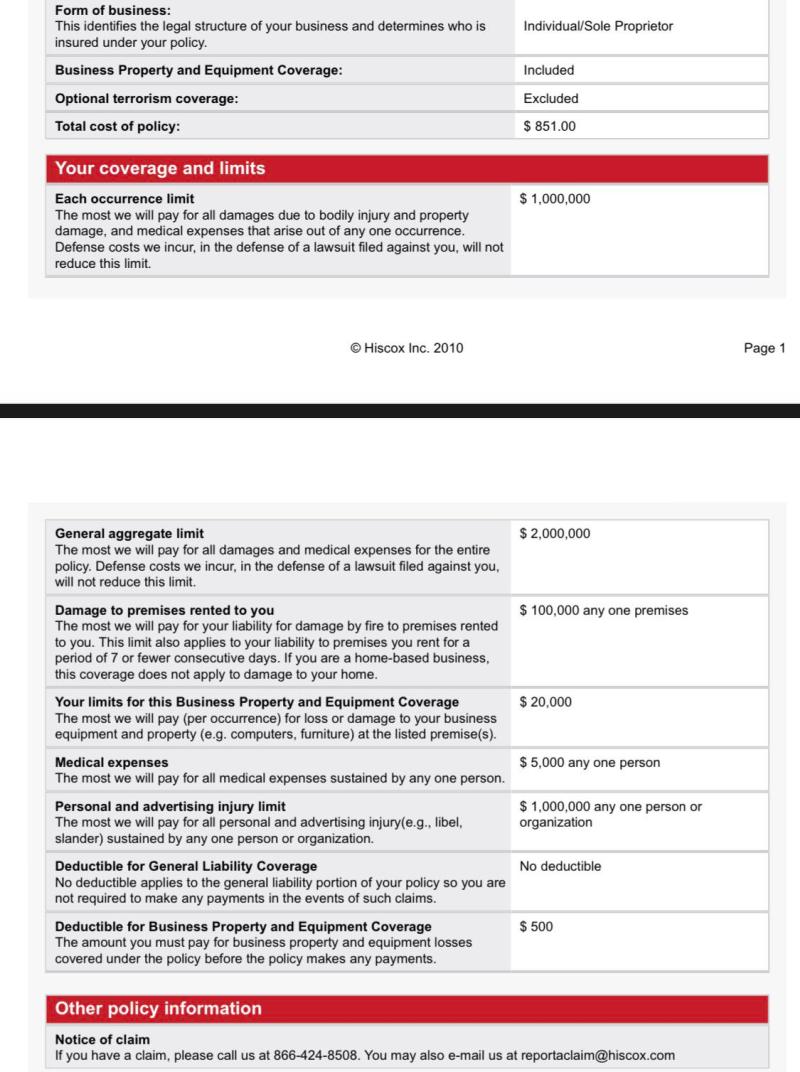

Hazard Insurance For Eidl Loan – Business hazard insurance is a type of small business insurance that doesn’t really deal with personal injuries but primarily focuses on insuring premises owned and leased by your business. Key Takeaways from This Article 1. Small business hazard insurance offers financial protection against natural disasters such as hurricanes, fires, and other extreme weather events for your business, its commercial buildings, and other physical assets. 2. Perils such as floods, earthquakes, acts of terrorism, nuclear attacks, and war damage may be excluded and may require alternative insurance options and separate business insurance policies. 3. Having proper hazard insurance can help you get a business loan. 4. The more assets you have, the more coverage you need. Hazard insurance covers all the equipment you use to run your company. In the article below, we’ll discuss what hazard insurance is, why your small business needs it, how much coverage you need, and where to get hazard insurance. Contents: What is Business Hazard Insurance? What does business hazard insurance cover? When is hazard insurance necessary? How much hazard insurance is required Does the SBA require hazard insurance? Why does the SBA want hazard insurance? What Insurance is Required for SBA Disaster Loans? What is Business Hazard Insurance? Small business hazard insurance offers financial protection against natural disasters such as hurricanes, fires, and other severe weather events for your business, its commercial buildings, and other physical assets. Your policy should specifically cover each incident so that your personal property and your business are protected and losses are covered. Many businesses use hazard insurance interchangeably with catastrophe insurance, but the two are different policies. How are they different? Hazard insurance refers to natural disasters such as storms, floods, and hurricanes. On the other hand, disaster insurance covers man-made disasters such as explosions and riots. What does business hazard insurance cover? We’ve covered them a bit, but let’s move on to a more complete list. The peril coverage portion of commercial property insurance generally covers: Lightning Theft Explosion Fire Damage Hail Snow, hail, and ice Power surges Wind damage Floods, earthquakes, terrorist attacks, nuclear attacks, vandalism, etc. Business insurance covers property damage. may be excluded from war and may require alternative insurance options and a separate business insurance policy. If you are in an area prone to natural disasters, you may want to consider a separate business risk policy from your insurance provider. When is hazard insurance necessary? Besides the old adage “better safe than sorry,” why is hazard insurance necessary? Having the right hazard insurance can help you get a business loan. Most small business owners understand that running a business involves certain financial risks. Having the coverage options you need can help reduce your risk. This added protection gives you peace of mind so you can focus on running and growing your business. How much hazard insurance is required? How much business hazard insurance you need will vary from business to business. The more properties you insure, the more coverage you need. The actual cash value of an item is usually less than its replacement cost because the asset depreciates over time. That’s why real cash value insurance is cheaper than replacement value. If the SBA requires insurance (which we’ll cover below), they must cover your hazard insurance for at least 80% of your loan amount. Does the SBA require hazard insurance? The Small Business Administration requires entrepreneurs to have SBA loan risk insurance. Including Economic Injury Disaster Loans (EIDL) due to COVID-19 and other conditions. Your business may already have the necessary coverage under your business property insurance policy. If in doubt, we recommend you contact your insurance company. Additional location-related add-ons may be required, such as flood insurance coverage within 12 months of your loan approval. Why does the SBA want hazard insurance? The SBA requires you to have certain business insurance policies to protect you and your business. They are also required to reduce the lender’s risk in providing a loan to your business. One of the benefits of the SBA, which requires insurance coverage, is providing low-interest SBA or EIDL loans to businesses. Why is this happening? Because credit institutions’ risks are reduced, they can offer lower interest rates. Other lenders may require certain types of business insurance before providing a loan. What Insurance is Required for SBA Disaster Loans? The Small Business Association requires small business owners to obtain property insurance to qualify for a Payroll Protection Program (PPP) loan or Economic Injury Disaster Loan (EIDL). If you have a PPP loan or are applying for an EIDL loan, you need general liability or commercial property insurance that includes EIDL hazard coverage. Take extra steps to help your small business succeed. We hope this guide will help you understand the importance of hazard insurance and why your business needs it. Insurance can protect your business, but you need specialized services to help it grow. Electronic Merchant Systems is a national payment processor and we understand small businesses and what it takes to be successful. That’s why we have over 1,000 Google user reviews with an average rating of 4.7/5. We offer valuable tools and services such as POS systems, mobile payment acceptance, gift and loyalty card programs, website design, and more. If you’re looking to improve your checkout process or just want better prices, click below to talk to one of our eCommerce Payments experts today. References: 1. 2. 3. 4.

