Loss Of Rents Insurance Coverage – The short answer is it depends. For added protection, we recommend requesting renters insurance.

If a tenant damages your rental property, your landlord’s insurance may cover the loss, but it depends on the type of damage and your coverage. Insurance companies classify renters’ losses in three different ways:

Loss Of Rents Insurance Coverage

That’s what it sounds like. Anything the tenant does accidentally, such as starting a fire in the kitchen or breaking a window, falls into this category. Any form of renter’s insurance covers accidental fire; however, other costs will depend on your policy.

Rental Car Coverage: Diminution In Value, Loss Of Use & Loss Damage Waiver (ldw) — The Basics

Your policy can also protect you if the damage results in loss of rental income. Landlord’s insurance does not cover replacement of tenant’s personal belongings. They need renters insurance to protect their belongings.

This is sometimes called vandalism. This type of damage occurs when a bad tenant steals from your property or hammers on the walls. Your coverage again depends on the insurance company and the terms of your policy.

People often confuse this type of damage with vandalism, which is covered by most policies. But it’s worth noting that some policies treat vandalism and vandalism differently.

This means things like stained carpets or worn floors are not covered by your renter’s insurance policy. As a landlord, a common way to cover this cost is to use the tenant’s security deposit to cover such costs.

Business Interruption Insurance: Part 3 (from The Experts)

What is covered and how much is covered depends on the type of renter’s insurance policy. As with many different homeowner’s insurance policies, there are three levels of renter’s insurance. Insurance companies call this primary dwelling coverage, sometimes referred to as fire insurance (DP-1), extensive dwelling coverage (DP-2), and special dwelling rental (DP-3).

The amount or coverage for home insurance and riders increases with each plan. For example, you can upgrade to replacement cost and actual cash value.

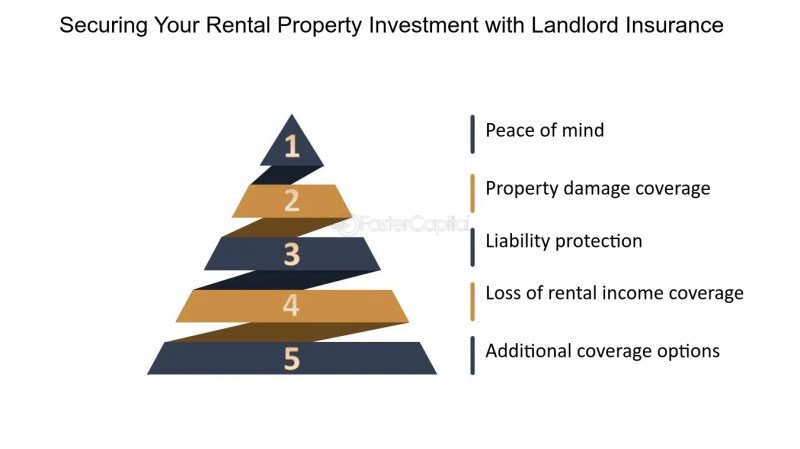

The three most important protections that renter’s insurance offers are property damage coverage, liability coverage, and rental income protection:

The insurance company pays for the repair costs of any covered damage to your rental property. A standard list of covered hazards includes:

Best Renters Insurance In Illinois Of December 2023

Note, however, that homeowners policies do not cover damage caused by floods or earthquakes. (In addition to a homeowner’s policy, you can also purchase flood and earthquake insurance.)

Landlord’s liability insurance usually only covers claims related to your rental. Contrast this with a homeowner’s policy for your primary residence, which covers you and your roommates for claims arising from accidents at home or elsewhere.

Rental income protection, also known as rent arrears or fair rent, pays tenants missed rent while your home is being repaired after a claim. Most policies limit coverage to 12 months of rental expenses.

Sometimes landlords believe that this policy covers the tenant’s short-term living expenses elsewhere. To do this, they need renters insurance, and this issue adds another reason why many landlords require landlords to purchase renters insurance.

Best Renters Insurance Of 2023

In addition, you can reduce the likelihood of loss of rental income and reduce your liability. All of these benefits lead us to strongly recommend requiring renters to purchase renters insurance.

Renters and landlords have a lot of confusion about how renters insurance works. Generally speaking, renters insurance only covers property and liability if a tenant is injured. Renters insurance usually does not cover damage to the building, such as kitchen fire damage.

Even if the landlord has insurance, we recommend requiring tenants to purchase renters insurance. Why? This reduces the chances of tenants and their guests suing you for personal injury or property damage. In the worst-case scenario, if the renter’s negligence causes a guest to be injured, the renter’s insurance policy may cover legal fees that you and the renter may pay out of pocket.

