Insurance Expense Adalah – Commercial Legal Expenses Insurance (LEI) is a type of Legal Protection Insurance (LPI). LEI coverage protects a company from the cost of defending it if someone files a lawsuit against it. It is designed to protect against costs arising from legal proceedings brought by third parties, but can also cover costs associated with legal proceedings brought by the insured against others. These costs can include attorney fees, witness fees, court costs, and even the cost of retaining expert witnesses.

LEIs are typically used in larger companies, but are critical to businesses of any size as they introduce litigation risk or offset expenses if litigation needs to be brought against a customer. Commercial Legal Expenses Insurance (CLEI) is a similar type of legal expenses insurance available to small and medium-sized businesses. LEI may from time to time incur legal costs related to the protection of the Company’s intellectual property and brand rights.

Insurance Expense Adalah

All businesses face lawsuits, but some are more vulnerable than others. With headlines about lawsuits being filed against manufacturers and doctors every day, any company or independent contractor can face the headache of lawsuits.

The Complete Guide On How To Sell Final Expense Insurance

Money managers and financial advisers can purchase legal expenses insurance to protect themselves from clients who believe the business has caused financial losses. Commercial legal costs insurance can be arranged by larger companies that face genuine litigation threats, such as wrongful dismissal claims and financial audits.

The LEI is usually reserved for large companies and usually covers intellectual property and brand-related litigation, while the CLEI is suitable for small and medium-sized enterprises to take advantage of.

There are two main structures for dealing with commercial legal costs. These structures are located before the event (BTE) and after the event (ATE).

Before purchasing legal expenses insurance, businesses should review their current insurance coverage to determine which risks are adequately covered and identify areas where there are gaps in coverage. BTE insurance provides wider coverage as the insurance company may consider the applicant to be less of a risk. The amount of the premium for this type of protection depends on the scope of the business and the risks the business is most likely to face. Some types of policies may also include general legal advice and legal fees associated with the protection of trademarks and copyrighted material.

Health Insurance: Know The Transplant Expenses Covered, Excluded When Buying Health Insurance

LEI is said to have been first introduced in 1911, when French ACOs offered such insurance to cover member fines.

For example, clients may claim that their financial adviser failed to advise them of worsening economic conditions when they, as clients, could have avoided such losses. If the consulting firm’s liability insurance does not cover legal expenses, the firm may consider purchasing legal expenses insurance.

The quotes shown in this table are from partners from whom we receive compensation. This compensation can affect how and where listings appear. It does not include all offers available on the market. The cost of insurance is the total cost incurred by a company to obtain an insurance contract, plus additional payments known as premiums.

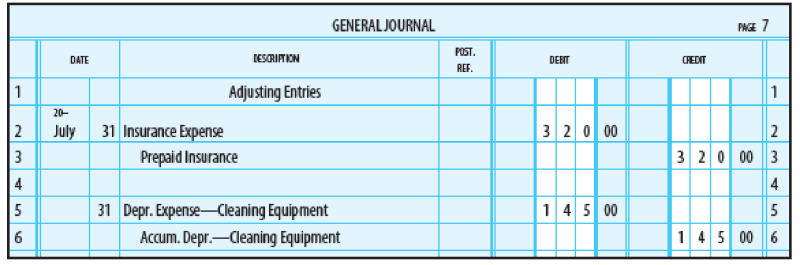

The cost of insurance is recorded as an expense during the period in which it is used.

Solved: A Company Closing Entries Month Ending 03/31/20xx Date Accounts 31 Mar Service Revenue Debit 6,225 Credit Income Statement 6,225 Close Revenues 31 Mar Income Statement 3,000.83 Rent Expense Business License Depreciation Expense 950

For an insurance policy protecting the manufacturer’s production function, the cost is allocated to the cost of production divided by the number of units manufactured.

This will allow expenses to be properly allocated between cost of goods sold (COGS) and ending inventory.

In order to obtain an insurance policy that protects the company in the event of certain unexpected events, these policies will usually provide for the company to pay a certain amount that the policy provider will pay if one of the specific events specified in the policy takes place. .

These premiums are what must be paid to get the policy, which are usually paid in advance and are known as prepaid policies.

Solved] I Am Calculating 12x2600monthly To Get The Year End Balance Of…

Once premiums become due, they are recorded as an expense, while unnecessary premiums are recorded as an asset account for prepaid insurance.

