Home Life Financial Assurance Corporation – The insurance sector includes companies that offer risk management in the form of insurance contracts. The basic idea of insurance is that one party, the insured, guarantees payment for an uncertain future event. Meanwhile, the other party, the insured or policyholder, pays the insurer a small premium in exchange for that coverage against the uncertain event.

As an industry, insurance is considered a slow-growing, safe sector for investors. This view was not as strong as it was in the 1970s and 1980s, but it is generally true when compared to other financial sectors.

Home Life Financial Assurance Corporation

The insurance sector is all about risk management. | All policies considered are considered with different risks, and an actuarial analysis is performed to better understand the numerical probability of certain outcomes. Based on the difference between statistical data and estimates, policyholders’ premiums are adjusted, or benefits are reevaluated. Generally, the amount of premium paid within a policy is a function of the risk associated with the person, property, or thing insured.

What Is Insurance Underwriting?

In some cases, insurance companies will partner with banks to sell their products to bank customers. This practice is very common in Europe, but is gaining ground in America.

What is interesting to insurance companies is that they are allowed to use their customers’ money to invest. This makes them similar to banks, but the investment is much larger. Sometimes this is called “float”.

A float occurs when one party extends money to another party and does not expect a return until something unexpected happens. This approach means that insurance companies have a favorable cost of capital. This distinguishes them from private equity funds, banks and mutual funds. For investors in stock insurance companies (or policyholders in mutual companies), this means low risk, the possibility of stable returns.

Insurance plans are the main product of this sector. However, recent decades have brought a large number of pension plans and annuities for retirees. These types of products put insurance companies in direct competition with other providers of financial assets.

Why Do I Need To Get Life Insurance?

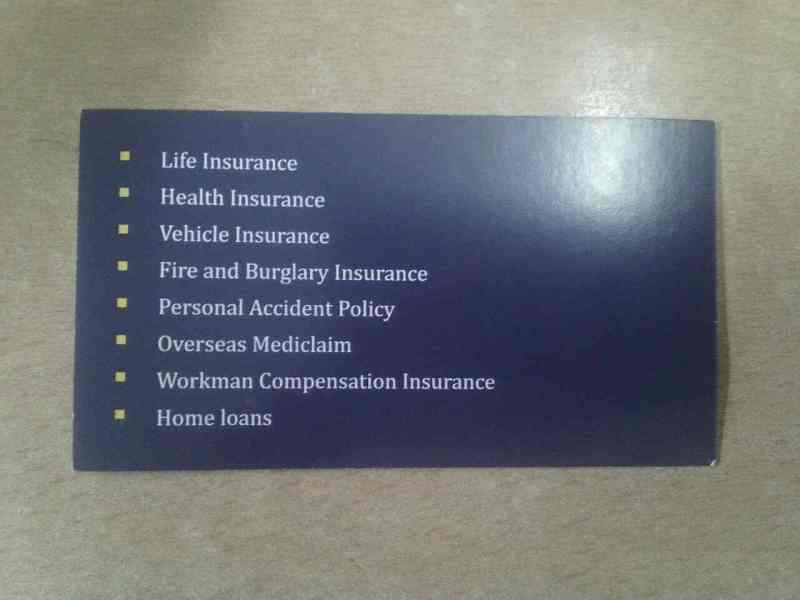

Not all insurance companies offer the same products or cater to the same customer base Among the largest categories of insurance companies are accident and health insurance; property and casualty insurance; and guarantor The most common types of personal insurance policies are auto, health, homeowners, and life. Most people in the United States have at least one type of insurance, and auto insurance is required by law.

Accident and health companies are probably the most well-known. These include companies such as UnitedHealth Group, Anthem, Aetna and AFLAC, which is designed to help the physically disabled.

Life insurance companies mainly offer policies that pay a lump sum death benefit to their beneficiaries on the death of the insured. Life insurance policies can be sold as term life, which is cheaper and expires at the end of the term, or permanent (usually whole life or universal life), which is more expensive but lasts for life and carries an accumulation component. Life insurers may also sell long-term disability policies that replace the insured’s income in the event of illness or disability. Well-known life insurers include Northwestern Mutual, Guardian, Pradyum and William Penn.

:max_bytes(150000):strip_icc()/titleinsurance-ef80077445c040029e7cd52f943b6a0c.jpg?strip=all)

Property and casualty insurance companies insure against non-physical damage risks This can include liability, personal property damage, car accidents and more Major property and casualty insurance includes State Farm, Nationwide and Allstate

Insurance Plans, Medical & Life Insurance

Businesses require specific types of insurance policies that insure against specific types of risk faced by a particular business. For example, a fast food restaurant may require a policy that covers damage or injury that occurs while cooking with a deep fryer. The car dealer does not face this type of risk but requires coverage for damage or injury that may occur during the test.

