Interest Rates For Student Loans – Every spring we keep a close eye on the 10-year US Treasury yield. The student loan interest rates for the next academic year will be adjusted based on where the auctions for this note take place in May. The result of the academic year 2023-24 is a continuation of the trend of increasing student loan interest rates. In fact, Graduate Direct Unsubsidized and Grad PLUS rates for the loans most commonly used by veterinary students will be the highest since Congress moved to a fixed rate structure in 2006.

Federal student loan interest rates use a fixed interest rate over the life of the loan. However, this fixed rate depends on the high yield from the last auction of 10-year US government bonds until June 1. The higher yield and ratio for the direct loan type determines the fixed interest rate you will be charged for loans taken out from 1 July to 30 June. The interest rate on the PhD/professional school’s direct unsubsidized loan for veterinary students is 7.05%, compared to 6.54% last year. The Direct Graduate Plus loan rate is 8.05%, up from 7.54% last year.

Interest Rates For Student Loans

The good news is that the pandemic forbearance period that began on March 13, 2020 has set interest rates at 0% for all eligible federal student loans. This special forbearance will likely last until August 2023. That’s why all of your eligible federal student loans, even those that many students take out at the beginning of the 2023-24 school year, will be interest-free for a while. The impact of pandemic resilience on veterinary student loans has been extremely beneficial, significantly reducing the interest that would normally accrue in veterinary school. Often, the interest savings on schooling are tens of thousands of dollars for newly graduated veterinarians.

Student Loan Interest Rates ‘absurd’ And ‘grossly Unfair’, Says Treasury Committee

The bad news – With forbearance discounts longer than three years, it can be difficult to know what your current or past interest rates are. The interest rates have been off for so long that we find that many borrowers have taken it for granted. You want to know what your interest rates are so that you will be prepared when the interest rate starts to be recalculated.

Veterinary Students – With student loan interest rates at zero for a while, don’t take on more debt than you need to. The less you borrow, the less interest you pay (long term) and the less you have to pay. When it comes to student loans, managing less is ALWAYS easier. Review your school’s published cost of attendance (COA) and look for ways to reduce the credits you are offered in your financial aid awards. When considering your financial aid award, make sure you’ve maxed out Direct Unsubsidized Loans before falling into the more expensive Grad PLUS category. Although rare, we do see some vets taking out fewer direct unsubsidized loans in order to use more Grad PLUS loans. Give yourself financial support and get as many Direct Grad PLUS loans as you need to cover your actual expenses.

As graduate/professional school students, you are often offered student loans to pay the full COA. Use your personal budget to decide whether you really should take all the loans you are offered. The COA sets the maximum amount you can borrow. Your mission, if you choose to accept it, will be to accept only the amount necessary to meet your budget, ideally less than the COA maximum.

Too many veterinary students pay off student loans while in school and still take on debt. While enduring the pandemic, some students are using new student loans to pay back old student loans, but no interest accrues. First, if you are able to make payments on your student loans as a student, ask yourself where that payment money is coming from. If you are using Federal Direct Student Loans to pay off other Federal Direct Student Loans while the interest rate is rising, you will get no reason. Whether the funds you use come from your vet school work or someone else’s help, a cheaper plan would be to borrow less at a higher interest rate instead of paying off your loans in the future. school.

Student Loan Interest Rates Uk

Reduce your future loan payments or pay off loans that exceed your budget to make a bigger impact on your overall debt balance. You have up to 120 days to repay loan amounts you may not need. When you repay your student loans, principal, interest and fees are also paid back. So any loan or principal you pay back that you don’t borrow within the 120 days will be way off paying interest. For more information, visit the VIN Foundation Borrow Better resource page.

If you’re starting vet school this fall or returning next fall, use the VIN Foundation’s My Student Loans Tool and School Loan Estimator to help you review your current student loans, interest rates, and project your graduation balance using this new interest rate information. .

Here is a video guide on how to find and download your student aid data file. These free tools help you keep track of your existing loans and help you estimate your total debt balance after you graduate. You can even use the school’s estimator to calculate how much you can save by repaying unused student loans or reducing future financial aid awards.

Upload your student aid data file to the My Student Loans tool or start a new estimate with the VIN Foundation In-School Loan Estimator.

Fixed Or Variable Rate International Student Loan?

Health Professions Student Loans (HPSL) and Loans for Disadvantaged Students (LDS) are potential federal alternatives to direct loans for veterinary schools if they are available for your degree program and you qualify for them. However, they require you to provide your parents’ financial information to determine your eligibility.