However, the three most common types are often bundled together as a package for business liability, casualty, and property insurance.

Property insurance protects any building or equipment belonging to the company, and liability and casualty both protect the business in case customers or employees suffer any injuries while working.

Once the premium has been paid and the cover for the period ends, the cost of the premium is recorded as an insurance expense.

Insurance Company Expense Analysis Table Excel Template And Google Sheets File For Free Download

Typically, the company will pay the insurance payable quickly to avoid any additional costs or loss of coverage.

Once the insurance premium is paid, it becomes an asset until the policy term ends, at which point it becomes an insurance premium.

May not be required: Business insurance policies (such as general liability insurance) are generally not required by law. Instead, companies should choose policies that they believe are beneficial.

Never To Be Used: A promise to indemnify the company in the event of a loss does not mean that such loss will occur. In most cases, companies pay more for insurance than they get in return for their underwriting expenses.

Solved Trans Id Transaction Aa Bb Cc Dd Ee A 12 Month

High Complexity: Insurance policies can be very confusing for many small businesses without experienced legal services. This can lead to getting unwanted coverage or not getting the right type or coverage for your company.

Almost all businesses face some form of insurance premium to protect their operations in the event of unforeseen adverse events.

Once the premium has been paid, it becomes an asset and is recorded on the balance sheet until the policy term ends, at which point it is recorded as an insurance expense.

FundsNet requires contributors, authors, and authors to use primary sources to locate and cite their work. These sources include white papers, government information and data, original reports and interviews with industry experts. Responsible publishers can also be found and cited where appropriate. Find out more about the standards we follow in producing accurate, unbiased and researched content in our Editorial Policy. More than 1.8 million professionals use CFI to learn accounting, financial analysis, modeling, and more. Get started with a free account and explore over 20 courses that are always free and hundreds of financial templates and cheat sheets.

Example Exercise 3 Example Exercise Ppt Download

An insurance premium is the amount a company pays to obtain an insurance contract plus any additional premiums. Payments made by the Company are classified as accounting period expenses. If insurance is used for production and operations, then the insurance premium can be listed in an indirect cost pool and allocated to each unit produced during the period. When this happens, part of the insurance cost will be listed in the closing inventory and part of the insurance cost will be listed in the cost of goods sold (COGS).

Companies must pay premiums on all their insurance policies. These policies are designed not only to cover its property and products, but also to protect its employees. All policies come with a premium. If they expire, they must be recorded as an expense. Unnecessary premiums should be listed as prepaid insurance in the asset account.

Property, liability and casualty insurance are often sold in bundles. Obviously, property insurance covers the buildings and land owned by the company and anything inside. Accident and liability insurance mainly covers a company’s employees and anything that might happen to them while on the job.

The good news for companies with this type of insurance is that they can be deducted from their tax liability as a business expense. Of course, this depends on the type of business. However, most companies can deduct such expenses on their income tax returns to obtain a tax deduction.

Project Cost Allocations

Insurance premiums are the cost of one or more policies that a company buys to protect itself and its employees. The agreement provides that the company, as the policy holder, pays premiums for the policy. These policies are designed to protect the company and employees from any adverse impact that may occur.

Insurance premiums payable refers to liabilities relating to insurance premiums. It shows the amount of unpaid premiums by the company. Outstanding fees must be paid as soon as possible. In most cases, the aim is to pay them at the end of the current period to avoid additional late fees or being waived entirely by the insurance company. Insurance payable is part of a company’s balance sheet.

Insurance premiums and insurance payable are two different concepts, but they are related to each other. Both are indispensable. If there were no insurance premiums, there would be no need for an insurance account payable.

:max_bytes(150000):strip_icc()/Underwriting-Expenses-Final-7d4c8718548540908c963ec2adf6eadb.jpg?strip=all)

CFI is the official provider of the worldwide Financial Modeling and Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To continue moving your career forward, the following additional CFI resources will be helpful:

Solved] Insurance Expense 535 Gas And Oil Expense 538 Depr. Exp. Office…

Build confidence in your accounting skills easily with CFI

Final funeral expense insurance, final expense insurance policy, expense insurance, burial expense life insurance, cheapest final expense insurance, liability insurance adalah, affordable final expense insurance, final expense life insurance, final expense insurance quotes, aarp final expense insurance, insurance adalah, final expense burial insurance