Is Cigna Hdhp A Ppo Or Hmo – Cigna offers many health insurance plans and has high customer satisfaction ratings, but there may not be plans where you live.

Founded in 1981, Cigna is a health insurance company based in Bloomfield, Connecticut. It serves more than 300 counties and jurisdictions in 23 states and offers many programs. It offers a 24/7 retiree help line and offers free health screenings through Cigna Health Improvement Travel.

Is Cigna Hdhp A Ppo Or Hmo

Cigna offers several health care options to help you create a personalized policy that fits your needs:

Cigna + Oscar Hot Plans, Q4 Rate Pass, Broker Bonus, And More

Cigna offers several health insurance plans, including three bronze plans, four silver plans and one gold plan. Plans can range from $357 to $640 a month, but your payment depends on where you live and whether you qualify for government subsidies.

All the plans are EPO plans, which means you have to take care of the network providers. No matter which plan you choose, you’ll get free visits with online care doctors.

Choosing the right health insurance provider requires consideration of many factors, not just the cost of the plans available. To understand how Cigna stacks up against its competitors, we’ve evaluated the company based on several metrics.

Cigna’s financial strength reflects its ability to pay policyholders’ long-term claims. A.M. Best Estimate of Financial Strength. A.M. Cigna’s high A rating indicates that it has a large customer base and reserves, meaning it can handle claims easily even if many customers claim at the same time.

How To Compare Health Insurance Plans: Aetna Vs. Cigna

It is inevitable that large health insurance providers like Cigna will have to deal with customer complaints from time to time. Our customer satisfaction ratings are based on third party organizations: BBB, NCQA and Consumer Affairs.

Cigna is rated A by the BBB. Cigna has closed more than 500 customer claims over the past three years. Many of these complaints are related to denied claims, bills and fees.

NCQA considers Cigna’s plans to be of moderate to high performance. Most customer satisfaction, prevention, and remediation programs are rated between 2.5 and 3.5, indicating that customers are reasonably satisfied with the service they receive.

Consumer Affairs rates Cigna at 3.6/5. This rating is based on approximately 300 customer reviews. Most of these are 4-star reviews, with many customers noting that claims are paid promptly and that there are many choices of providers.

How Much Does Health Insurance Cost?

Cigna’s pricing is based on how the company’s health insurance policies compare to competing companies’ policies at the same price. It includes factors such as monthly premiums, annual deductibles, the cost of seeing a doctor or specialist, how much urgent and urgent care costs are and the level of care policy. Seeing how Cigna’s pricing compares to the competition can help you get the most bang for your buck.

No matter how good the health insurance policy is, if its coverage is limited and you cannot use it effectively, it is not right for you. Cigna’s coverage score depends on several factors, including how many policy types it has, how many states the company sells plans in, and the size of its provider network.

Tammy Burns is an experienced health insurance consultant. She earned her nursing degree from Jacksonville State University in 1990, earned her insurance billing and coding certification in 1995, and holds health and life insurance licenses in Alabama, Georgia, Iowa, Mississippi and Tennessee. The Affordable Care Act (ACA) covers Burns, health insurance, and other excess, life, and premium products. Maintains a registered nurse license and practices private nursing.

As a nurse, insurance billing and consultant and insurance consultant, Burns specializes in infectious diseases, oncology, gynecology, phlebotomy, surgery, family medicine, geriatrics, home health, hospitals, human resources, administration, billing, coding, claims, defined annuity, group and individual health and wellness products and Medicare. Always passionate about helping people, she has spent more than 25 years as a nurse practitioner in hospitals, private physician offices, home health and hospitals. As a nurse, Burns helped patients file insurance claims with Medicare, Medicaid and private insurance companies, as well as answered confusing patient billing questions.

The Pros And Cons Of High Deductible Health Plans (hdhps)

Seeing that patients were often confused by an overly complicated system they didn’t understand led Burns to become an insurance agent and health consultant who now helps people understand the medical system. Since becoming an insurance agent in 2013, he has worked with some of the largest recognized insurance companies and organizations in the country and has built a large loyal customer base through his commitment to transparency and personal service. When is the best time to choose a health insurance plan? Health insurance is difficult, but many people, regardless of how educated, are bad at making this decision. According to a report by the Kaiser Family Foundation, it’s confusing even for people who understand all the terms, including separation and paying a spouse.

Not surprisingly, most people don’t want to spend a lot of time choosing a health plan. A 2020 Aflak study found that 92% spent an average of 33 minutes on this important decision. Why? Perhaps these employees will stick with what they have, choosing the same plan as last year.

However, it can be a mistake because your employer may have changed its offers and plans, and if you stick with your old plan, you may not have the best option for you and your family.

