market, and as a result, the student debt crisis. The private student loan market grew rapidly in the years following the Great Recession, outpacing the growth rates of the markets in mortgages, car loans and credit cards. Although the industry assures that the private student loan market is borrower-free, a closer examination of the results shows that certain subsets of borrowers are disproportionately burdened with private student debt—namely, Black and Latinx borrowers.

This difference is particularly noticeable in the private student loan market. While less than half as likely to take out private student loans, black students are four times more likely to struggle to repay private student debt than their white peers. This difference is worrisome, especially since private student loans carry additional risks for borrowers. Unlike federal student loans, private student loans contain fewer protections to help reduce defaults when borrowers face financial hardship. Struggling borrowers then have fewer options for getting help if they fall behind, as default reduction programs are left to the discretion of lenders.

Simple Interest Vs. Compound Interest

Further, students who attend for-profit institutions are more likely to use high-cost private student loans to finance their education, including largely unregulated shadow student debt—a subset of unmonitored and often exploitative debt and credit products aimed at for-profit students. . schools The main features of these products often include high interest rates, misleading marketing and risk insurance. Because these institutions have an overrepresentation of Black students, the consequences of this predatory debt fall disproportionately on the Black community.

The burden of the student debt crisis is not borne equally – black and Latino borrowers will bear some of the worst consequences associated with this debt, stemming from systemic discrimination that reaches our nation’s financial markets. Economic policies of exclusion and racial discrimination have contributed to a racial wealth gap that causes the median white household to have 13 times the wealth of the median Black household and 10 times the wealth of the median Latinx household. As a result, the typical white student loan borrower will pay off nearly 95 percent of his loan within 20 years of starting college, while his black peers will still pay it off.

95 percent of their original balance after the same period. Debt-driven higher education only reinforces and exacerbates these systemic barriers, and a deeper dive into the nuances of borrowing in the private student loan market shows a similar trend.

The opacity of the private student loan market only adds to concerns about disparate loan yields and repayment difficulties and the predatory targeting of Black borrowers. Very little data is available on the private student loan market and the borrowers’ yields in it, in part because of the Consumer Financial Protection Bureau below

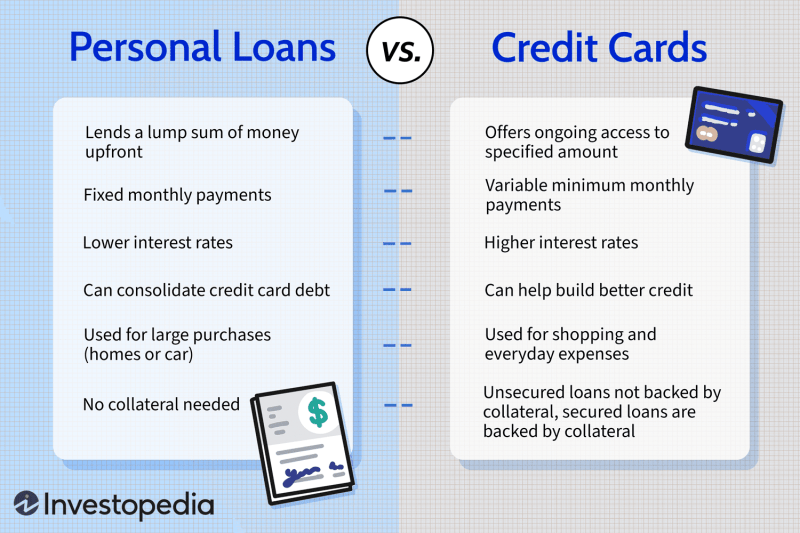

Personal Loans Vs. Credit Cards: What’s The Difference?

Current interest rates student loans, interest rates on student loans, graduate student loans interest rates, low interest private student loans, private student loans rates, refinancing student loans interest rates, private student loans low interest rates, private student loans interest rates, private student loans with low interest rates, student loans interest rates, private student loans interest rate, student loans rates comparison