Insurance Meaning Premium – Our site uses cookies to improve the experience of your visitors. By browsing our website, you accept the use of cookies and accept our privacy policy.

Life insurance premium is a payment you pay to the insurer in exchange for the company’s agreement to pay death benefits to your beneficiary.

Insurance Meaning Premium

With some policies, part of the payment you make may cover your cash value balance. Many factors can affect the amount of your life insurance premium, including the amount of coverage you receive, the anticipated risk for the insurer, and the type of policy you choose. Here is something to consider.

Insurance Premium Defined, How It’s Calculated, And Types

The premium you pay on a life insurance policy primarily covers the death coverage provided. They may also be used to cover insurance costs or other applicable fees depending on your policy type and/or riders. Depending on the type of coverage, premium payments may also provide cash value.

Here are the most common types of life insurance with more information on the benefits offered for paying premiums.

Term life insurance provides pure insurance coverage (no cash value) for a specified period (term). The premium may be the same for the duration or may increase with the age of the insured depending on the product. Individuals take out a long term life insurance policy with the aim of providing death benefits to their beneficiary. Paying premiums allows your loved ones to receive death benefits in the event of your death during or while your policy is active.

Whole life insurance policies work a little differently. The premium you pay helps ensure that the policy remains in force and that the death benefit is available to your beneficiary. Over time, the cash value has the potential to increase. When your cash value reaches a certain amount, you may be able to borrow money. Keep in mind that loans will carry interest. Loans and withdrawals may result in income tax liability, reduced cash value and death benefit, and result in policy cancellation.

What Is An Insurance Endorsement?

Another type of insurance is called universal life insurance. It has the same cash value as whole life insurance, but unlike whole life insurance, it offers premium flexibility and often the ability to adjust the death benefit to suit your needs. Just keep in mind that there must be enough cash value in the policy to cover the monthly costs if you pay less than the intended premium or no premium at all. Additional premiums may be required to keep this policy valid.

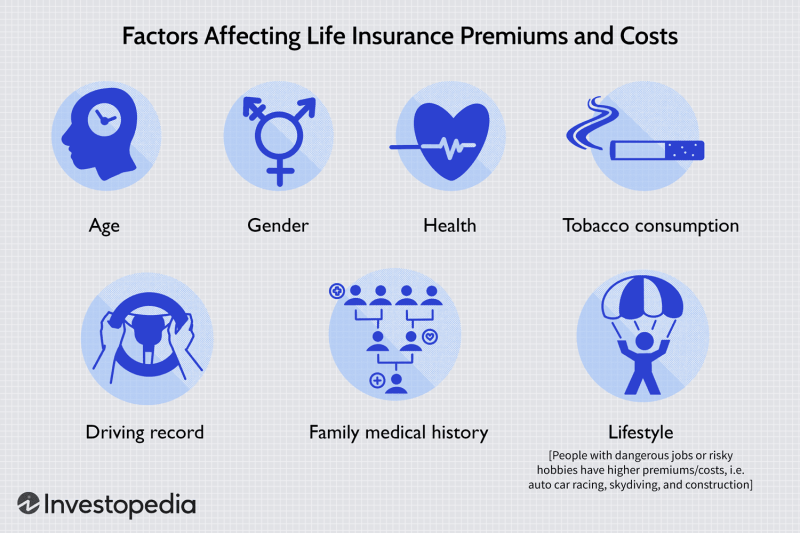

When purchasing a life insurance policy, the insurance company usually performs a process called underwriting. Based on your information about your age, gender, health status and lifestyle, the insurer estimates the mortality risk it will bear by granting you cover. Underwriting is a key factor in determining whether you qualify for a policy and how much your premium will be.

In addition to the type of policy and commitment, the amount and duration of coverage you receive has a large impact on premiums. Some customers may purchase relatively modest insurance policies to help cover funeral expenses after death. Others may seek death benefits that provide full income replacement, potentially for several years.

The length of the contract is another key variable. Term policies, which set death benefits for a number of years, are less expensive than whole life policies and other permanent policies that do not have such limits. For a given individual, a short-term insurance policy usually costs less than a long-term policy. Riders, which are additional benefits you can add to a policy, usually increase the premium you pay as well.

What Is Reduced Paid Up Insurance?