For example, we use a preferred provider organization (PPO) for Aetna and Cigna employer-provided health insurance. The details of these companies will vary between employers. But these tips for comparing plans can help you make a decision, whether it’s plans offered by your company or policies offered in the individual markets through the Affordable Care Act’s (ACA’s) Health Insurance Marketplace/Exchange at HealthCare.gov.

Co Pay Vs. Deductible: What’s The Difference?

The first step is to look at your options. You probably have several plans to choose from. For example, New York state workers have up to 9 different plans to choose from depending on their profession. HealthCare.gov has many options in many parts of the country.

In both cases, there is an annual fee to check whether a new or extended plan is available to you.

Aetna and Cigna both insure the most people and are in the top ten in size. Although a large health insurance company is not ideal, many have more doctors to choose from in their network of providers and you can get local experience. plans offered to you.

Employees who frequently travel or work abroad may find Cigna a good fit for their international health insurance policy.

Aetna Vs. Cigna: Which Should You Choose?

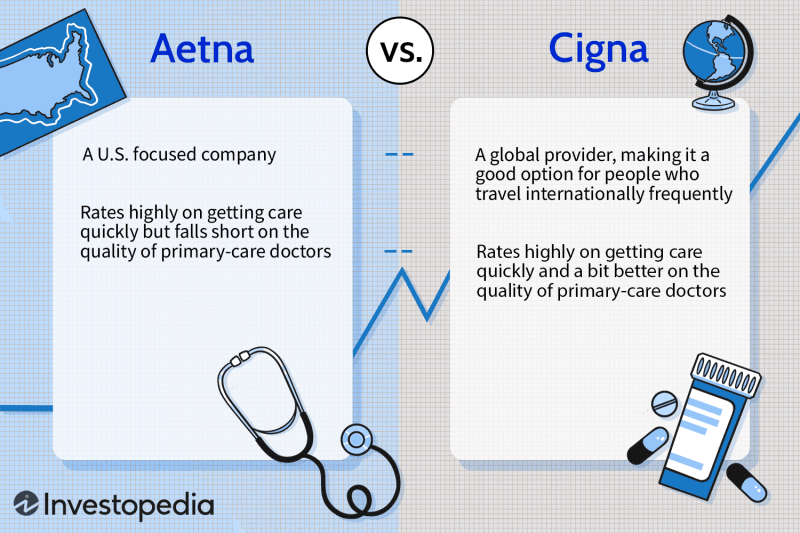

One difference is that Aetna is a US-based company that offers health insurance through employers and in the private market. Cigna is a global provider of employer health insurance in more than 30 countries. If you work abroad or travel a lot, you’ll find that Cigna has several international health insurance policies.

Rankings of health insurance plans based on consumer satisfaction and other factors are available and available. The nonprofit National Committee on Quality Assurance (NCQA) creates annual quality standards for PPOs and health maintenance organizations (HMOs) in each state.

If your choice is between Aetna and Cigna PPOs, the 2019-2020 ratings (the most recently available) show that both insurance companies are preferred by consumers. Pennsylvania has a score of 3.5 on a scale of one to five. But in Vermont, Cigna’s plan gets a 3.5 for consumer satisfaction, while Aetna gets a 3.0.

Using the comparison tool, you can highlight the plans you’re interested in and drill down to see how users rate things like speed of care and quality of primary care doctor.

Cigna Dental 5000/250 Insurance Plan

In Vermont, Aetna ranks high for urgent care, but falls short of primary care physicians. Cigna also has high rates of urgent care and slightly improves the quality of primary care physicians.

The details in the ratings can be useful. If you want to add to your family, check the prices of the company’s prenatal and postnatal services. If someone in your family has asthma, check the cost of asthma control and an asthma medication management plan.

It may not be possible to check every box on your family’s list of medical needs, but try to cover as many as possible.

If you have a favorite doctor, you’ll want to check with their office before switching insurance plans. Most doctors and hospitals have multiple plans, so this may not be a problem. If you’re looking for a new doctor, don’t pick at random from your insurer’s list of providers.

Health Reimbursement Arrangement (hra) Vs. Health Savings Account (hsa)

Co-workers, neighbors and health care providers can provide you with useful reviews of doctors in your area. It may take some time to assemble

Is cigna an hmo or ppo, hmo vs ppo vs hdhp, is cigna oap a ppo or hmo, is cigna ppo or hmo, hmo ppo hdhp, hdhp vs ppo cigna, is cigna hdhp a ppo or hmo, cigna dental ppo or hmo, is hdhp a ppo or hmo, is cigna dental hmo or ppo better, is my cigna hmo or ppo, is cigna dental a ppo or hmo