Insurance Meaning Unilateral Contract – An insurance contract is a document that represents an agreement between an insurance company and the insured. The core of the insurance contract is the insurance agreement. The risk covered defines the limits of the insurance agreement and the duration of the policy. In addition, all insurance contracts include the following:

The content of the insurance contract includes the type of policy, which obviously depends on what the applicant wants and how much he is willing to pay. The details of the insurance policy are in the standard insurance policy. Since only valid contracts are legally enforceable, this article covers the requirements for valid insurance contracts.

Insurance Meaning Unilateral Contract

There is an additional requirement that the insurance contract be legal. Since insurance contracts are governed by state law, insurance contracts must comply with these requirements. For state-specific insurance, only certain forms may be used, or the contract may stipulate that there must be provisions. In addition, the contract must be approved by the State Insurance Department before being executed.

A Complete Guide To Unilateral Contracts

If the contract lacks any of these basic elements. This is a binding contract without any binding effect. For example, most contracts signed by minors are void. If the party violates the contract or if the information in the contract is false or if the contract is canceled, the contract may be terminated. The invalid party may choose to enforce it. For example, insurance companies often cancel contracts because an applicant provides false information on an application. Therefore, if someone is involved in a car accident and fills out an insurance application, that person has no previous speeding tickets, the insurance company will cancel the contract and not receive compensation. Although most contracts can be verbalized, most are written because of their complexity.

Insurance usually begins with filling out an insurance application, which is provided through the services of an insurance agent, who must be authorized by the insurance applicant on behalf of the insurance company. Sometimes insurance applications can be submitted directly to the insurance company through their website. Acceptance of the offer means that the insurance is an asset. Depends on whether you have liability or life insurance. Provision for Property and Liability Insurance Insurance Applications and Payments 1.

Reward or promise. In most personal insurance lines, the agent can accept the company’s offer and bind the company to the contract.

A bond is a temporary contract that binds the insurance company to the contract immediately until the insurance company has had a chance to review the application and issue a valid policy. By connecting, the warranty is effective immediately. Most bonds specify the type and amount of insurance; Include general information such as parties’ names and dates of engagement. But once a formal policy is made, the terms of the policy become binding. This is especially true for parties with an oral binding agreement, because after a written policy is made, in the event of an inconsistency between the oral and written agreement, the waiver evidence rule governs the written policy. If you make a mistake in the policy, such as typing the wrong policy value. By correcting the mistake, the contract can be changed and both parties can be prevented from being unjustly enriched.

Unilateral Offers: Navigating The Complexities Of Acceptance

However, some agents may not bind insurance companies. In this case, the insurance company must accept the application. Or it can be rejected. The warranty is not valid until the application is accepted by the company.

In life insurance, the agent has no authority to bind the company. The applicant fills out the application form 1

Premium. The applicant is then issued a conditional insurance policy – the most common form is an uninsured insurance policy. The applicant cannot be insured according to the company’s insurance standards. Life insurance is effective from the date of application or from the date of medical examination.

However, if the premium is not paid at the time of filling the application, the policy will not be issued until the premium is paid and the applicant is not in good health when the policy is issued. Some companies require that the applicant not receive any medical treatment between applying and delivery of the policy. Otherwise, the policy will not be effective.

Aleatory Contract Definition, Use In Insurance Policies

Therefore, prescribed vouchers may look like binders, but coverage varies depending on the applicant’s health, employment, and other factors. Bonding doesn’t require premiums to be valid – time is needed to determine premiums.

The insurance company determines the terms of the contract, although the insurance applicant is considered the provider of the proposal. A surety bond may be accepted in full. Because of different legal definitions and decisions of various courts in the past and requirements imposed by state governments and their agencies, suretyship agreements must be legally binding and provide reasonable security. Thus, publicly issued insurance contracts are standardized. Another reason is that insurance companies can only calculate competitive premiums based on statistical studies, which are based on certain limitations and sales guidelines. Therefore, most insurance contracts are non-negotiable. However, the insured may request special riders and waivers from the policy. A rider or endorsement is a change or addition to the basic policy that adapts the policy in a way that suits individual circumstances. Exclusions are damages not covered by the contract.

Because most insurance contracts are non-negotiable, courts have developed case law in favor of policyholders. The first law that generally applies to contracts is that if there is an uncertainty in the contract, in the case of an insurance company, which is an insurance company, the uncertainty is between the contracting party and the insurance company. Therefore, unless the terms of the contract are incorrect, these terms will be interpreted in the manner most favorable to the insured. The principle of reasonable expectation is also set out in the case law as exclusionary or other qualifications must be raised. Otherwise, the insured will have a reasonable estimate of coverage.

