How To Find Sum Assured In Lic Online – When you’re looking to invest in an insurance policy, it’s natural to wonder if it’s the best investment option available to you at the time. You may also want to know the return on investment you will get from the policy. In this article, we will discuss in detail how to calculate the return on investment in a policy.

Before you start calculating the return on investment, it is good to know the main types of insurance policies available in the market.

How To Find Sum Assured In Lic Online

1. Conventional policies: These are the most popular types of life policies these days. Common policies include “Assurance Endowment” (the Sum Assured along with an accumulated bonus is paid to the policyholder at maturity) and “Money Back” (the Sum Assured is paid several times a year and the benefit is paid through final settlement or maturity) type of policy.

Lic Siip Market Linked Plan: Key Features, Minimum Investment, How To Buy Policy And Other Key Details

2. Unit Linked Insurance Policy (ULIP): ULIP is a special insurance policy where the money is invested in the stock market, bonds or equity market depending on the type of fund chosen. The applied amount is converted to units based on the unit price received at the time of purchase. The maturity value or bid value is an amount equal to the unit price (available on that day) multiplied by the total number of units available.

3. Term Insurance: Term insurance is purely an insurance based plan where no part of the deposit can be deducted. There will be no maturity value or surrender value for these types of policies.

Obviously, the premium paid for the plan includes two of these components. Before calculating the plan’s rate of return, we should deduct the policy component from the premium paid and take the savings component of the policy.

An easy way is to find out the amount paid for net insurance and subtract it from the total amount paid.

Lic Dhan Vridhi

To understand the savings component of an insurance policy, let’s consider how much a person pays to take out an endowment insurance plan and a term insurance plan.

Therefore, from the above calculated share of savings for a period of 25 years, the endowment insurance is Rs. 38,866 per annum and the total number of shares in stock came to only 8,48,900.

Calculate the approximate maturity value for the plan considered in the example above based on the current interest rate shown below.

The internal rate of return on a recurring investment can be easily calculated using the IRR function in Microsoft Excel. Since the cost of savings in the above example is Rs. 33,956 and the expected maturity value* is Rs. 26, 50, 000 , we can calculate the Internal Rate of Return (IRR) using these values. The calculation is shown in the figure below.

Lic Premium Calculator For Life Insurance Term Plan & Health Plans

From the above calculation, we can understand that endowment insurance as shown in the example above gives an internal rate of return (IRR) of 7.93% .

The return on investment of 7.93% in the current market in terms of low interest rates is very attractive in all respects.

In this situation, banks offer interest rates of around 6% per annum and the rate tends to fall further. In addition, income from bank interest is also subject to income tax. This further reduces the effective interest rate.

On the other hand, insurance policies also provide income tax benefits. The amount paid is deductible from income tax u/s 80 C and the amount due is exempt from tax u/s 10(10D) of the Income Tax Act.

Understanding Sum Assured: Significance & Calculation

The policy maturity is calculated based on the bonus rate and may vary depending on LIC’s experience in India.

Anish LJ is a ‘Financial Planner’ and Fellow of the Chartered Insurance Institute (CII), London and the Insurance Institute of India. He is also a financial, insurance and software consultant. He closely follows the development of finance, insurance and other related fields.

Amulya Jeevan Arogya Rakshak Articles Bank Bonus Calculators Worker and Employee Claims Settlement Treacherous Fund for Employees and Employees Govt of India HLV Insurance History Income Tax Insurance Insurance Calculator IRDA Insurance Plans Jeevan Labh Jeevan Shree Jeevan Umang LIC of India LIC National Pension Scheme Online New Mutual fund Corporate News Jeevan Anand News Appointment NPS Pension PMJJBY Service Policy Postal Payment Premium Private Insurance Policy RD Protection Return of Recurring Deposits Revival Calculator Personal Revival Campaign Term Insurance ULIP Excluded Plan LIC Premium & Maturity Calculator is an online tool designed to help people estimate the amount the amount of premium they have to pay for the LIC policy and the maturity value they can expect at the end of the policy term.

Introduced by Life Insurance Corporation of India, the LIC Premium and Maturity Calculator is a useful tool for anyone looking to buy an LIC policy. The LIC calculator provides many benefits and helps policyholders understand how various parameters affect premiums and payouts.

Lic Jeevan Kiran Life Insurance Policy: How To Buy Online From Www.licindia.in

The LIC Premium Calculator allows users to calculate the premium for their chosen insurance based on certain relevant factors. The tool offers monthly, quarterly, semi-annual and annual premium cost estimates to facilitate user selection. In addition, it shows the GST charges separately. The idea behind the LIC Premium and Maturity Calculator is to enable users to choose the best plan based on their budget and other insurance needs.

