Low Interest Rates For Student Loans – Wants to help people understand their finances and equip them with the tools to manage them. Our content is available for free, however, the services presented on this site are provided by companies that pay us a fee to click or register. These organizations may change the way and where the services appear on the website, but do not change our decisions, opinions or editorial advice. Here is a list of our service providers.

The United States Senate on Wednesday failed to reverse the doubling of the interest rate to 6.8 percent on millions of new federal student loans.

Low Interest Rates For Student Loans

Although the measure to return the rate to its lowest level of 3.4 percent for Stafford Loans actually received a vote of 51-49, the arcane procedures of the “world’s largest consulting firm” require a of 60 votes for approval. In the US Senate, the majority thought it was an old idea.

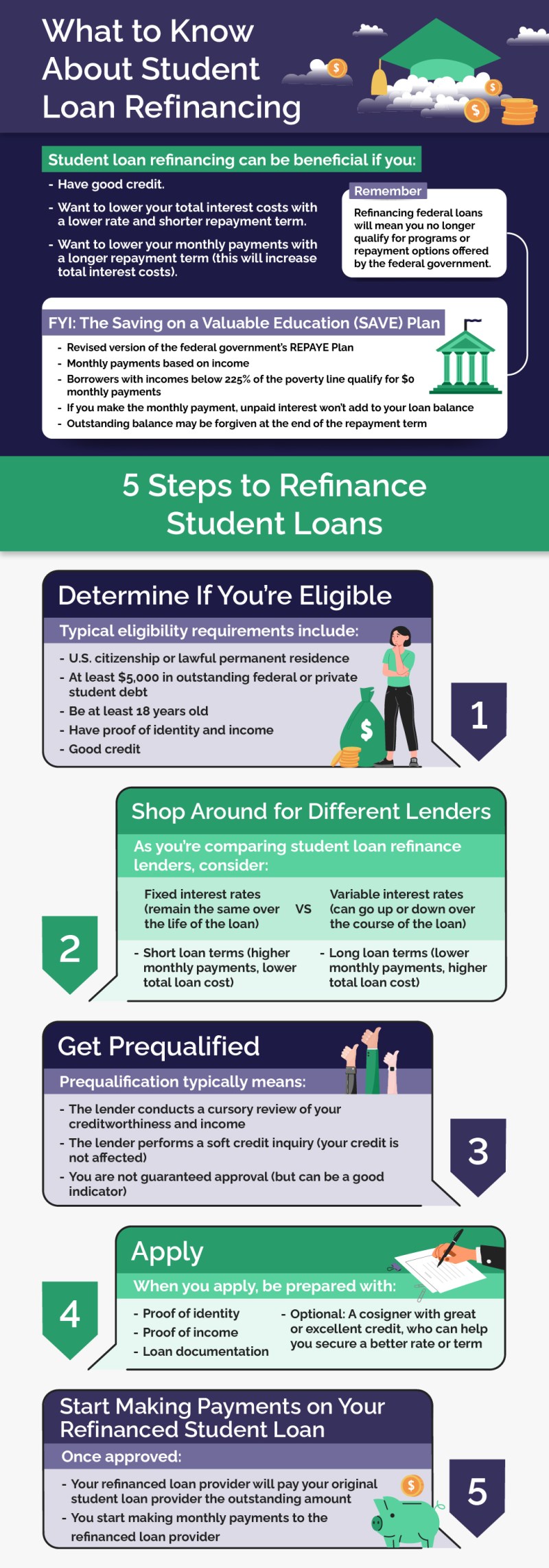

Pros & Cons Of Refinancing Student Loan

Student loan debt is currently at $1 trillion. The fallout from the election means millions of young college students will have to pay more in the coming years because of the indifference of Washington politicians.

Rates on new Stafford loans, awarded to undergraduate students from low- and low-income families, doubled on July 1. About 7 million students are affected — or 25 percent of federal student loans. newly issued this year.

Rising interest rates mean that a student borrower will pay about $1,000 more over the life of the loan and up to $4,000 more in interest if they take out more of credit during their four-year academic career.

That’s not a lot for the millionaires in the Senate, but it’s a lot for a college graduate with few job prospects in a market where unemployment is at 7.6 percent.

Interest Rates: Understanding Interest Rates On Education Loans

The 6.8 percent increase in student loan interest is a significant difference to the interest rate borrowers will pay over the life of their student loans. This interest reduces their savings and other resources.

The interest rate on federal student loan consolidation, which allows borrowers to consolidate all of their student loans into one package, is based on the average of the combined interest rates, can be increased for borrowers who receive a Stafford loan increase.

The class of 2013 is expected to graduate with more than $35,000 in student loans. In other words, they will have less money for savings, investment in the housing and automobile industry, and retirement, which will hinder the country’s economic growth. next year.

Critics say the Senate is unwilling to address the issue immediately; he wants to find a permanent solution to the overall problem of the nation’s highest student debt.