HPSL and LDS have an interest rate of 5% and they do not accrue interest during school time (subsidized loans). They can also be consolidated into a consolidation loan directly after graduating from vet school, making them eligible for income-based repayment plans or public service loan forgiveness. Contact your school’s financial aid office for more information about accessing these special loan types and the application process.

Avoid private student loans to finance your veterinary education. If you attend an accredited veterinary school and are eligible for US federal student loans, you can borrow US student loans up to the cost of your education. Federal student loans are the most flexible and least risky loan you can have.

Private student loans lack the benefits, protections and repayment options that come with federal student loans. Even if you find personal loans with low interest rates, the repayment options and hassles are not as favorable as with federal loans. Private student loans can limit your career options due to balance and foreclosure rules. Before considering any type of private student loan for vet school, make sure you’ve maxed out all of your federal student loan options.

Interest Rates On Federal Student Loans To Increase For 2022 2023 — The New Capital Journal — New Capital Management

Happy budgeting this spring, summer and fall. An ounce of planning is worth a pound of interest saved on repayment. For all questions: studentdeb@.

The VIN Foundation is here to help you understand your vet school loan and repayment options now or in the future!

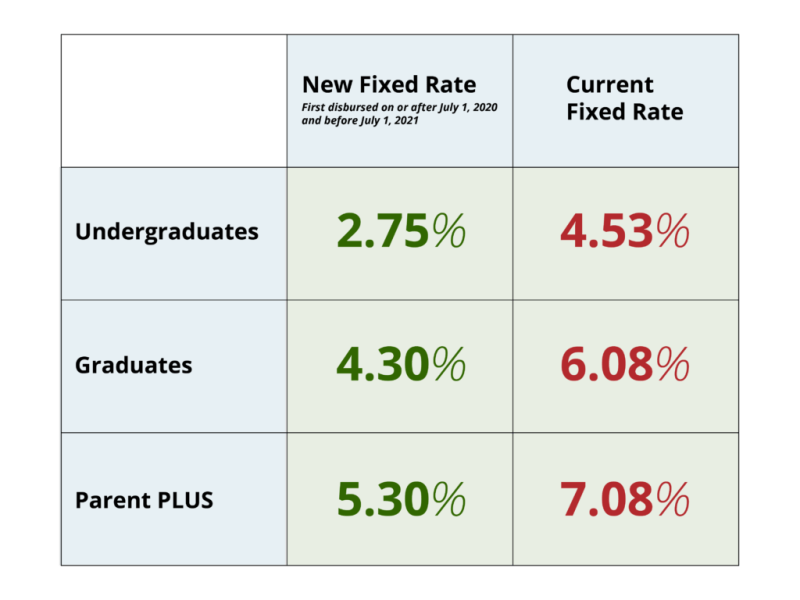

The VIN Foundation is a 501(c)(3) nonprofit organization made possible by the generous gifts of individual donors and grants. All gifts to the VIN Foundation are tax-deductible. The VIN Foundation has received the highest ranking from nonprofit tracker Candid (formerly GuideStar) every year since 2017. Fewer than 2% of nonprofits surveyed receive this level of recognition. Interest rates on federal student loans will rise slightly next year. In the academic year 2017-18, the loan for master’s students will be 4.45% from the current 3.76%. The rates on standard student loans go up to 6%, and the rates on PLUS loans for students and parents go up to 7%. While all of these numbers represent year-over-year growth, all are still below what they have been for the better part of a decade.

One would think that rising student loan interest rates would benefit taxpayers at the expense of student borrowers. But actually it’s the exact opposite.

Interest Rates Loan Interest Rates

Since 2013, interest rates on federal student loans have fluctuated directly with the yield on the 10-year U.S. Treasury bond, rather than being set at levels set by Congress. In theory, this would ensure that the cost to taxpayers of the student loan program remains roughly constant. Because the federal government runs a deficit, it must issue government bonds to raise any marginal funds needed to finance the upfront costs of student loans. When the government’s borrowing costs rise, so do student loan interest rates, and with them the future returns from the loan program.

Even if student loan interest rates increase, taxpayers’ net income may not increase because the government’s borrowing costs will also increase.

Compare student loans interest rates, graduate student loans interest rates, current interest rates student loans, best interest rates for private student loans, current interest rates for refinancing student loans, student loans interest rates, interest rates on student loans, private student loans interest rates, best interest rates for student loans, refinancing student loans interest rates, low interest rates for student loans, student loans lowest interest rates