A landlord’s liability policy does not cover damages if the tenant’s negligence causes damage to the building or injures someone. However, let’s say your landlord has renters insurance. In this case, it will cover lost property and pay medical bills for guest injuries, adding an extra layer of protection for the tenant and you, the landlord.

Finding Insurance For Your Rental Business

A renters insurance policy can also help keep your premiums from rising by reducing the number of claims you need to make on your landlord’s insurance. Your renter’s insurance premiums may increase after a claim is made, or you may lose your ability to renew your policy if your premiums are too high.

If the tenant has renters insurance, in most cases they will file a claim on your behalf. For example, if a tenant’s guest slips and falls because of a drink spilled in the kitchen, they can file a claim to cover their friend’s medical bills. Otherwise, you will be sued and must file a claim against the landlord’s policy.

As another example of how to look at the implementation of these two policies, imagine that a tornado hits your rental property, destroying part of the structure and the tenant’s personal property. Your renter’s insurance covers repairs to your property, as natural disasters cover the costs. Renter’s insurance (not a landlord’s policy) covers damage to their personal property.

FREE RESOURCE: We’ve written the ultimate guide to landlord insurance. This will give you a better view of your renter’s insurance.

Landlord Insurance For Rental Properties: Coverage And Costs

Our advice is yes, and most insurance agents agree. The best way to protect your property and income is to make sure you have a landlord insurance policy and require landlords to purchase renters insurance. You reduce the risk of uncovered losses and the likelihood of someone suing you for losses due to tenant negligence.

Renter’s renters insurance can help you skip filing a claim. A good example is renter’s insurance that covers medical expenses for injuries sustained by the renter’s guests.

As a little refresher and help before getting an insurance quote, here’s how to break down each type of insurance: As a renter, one of the most important steps you can take when it comes to protecting your finances and your property is getting renters insurance. . Although many landlords underestimate the need for this type of insurance, the reality is that unexpected events can occur at any time, leaving you vulnerable to significant financial losses. In this section, we’ll look at why renters insurance is so important and how it can give you peace of mind in a variety of situations.

Renter’s insurance acts as a safety net in the event of unforeseen events that may result in loss or damage to your personal belongings. For example, imagine you come home after a long day at work and your apartment is flooded due to a burst pipe. You are solely responsible for moving furniture, electronics, and other valuables without renters insurance. However, with the right coverage, your insurance company will cover the financial burden of replacing or repairing these items, allowing you to recover faster.

Best Rental Property Insurance

In addition to property protection, renters insurance provides liability coverage. This means that if someone is injured while visiting your rental property, your insurance policy will help cover medical bills and legal fees. For example, if a guest slips and falls in your apartment and is seriously injured, landlord liability insurance can help protect your finances by covering the costs of a potential lawsuit.

Another often overlooked benefit of renters insurance is coverage for temporary living expenses. If your rental home becomes uninhabitable due to fire or other peril, your insurance policy can help cover the cost of temporary accommodation, such as a hotel or rental property, until your residence is repaired or replaced. This is especially important if finding alternative housing is a financial burden.

Contrary to what some may believe, renters insurance is usually affordable, with monthly premiums often less than the cost of a night’s meals. When considering the potential financial losses and liabilities that may arise from unforeseen events, the cost of renters insurance is relatively low. By investing in this type of insurance, you can have peace of mind knowing that you are protected against the unexpected and that your finances and assets are protected.

Renters insurance is an important part of protecting renters’ finances and property. From loss and damage coverage to liability coverage and temporary accommodation expenses, the benefits of renters insurance go far beyond the minimum cost. Don’t wait until it’s too late, take the necessary steps to get renters insurance today and have peace of mind knowing you’re protected.

Rental Car Insurance

Renters insurance is an important investment when it comes to protecting your tenants’ finances and property. It provides your personal property, liability protection and additional living expenses in case of unexpected events such as theft, fire or natural disasters. To help you understand the basics of renters insurance, we’ve broken down the key components:

One of the main purposes of renters insurance is to protect your personal belongings. This coverage usually covers the items

What is loss of rents coverage, homeowners insurance loss of use coverage, loss of income coverage, loss of coverage, loss of use coverage home insurance, hearing aid loss insurance coverage, medicaid loss of coverage, loss of use coverage, loss of rents insurance, loss of rents coverage, hair loss insurance coverage, loss of coverage qualifying event