Interest Rates: Different Types And What They Mean To Borrowers

Senators argued the bill would completely change the way student interest rates are charged, capping payments on ten-year bonds, and some rates.

There are two problems with this approach: First, as interest rates on Treasury bills rise, interest rates on student loans will rise. There would be no limit on those exchange rates, under the legislation proposed by Sens. Joe Manchin, D–W.Va. and Richard Burr, R-N.C.

Although they may be low for the first few years (3.66 percent for all college loans for the next school year), interest rates can explode, even more than the current rate of 6.8 percent. Great for helping middle school and high school students.

The second, and perhaps even bigger, problem is that no matter what legislation the Senate passes (if it can win over its district and the 60-vote rule), it will never become law. because the House has a mind. the loan model and there writing.

The 4 Best Ways To Lower Your Student Loan Interest Rate

There is very little connection between the two sides of the Capitol – everything that goes in the Republican House these days seems to die in the Democratic Senate and vice versa.

In some ways, it is commendable that some senators want to fix the biggest flaws in the current system rather than applying a temporary Band-Aid, and in their opinion, change of double interest for the same year.

But on the other hand, they don’t accept the fact that because Congress is so sick and stuck in gridlock, they will never see their proper solution. They can talk and argue as much as they want, but this is just a good show that will not bring any fundamental change.

Despite bills proposed by other lawmakers, the doubling of student loan payments will continue, hurting the very people our lawmakers say they want to help the most – those 7 students million this school year.

Lower Your Student Loan Interest Rate → Now ←

Congress has again talked the talk but lacked the wisdom and willingness to walk the walk. College students and their families will pay the price for its failure.

Bill Fay “Free” has lived well in his financial life. He began to write and boast about it in 2012, helping to give birth to life as the first source of the website “The Thrifty Man.” Before that, he spent more than 30 years covering the world of high-profile college and professional sports for major publications, including the Associated Press, the New York Times and Sports Illustrated. Illustrated. His interest in sports has waned, but he is as passionate as ever when it comes to his pocket. The invoice can be accessed at [email protected] . In order to serve you better, we will make reservations on 13 July 22, 23:00 SGT for the nearest location. 3 hours.

The platform will be unavailable between 15:00 and 16:00 SGT on 16 November 2023. We apologize for any inconvenience.

Leap into Prosperity this CNY Leap into Prosperity this CNY 💰Get an $88 start to grow your wealth. Get more

What If Interest Rates On Student Loan Stayed At 0%?

You can create headlines, paragraphs, block words, images and videos in one place instead of adding and linking them individually. Just double click and the view will be done easily.

A rich text element can be used with static or dynamic content. For static content, just jump to another page and start editing. For dynamic content, add a rich text field to each collection and then attach a rich text element to that field in the array. Voila!

Headings, paragraphs, bullet points, pictures, images, and graphics can be nested after a layer is added to the rich text element using the nested When Inside selection system.

If you’re paying off debt while saving for retirement, you may struggle with how to allocate your money and where to put it first.

What Is The Interest Rate For Federal Student Loans?

Whether you save, pay off serious debt, or invest first is a personal decision and depends a lot on your unique financial situation and goals.

Before any of us start paying off debt or building our wealth, we need to understand what kind of money we need to set ourselves up first. Here are 5 things to consider to decide which one is right for you.

Even before you focus on reducing your debt, it’s easy to have an emergency fund.

The biggest mistake you can make is not budgeting for unforeseen circumstances and major expenses such as unemployment or serious illness. If you don’t have an emergency fund, it’s important to set one aside.

Student Loan Consolidation Credit Rating And Its Effect On Your Interest Rate By Disha

A general guideline is to have money in your emergency fund to cover at least three to six months of expenses. That said, this is not a hard and fast rule.

To add stability to your emergency fund, consider “paying yourself first” by withdrawing a fixed amount each month into a low-cost investment product – this could be a money market fund or without a large dedicated account. Your financial management plan is an important part of your financial planning.

For a detailed guide on building and managing an emergency fund, click here. Also, get some tips on how to save more money.

As Singaporeans, most of us are taught from a young age that all debt is bad. But the truth is more complicated.

How To Get A Student Loan

The difference between good credit and bad credit can prevent you from taking on an unreasonable financial burden and help you create an effective loan repayment plan.

What is good credit? The reason is that investing helps you increase your personal and financial capital, and can improve your overall financial health. Good credit usually has a low interest rate, can help you increase your future income, and can increase your net worth. College student loans and some mortgages can fall into this category.

In contrast, bad debt comes from expenses that don’t help you make money and don’t help your financial health. It is often low cost and carries high interest rates. Credit card loans and car loans are examples.

The main reason

Student Loan Refinance 101

Student loans with low interest rates, student loans interest rates, graduate student loans interest rates, best interest rates for private student loans, private student loans with low interest rates, best student loans with low interest rates, current interest rates student loans, current interest rates for refinancing student loans, private student loans interest rates, private student loans low interest rates, refinancing student loans interest rates, interest rates for student loans