In order to avoid disputes in life insurance and some health insurance contracts, all statements, including those made by the insurer themselves, are required. Entire contract clauses prevent incorporation based on other written works, such as company rules, that the insurance applicant has not read.

Notes On Business Law

A property insurance contract is a private contract between the insured and the insurer. Property insurance protects against damage to the insured’s property, not the property itself. If the insured sells the property, the insurance does not transfer with him. No guarantee shall be given to another person without the guarantor’s consent. Property and liability contracts are freely assignable. If a person with a low risk of loss buys or sells the policy to someone with a higher risk, it does not provide enough insurance to cover a large loss. For example, parents can buy their own car insurance. Teenagers have a higher accident rate than other groups, so it’s usually a teenager who decides to adopt a policy.

On the other hand, a whole life insurance policy can be given for free as the insured remains the same. Indeed, many terminally ill people sell 3-term life insurance policies.

Profits are subject to change. Since changing the beneficiary does not change the insurable interest, if the policy changes the beneficiary, the insurance company may not have any consequences, but the change has no legal effect on the insurance company’s protection of the policyholder. Paying the wrong person or asking for two payments

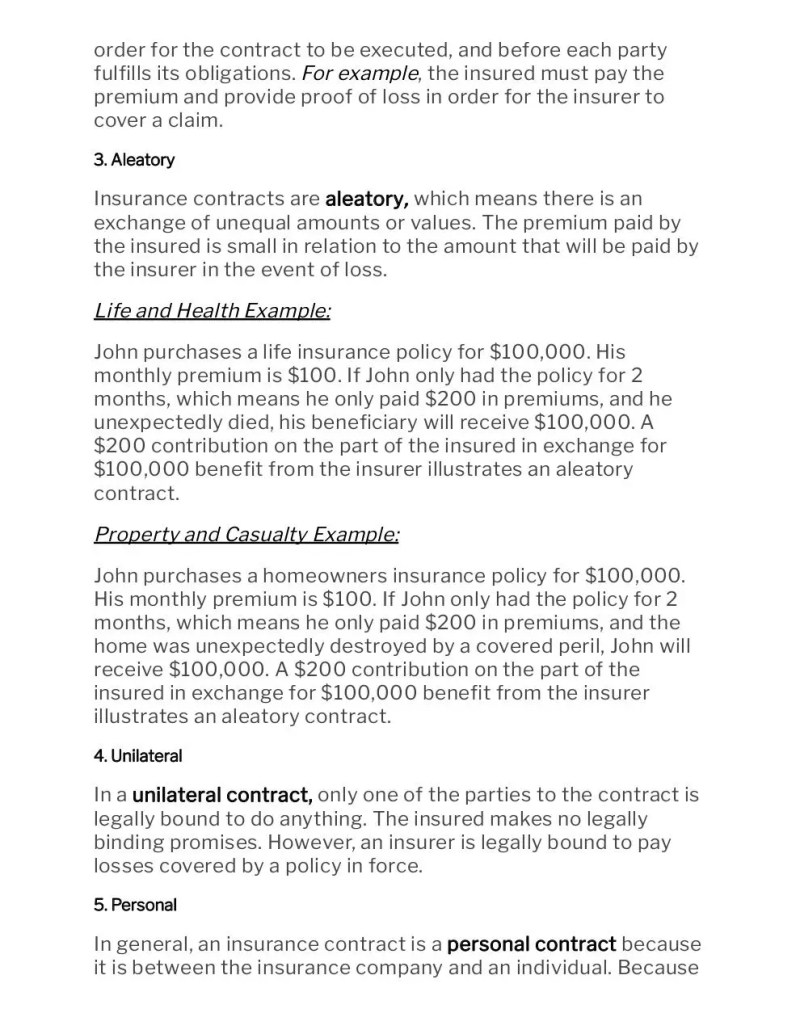

Consideration is the value given by the parties to the contract – because the contract was made. In an insurance contract, the insurer undertakes to pay the loss suffered by the insured, and the insured undertakes to honor the contract and pay the insurance premium. Most unsecured contracts are bilateral agreements where each promise is enforced by the other party through litigation. However, insurance contracts are unilateral contracts where only the insured promises to pay for the losses incurred. The company may not sue the insured for breach of contract. However, guaranteed contracts are conditional contracts.

Final Exam: California Life Insurance Questtion And Answers 2023

Unilateral termination of contract, examples of unilateral contract, unilateral contract acceptance, unilateral contract revocation, unilateral cancellation of contract, unilateral insurance contract, what is unilateral contract, unilateral contract real estate, unilateral contract meaning, bilateral or unilateral contract, contract unilateral, unilateral contract insurance definition