Insurance policies are also available for more specific needs, such as Robbery and Rescue (K&R), medical malpractice, and professional liability insurance, known as Assault and Cancellation Insurance.

Some companies deal with risk mitigation Insurance is insurance that insurance companies buy to protect themselves from excessive losses due to excessive exposure. Insurance is an important part of insurance companies’ efforts to avoid defaults in order to stay solvent, and regulators mandate it for companies of a certain size and type.

For example, an insurance company can write extreme hurricane insurance, based on models that show the likelihood of a hurricane in a certain area. If something goes wrong with a hurricane in that area, the loss can be huge for the insurance company. By taking risk off the table without insurance, insurance companies can go out of business when disasters strike.

Life Insurance Policy

Insurance companies are classified as stocks or similar depending on the ownership structure of the organization There are also some exceptions, such as Blue Cross Blue Shield and fraternal groups that are separate sectors. However, joint stock companies and joint stock companies are the most common ways insurance companies organize themselves.

A stock insurance company is a corporation owned by shareholders or shareholders, and its purpose is to make a profit for them. Policyholders are not direct shareholders in the profits or losses of the company. Other requirements must be met if the company’s shares are publicly traded. Other well-known US stock insurers include Allstate, MetLife and Prudential.

A mutual insurance company is an entity owned only by policyholders, who are not “contractual lenders” who have voting rights on the board of directors. Generally, companies are managed and assets (insurance reserves, surplus, contingency funds, dividends) are held to serve and protect policyholders and their beneficiaries.

The directors and board of directors determine how much operating income is paid out as dividends to policyholders each year. While not guaranteed, there are companies that have paid dividends even in difficult financial times. The largest mutual insurers in the United States include Northwestern Mutual, Guardian, Penn Mutual, and Omaha Mutual.

Mahindra Finance: Apply For Loans, Fixed Deposit Investments And More!

As of March 2023, the latest data collected from the Insurance Information Center shows that US insurance companies will record 1.4 trillion in monthly premiums by 2021.

Buying stocks in the insurance industry can have many benefits Insurance companies get money from premiums paid by policyholders Investors can benefit from the reliability and stability this source of steady income can provide, as these cash flow streams are often fixed and can be locked into long-term contracts.

As their portfolio of customers and insurance products expands, insurance businesses can see long-term growth. As the population and economy become more complex, the need for insurance protection increases. In addition, the insurance sector is more vulnerable to economic downturns than other industries.

Dividends are common in the insurance industry. Insurance stocks appeal to income-oriented investors because dividends can provide investors with steady income. In addition, insurance companies can adjust their premiums to reflect inflation, which will help protect the value of the investment against inflation.

Insurance Quotes For Home, Auto, & Life

Finally, there are legal implications that may be favorable. Mergers and acquisitions are a common form of business integration in the insurance sector. As businesses consolidate and realize potential synergies, this can lead to greater shareholder value. The industry is also somewhat leery of regulations that could be stronger to protect policyholders, companies and investors.

Despite its strength, the insurance sector has seen a decrease in equity positions. Insurance companies face large losses due to natural disasters, major accidents or large claims. Such events can have a negative impact on their financial performance, especially when unexpected or dark swan events occur.

Because insurance companies operate in a highly regulated industry, changes in regulations, failure to comply or legal issues can result in financial penalties. It can also cause significant damage. Another such example would be an insurance regulation that requires capital to ensure solvency and stability. An insurance company may be forced to cut dividends to ensure that sufficient cash is maintained to meet such requirements.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg?strip=all)

Insurance companies make a profit by investing the premiums they receive. Fluctuations in interest rates or poor investment performance can affect their sources of profit. Alternatively, insurance companies can be adversely affected by adverse economic conditions. Note that companies that go out of business no longer require coverage and may waive their premiums

Term Vs. Whole Life Insurance: Differences & How To Choose

Regulation is an important part of ensuring consumer protection, financial stability and ethical conduct in the insurance industry. Insurance companies must comply with laws and regulations set by regulatory bodies and the government Here is a summary of the laws that govern the insurance sector

The insurance sector has been around for a long time

United life assurance corporation, asianlife financial assurance corporation, empire general life assurance corporation, home financial corporation, philippine life financial assurance corporation, american skandia life assurance corporation, prudential annuities life assurance corporation, ohio national life assurance corporation, sun life financial assurance company of canada, plymouth rock home assurance corporation, national family assurance corporation life insurance, home point financial corporation