Hmo Vs Ppo Medical Plans – You will find the lowest prices available for health care coverage. Depending on your income and the size of your home, you may also be eligible for government rebates through the Affordable Care Act. Our rates can’t be beat.

We make the process as simple as possible. Get accurate quotes in seconds without giving out your email or phone number. Use online tools to help you quickly find the plan that best suits your needs. Plus, sign up in minutes on a computer or mobile device using our quick and easy online process.

Hmo Vs Ppo Medical Plans

Everyone should have health insurance now that the Affordable Care Act is in place, but that doesn’t mean health care has become any less confusing. We tend to go with what we know, or what we’ve always had when it comes to insurance, but the truth is, you have options.

Hmo Vs. Ppo Plans: What’s The Difference & Which Is Better?

In California, health insurance options primarily include a Health Maintenance Organization (HMO) and a Preferred Provider Organization (PPO). There is also a third option, the Exclusive Supplier Organization (EPO), which is growing in popularity in California.

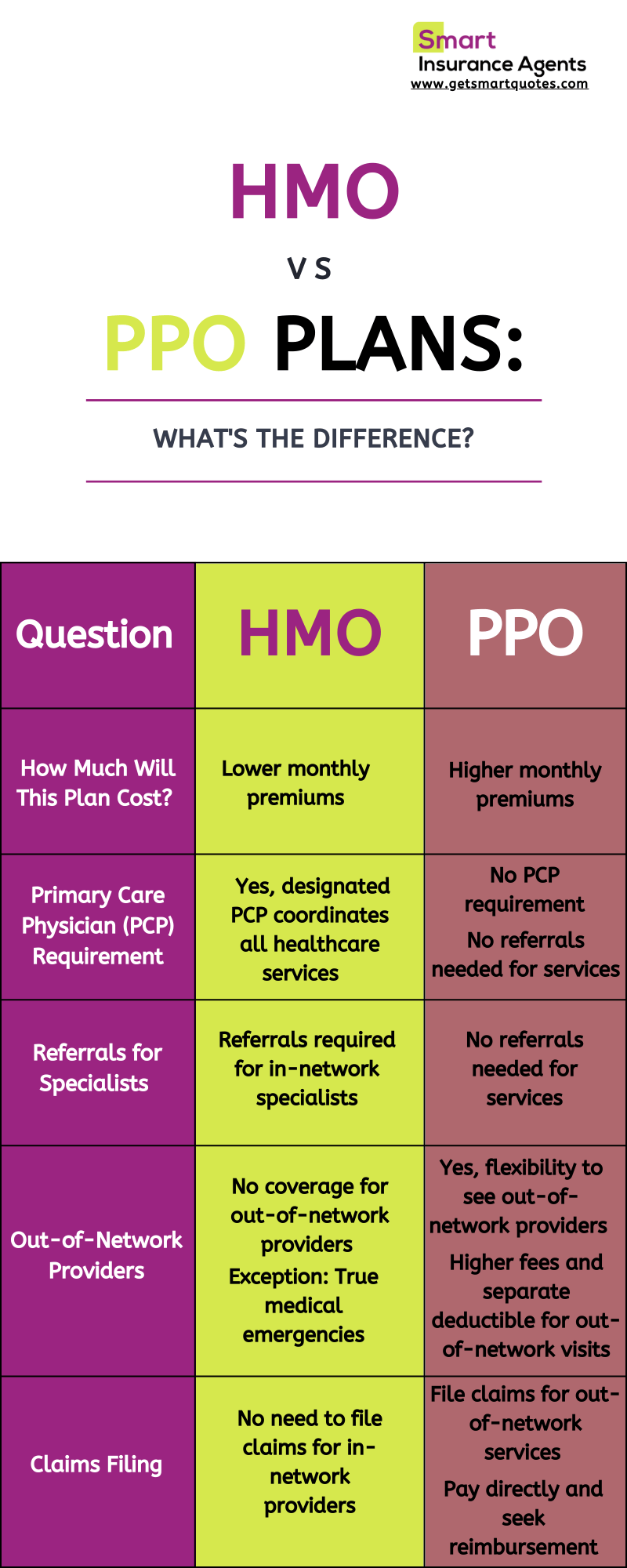

While all of these plans can provide the coverage you need, it’s important to understand each one individually and then compare them to each other. Not understanding the differences between HMO, PPO and EPO plans can lead to significant unexpected costs and the frustration of having to change doctors due to a change in insurance coverage. These plans provide coverage, but there are big differences in how they work and how much they cost.

Whether you don’t have insurance and are looking to purchase a plan soon or are just exploring your options as a Californian, we’ve provided some insight into HMOs, PPOs, EPOs, and Kaiser Permanente.

Of the three plan types—HMO, PPO, and EPO—you have HMO and PPO at opposite ends of the spectrum, with EPO plans somewhere in the middle. You must first distinguish between HMO and PPO plans. So you can see where EPO fits in, as a hybrid of the other two.

Hmo Vs. Epo Vs. Ppo: Which Is Better? What’s The Cheapest?

HMO plans mainly revolve around a primary care physician (PCP). Your PCP is the doctor you go to for an annual physical or when you are sick. You can choose your PCP, but they must be within the HMO’s local network of health care providers. Here is more information about the health insurance funds:

But what happens when your PCP doesn’t think you need more treatment? Or does your situation not justify contacting a specialist? These situations may occur and should be considered. As long as you choose a reliable PCP, it is unlikely to present any problems.