Knowing how much your premium is and how it is calculated is an important part of understanding life insurance. Timely payments help keep your policy valid and ensure your beneficiary receives the death benefit. If someone with coverage misses a premium payment period, their policy usually enters a grace period. If they fail to make the full payment within this deadline, their insurance policy will lapse.

Whole life insurance policies sometimes work the same way. Premiums are fixed and non-payment may result in loss of coverage. With universal life insurance, there may be flexibility in the timing and amount of payments, but as explained above, sufficient premiums must be paid to avoid loss of coverage.

The information provided is general and educational in nature, and any product or service discussed may not be offered by Western & Southern Financial Group or its member companies (the “Company”). The information is not intended and should not be construed as legal or tax advice. The company does not provide legal or tax advice. Specific state laws or laws applicable to a particular situation may affect the applicability, accuracy, or completeness of this information. Federal and state laws and regulations are complex and subject to change. THE COMPANY MAKES NO WARRANTY AS TO THE INFORMATION OR RESULTS OBTAINED FROM ITS USE. The Company disclaims any liability arising from your use or reliance on this information. Consult an attorney or tax advisor regarding your specific legal or tax situation.

When you choose to link to an external website, you are subject to that website’s privacy, copyright, security and information quality policies. West and South Financial Group: Premium balance is the amount of premium owed to the insurer for the policy but not yet paid by the policyholder. As the policyholder pays installments, the value of the balance of the insurance premium decreases during the life of the insurance policy. Policyholders can sometimes request a refund of unpaid premiums.

What Is D&o Insurance? Learn More Here

Many insurers allow policyholders to pay for their policies in installments. Paying the full premium value of an insurance policy can be a challenge for your budget, and offering different payment structures allows insurers to reach a wider market. This type of insurance policy is mostly seen in car insurance, which can offer monthly, quarterly, semi-annual and annual payments.

Insurers allow policyholders to pay premiums over a longer period of time because they can charge a flat fee for the privilege. For example, an auto insurance company may allow the premium balance to be paid monthly, but add a small fee to the monthly premium. In addition, if the policy is canceled before the end of the policy term, the insurer may charge a cancellation fee. These fees, called short-term rates, are generally a percentage of the premium remaining on the policy.

Insurers calculate premiums in different ways, depending on whether premiums have been collected or not, based on the time elapsed without claims and the amount of premiums already paid.

Unearned premiums are treated as liabilities on the balance sheet until sufficient time has passed between the collection of premiums and the absence of a claim against the policy. If the insurer’s business increases from year to year, the premiums earned will likely be lower than the premiums written. This is because the premium is considered fully paid when purchased and the balance (unearned premium) represents the premium allocated to the unexpired portion of the policy.

How To Compare Life Insurance Types: Factors & Considerations

Reducing that debt balance requires planning. Policyholders can pay the premium balance in a variety of ways: cash, check or credit card. If the cardholder has a rewards or cash back card, credit card installments can be beneficial and allow them to enjoy benefits while paying. That way, you can usually lower your premium by 2% or more, or earn airline miles or other benefits, depending on what the card offers.

When choosing an insurance policy, it’s usually helpful to compare prices, especially if you’ve been with the same company for years. There are many online sites that compare and offer you many policies. Finally, check to see if you’re paying for insurance features you don’t need. Maybe towing coverage is included in your car insurance policy and you have AAA, or maybe your deductible is too low.

Although canceling your current policy to purchase a new policy with another insurer may result in unwanted expenses, the long-term benefits of switching can save you money. Additionally, if you tell your current insurer that you are leaving, they may encourage you to stay by offering special benefits or reduced premiums. It’s always helpful to know what an insurance company can do for you if you’ve been a customer for a long time.

John buys a new car and takes out car insurance to protect himself in case of an accident or theft. He takes out his policy with ABC Insurance. The cost of the policy is $1,000 per year, and John decides to make quarterly payments, which equals 4 payments of $250 per year.

What Is An Insurance Premium?

The year continues and is now over

Life insurance premium financing, term life insurance premium, life insurance policy premium, credit insurance premium, insurance premium, car insurance premium meaning, premium in insurance meaning, car insurance premium increase, homeowners insurance premium, annual premium insurance meaning, annual home insurance premium, life insurance premium meaning