Currently, I lead a talented team of top social media strategists, web designers, content creators, and communications professionals in our digital marketing efforts for companies and small businesses. I am very excited to use B2C digital marketing strategies in an industry that traditionally uses B2B methods to acquire new customers. My consistent mission is to “empower the sales force.” I started in the payments industry in the early 90s as a software evangelist at ICVERIFY. Now I manage schizophrenics: product developers, web and social strategists, speakers, coaches, content creators, number crunchers, scout leaders, photographers, fathers.

Hazard Insurance For Eidl Loan

Apr 01, 2022 How to Find the Best Health Insurance for Small Businesses Oct 23, 2023 The Best POS Systems for Your Small Business: Complete Overview Jun 23, 2022 CBD Pay Online understands the challenges of how to thrive and succeed in a growing industry. Florida Homeowners Insurance Claim Denials The Florida homeowners insurance landscape is a complex and often challenging area for homeowners. Property insurance claims, particularly denials and underpayments, have increased in the state in recent years. This article aims to shed light on this pressing issue and provide insight and guidance for those facing the turmoil of Florida property insurance claims. 1. Amazing Florida Insurance Claims Statistics.

These Eidl Loan Restrictions May Surprise Business Owners

Making a living in the competitive world of insurance sales can be a daunting task. However, there is a secret weapon you may not have thought of – Fiverr. With ten years of experience, I have found this platform to be a breakthrough in maximizing your lead generation efforts. In this article, we’ll learn what Fiverr is, how to open an account, and how to use it to get more out of life. What is Fiverr? Fiverr is a global online marketplace founded in 2010.

The insurance industry, traditionally considered conservative and slow to adapt to change, is now undergoing a dramatic transformation thanks to technology. Combining insurance with technology, known as “insurtech,” is changing the landscape of insurance offerings, customer service and business models. Insurtech The evolution of Insurtech began as a response to the digital revolution sweeping other industries. Today, it represents a wide range of applications, from artificial intelligence and machine learning for underwriting and fraud detection to blockchain and the Internet for secure and transparent transactions.

The real estate coverage ecosystem in the state appears to be weakening compared to recent years. Florida’s home insurance market appears to be stabilizing, but it’s clear that the state needs more funds to strengthen homes after each year’s more severe windstorms. Risk experts say this can prevent major losses for both policyholders and insurance companies. “Defense is a big problem. If you’re wondering how…

In 2021-2022, the number of uninsured children in the state increased dramatically. Pennsylvania is one of only three states in the country

Sba Offers Disaster Assistance To Wisconsin Small Businesses Economically Impacted By Covid 19

Eidl hazard insurance requirements, sba loan hazard insurance requirements, business hazard insurance for sba loan, sba eidl loan hazard insurance, eidl loan hazard insurance requirements, eidl loan hazard insurance, hazard insurance for eidl sba loan, hazard insurance for eidl, hazard insurance for sba loan, sba eidl hazard insurance requirements, apply for eidl loan, sba eidl hazard insurance