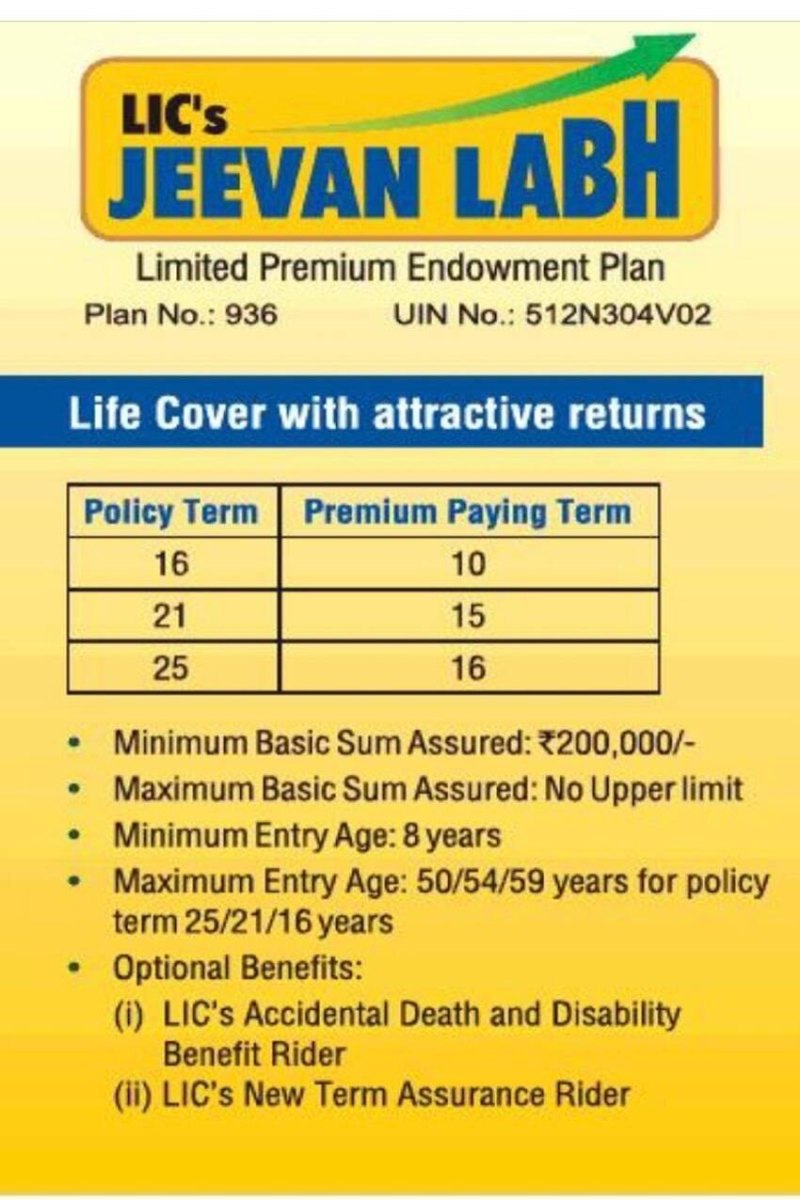

LIC of India LIC Jeevan Shanti LIC SIIP LIC Jeevan Labh LIC New Jeevan Anand LIC Jeevan Umang LIC New Jeevan Amar LIC Bima Jyoti

LIC premium is a one-time or recurring payment you make under your LIC plan. A life insurance plan remains active only if the premium is paid on time and as directed by the insurer. Here are some other important life insurance tips –

The LIC Premium and Maturity Calculator is useful as it allows you to do all the calculations independently. Apart from providing policy value, LIC calculator saves time and helps you choose the best LIC policy as per individual requirement and suitability. Let’s take a closer look at the LIC calculator and understand its benefits:

Will Your Online Plan Pay The Claim?

Before using the LIC calculator, you must read the brochure of your chosen LIC policy as each LIC plan has certain requirements that need to be met before purchasing the plan.

It will take you less than a minute to fill out the entire form. After entering all the necessary information and your preferences, the tool will display the relevant insurance numbers.

The results shown by the LIC calculator are approximate as the insurance company may ask for additional details about your background which may affect the premium calculation.

LIC Premium Calculator is an important tool that will help everyone to gain knowledge about various LIC insurance policies and their coverage terms. This LIC Calculator tool is very useful to help people to make the right decision in choosing the best policy.

How To Check Lic Policy Status Without Registration?

In addition, the LIC return calculator provides useful information about taxes, insurance, accidental cover and health risks that may be associated with the policy chosen. It also estimates the total amount of compensation and benefits the officer can expect at maturity.

Many variables play an important role in calculating the amount of premium you have to pay. Therefore, in this situation, the LIC calculator is considered the best tool to calculate the premium. Here is an example of life insurance premium calculation using LIC premium and maturity calculator.

*Accident insurance provides additional coverage in the event of accidental death over and above basic life insurance. The insurance company charges additional insurance premiums for such additional insurances. The LIC premium calculator provides an overview of the additional costs for the driver.

Buying an LIC policy at a young age is a proactive strategy to reduce premiums. Younger people are generally considered lower risk, which leads to lower costs. By starting coverage at an early age, policyholders can lock in lower premiums and provide long-term financial protection at an affordable cost.

Lic’s Bonus Rates

A careful consideration of the Sum Assured is important to optimize the LIC premium. Assess your coverage needs properly and avoid overpaying for coverage. You can ensure sufficient protection without unnecessary expenses by choosing funds that suit your financial obligations and goals.

Maintaining a healthy lifestyle can have a positive effect on LIC costs. Regular exercise, a balanced diet and good health help reduce the risk. By prioritizing health, people improve their quality of life and may have lower insurance costs.

Quitting smoking is beneficial to your overall health and can lead to significant reductions in your insurance premiums. Insurance companies consider smokers to be high-risk individuals and therefore often face higher premiums. Policyholders can enjoy lower premiums when they stop smoking, reflecting the positive impact on their health and risk reduction.

Insurance conditions play an important role in determining the premium. Choose a term policy that suits your financial goals and objectives. Avoid unnecessary extension

Lic Jeevan Amar Vs Lic Tech Term: How These Two Term Insurance Plans Compare

How to find sum of squares, sum assured meaning in insurance, how to find the sum, how to find the sum of series, how to find the sum of numbers, what is sum assured in lic, how to find the sum of fractions, sum assured in lic, how to calculate sum assured in lic, how to find sum of arithmetic sequence, lic jeevan saral maturity sum assured chart, sum assured in life insurance