All of your health care is provided within a local network – if you find an out-of-network provider, you are responsible for paying the cost out of pocket. If you have a doctor you like, expect a change in insurance coverage and are considering a HMO plan, make sure your doctor is in the HMO’s network. Otherwise, you will need to change doctors so that you have a PCP that is included in your plan’s network.

There is one exception to the rule of the health insurance network. You may be wondering – what if I’m on vacation and have an emergency? For this reason:

Chapter 3: Ppo, Hmo, Hdhp + More! Smb Health Insurance Plans

In general, the health insurance networks are small, but the health insurance plan has two advantages – both within the financial department. As long as you work within the health insurance network, you probably won’t need to file a claim. Instead, your insurance company works directly with your healthcare providers. Also, health insurance plans are almost always affordable—they often have lower monthly premiums and lower out-of-pocket expenses.

Yes, that means PPO plans, which fall on the opposite end of the spectrum, are almost always more expensive—however, with the added cost comes flexibility and freedom. There is still a network, but you are free to go to providers outside your network if you want:

With a PPO plan, there is also more flexibility when it comes to choosing a PCP and finding specialists. If you have a PPO plan, you don’t need to have a PCP and you can go see any provider you choose, but you’ll end up saving money by choosing an in-network doctor.

You also don’t need to get a referral from your PCP if you need to see a specialist—that’s a decision you’re free to make without going to see your PCP first. You can even choose to see a specialist who is not in your network, because in a PPO plan you can do that.

Differences Between Hmo And Ppo (comparison Chart)

With all that flexibility and freedom comes a higher price tag and a higher level of involvement in your health care, since you’re often the one making and scheduling appointments, while a PCP often takes care of most of that in a HMO plan. If you choose to see a doctor outside of your network, you may still need to gather information and submit the claim to your insurance company to get some of the cost covered.

There are some significant differences between HMO and PPO plans, and there is no one-size-fits-all solution. Which one is best for you ultimately depends on your preferences.

There is a third option that is becoming popular in California – the Exclusive Provider Organization (EPO). This third option is a bit of a hybrid of HMO and PPO plans. You’ll have many of the same freedoms you have with a PPO plan. Here is the feature list for the EPO program:

Because you have an exclusive network usage limit with an EPO plan, it’s often less expensive than a PPO plan, making it a better deal for those looking for more control over their health without paying much more in insurance premiums. Again, you need to know if your doctor and any specialists you see are in network or not, as you will be responsible for all costs if you go to a doctor outside the EPO network.

Case Study: When A Hmo Plan Is Best For Your Employees

California is home to the nation’s oldest and largest health insurance company, Kaiser Permanente. Founded in 1945 and headquartered in Oakland, California, Kaiser Foundation Health Plan Inc. is an insurance provider serving people in California, Colorado, Georgia, Hawaii, Virginia, Maryland, Oregon, Washington and the District of Columbia.

The organization also supports Kaiser Foundation Hospitals and Permanente Medical Group, Inc., a physician group practice of more than 9,000 physicians. Kaiser Permanente created its own brand, the network.

As a health plan, Kaiser has a regional network of providers in California that includes PCPs, clinics, hospitals and pharmacies. If you live in an area where there is no Kaiser facility, you can receive care from sites with a Kaiser contract – they do not carry the Kaiser name, but are accepted into the Kaiser network.

The Kaiser network currently serves over eight million Californians through 15,774 physicians, 467 medical offices and 36 hospitals located throughout Northern and Southern California. You can view the Kaiser rating by searching online.

Hmo Vs Ppo

You may have heard of the Kaiser Permanente campaign called “Thrive”. This health promotion emphasizes preventative care and includes 24/7 access to nurses on the phone, disease management programs, healthy lifestyle programs, and discounts on fitness classes and programs, among others.

In some ways, Kaiser Permanente is taking health plan plans to a new level, actually owning its medical groups and hospitals at its core, rather than merging with multiple health plans. However, it’s still a HMO plan at heart, so it comes with the limitations that define a HMO plan — having to stay in-network and manage all of your care by seeing a PCP first.

The first step is to look at your options – not all three plans are offered everywhere, so it’s best to start by checking what’s available to you. You can start by entering simple information about yourself and your family, if applicable, on our website.

Requesting a free estimate will give you a list of options, including plan type (HMO, PPO, or EPO). Once you know what your plans are, you can start thinking about your priorities.

Help With Health Care Plan: Kaiser Hmo Vs Ppo+hsa (in Ca)

There is no winning plan, but the plan that works best for you and your family. See how important each of these things is:

As you consider your options, keep in mind that each of these types of insurance plans in California will cover the health care you need. The way they usually provide these services is different. Individuals and families come in all shapes and sizes – and so do insurance plans.

Now that you have background information on HMO, PPO, and EPO plans, as well as an explanation of how Kaiser Permanente fits in, you’re ready to get an insurance quote. Whether you don’t currently have insurance and need coverage or want to shop around, we have an online tool that gives you the opportunity to get free health insurance quotes instantly. Not only will you have the opportunity to see everything

Ppo vs hmo, ppo vs hmo plans, wellcare hmo vs ppo, hmo ppo pos plans, medicare hmo vs ppo plans, hmo vs ppo dental, healthcare hmo vs ppo, aetna hmo vs ppo, hmo vs ppo insurance plans, aetna hmo vs ppo plans, medicare ppo vs hmo, which is better hmo or ppo plans