Graduate Student Loans Bad Credit – Your credit score is like a score: it tells lenders how likely you are to repay the amount you borrow. The higher your credit score, the more willing lenders are to work with you.

If you have a college-aged child, you’ll have to take their credit score and your credit score into account when considering student loans. If you or your child need to get student loans but have bad credit, what are your loan options?

Graduate Student Loans Bad Credit

Here are some tips on how to qualify for student loans, even if you have poor credit:

When To Refinance Student Loans

The most important factor is your payment history. Missing bills or late payments will lower your score; Paying all your bills in full and on time will increase it.

Lenders like to see that you are not heavily dependent on debt. Keeping the amount you owe low compared to the total amount of credit you have will benefit your credit score. Factors include the number of accounts you carry with balances, whether you’re already getting close on several credit cards, and whether you owe a lot on an installment loan. .

The longer you’ve been using credit, the better our track record of managing it responsibly. If you have a short credit history, it might raise a red flag that you don’t have enough experience, so your score could be low.

Having a variety of credit lines, including credit cards and loans, shows lenders that you can handle different types of debt.

Best Student Loan Lenders For Bad Credit Or No Credit Of December 2023

It’s a good idea to apply for a new loan in moderation. Trying to get too many loans or credit cards can show that you are unable to meet your financial responsibilities.

, a score that falls between 580 and 669 is considered “fair,” while a score between 300 and 579 is considered “very poor.” If your or your child’s credit score falls within these categories, you may have difficulty getting approved for a loan and/or you may pay a higher interest rate when you borrow money.

Even if you or your child has bad credit, you still have many loan options. This is especially true with federal student loans, which do not have the same credit requirements as other types of loans.

Federal student loans are backed by the government; They do not require a regular credit check because they are considered financial aid. When you fill out the Free Application for Federal Student Aid (FAFSA

Can You Get A Student Loan With Bad Credit?

) each year, you will find out if you qualify for federal student loans, and if so, how much and what types.

Each year, the federal government also sets student loan interest rates, which are the same for all borrowers, regardless of an individual’s credit score. However, that does not mean that the borrower’s credit is irrelevant. Depending on the type of loan, your credit report can still determine whether to get approved.

Direct loans for college students, as well as subsidized and unsubsidized federal loans, do not require a credit check. As long as the student qualifies for these loans according to the FAFSA, they can borrow even with bad credit.

Federal Direct PLUS loans are available to parents and graduate/professional students. These loans require the borrower to check the borrower for “bad credit history.” In other words, your credit score doesn’t matter, but the government will want to know if you have a history of late payments, debts, or foreclosures. or other major negative indicators on your credit.

Do You Have To Pay Student Loans In Graduate School?

If you happen to have bad credit and don’t qualify for a federal Direct PLUS loan, you don’t have to be out of luck. If you can prove that your credit problems are due to depressing factors, you can petition to have your loan approved. Alternatively, you can apply to a cosigner with good credit, which is similar to having a cosigner. (Like cosigners, cosigners are responsible for paying the debt if you are unable to do so.)

Unlike federal student loans, private student loans are issued through private financial institutions, such as banks and credit unions. Loan terms, interest rates, and eligibility criteria vary by lender. Lenders often supplement the cost of a college education that is not covered by federal financial aid and loans with private student loans.

Like other types of loans, private student loans are subject to a credit check, and your score affects approval, fees and terms. Lenders usually reserve very low rates for borrowers with a good credit report and may not approve those with bad credit. Many lenders allow you to apply to a cosigner, but again, this person is equally responsible for the debt, so it is important to take this route only if you are confident that you will be able to pay the debt on time.

In addition to your credit score, student loan lenders may consider your work history, income and other financial information. Therefore, a good credit score is not necessarily a guarantee that you will be approved for a private loan, but it certainly helps.

How To Get Student Loans For Parents With Bad Credit

If you have existing school loans and want to get a lower interest rate or change the terms, you may want to consider refinancing. Student loan consolidation and refinancing are often confused, but the distinction is important.

Student loan consolidation is only available for federal student loans through the Federal Direct Loan Consolidation Loan. Consolidation is often required to enroll in certain payment plans and forgiveness programs. In this case, your credit score is not a factor: the interest rate on your combined loan will be the weighted average of your existing loans, plus a small percentage.

Refinancing, on the other hand, is only available through private lenders. The same is true when refinancing federal student loans. This is because the process of refinancing involves getting a new loan through a private loan and using the money to pay off your previous loans. It also means that your credit score is a factor in whether or not you will be approved. You will be subject to the same types of requirements as when applying for private student loans.

Student loans can be confusing, but we’re here to help you make sense of it all. For more information about student loans, check out our student loan options or call 1-888-411-0266 to speak with a student loan specialist.

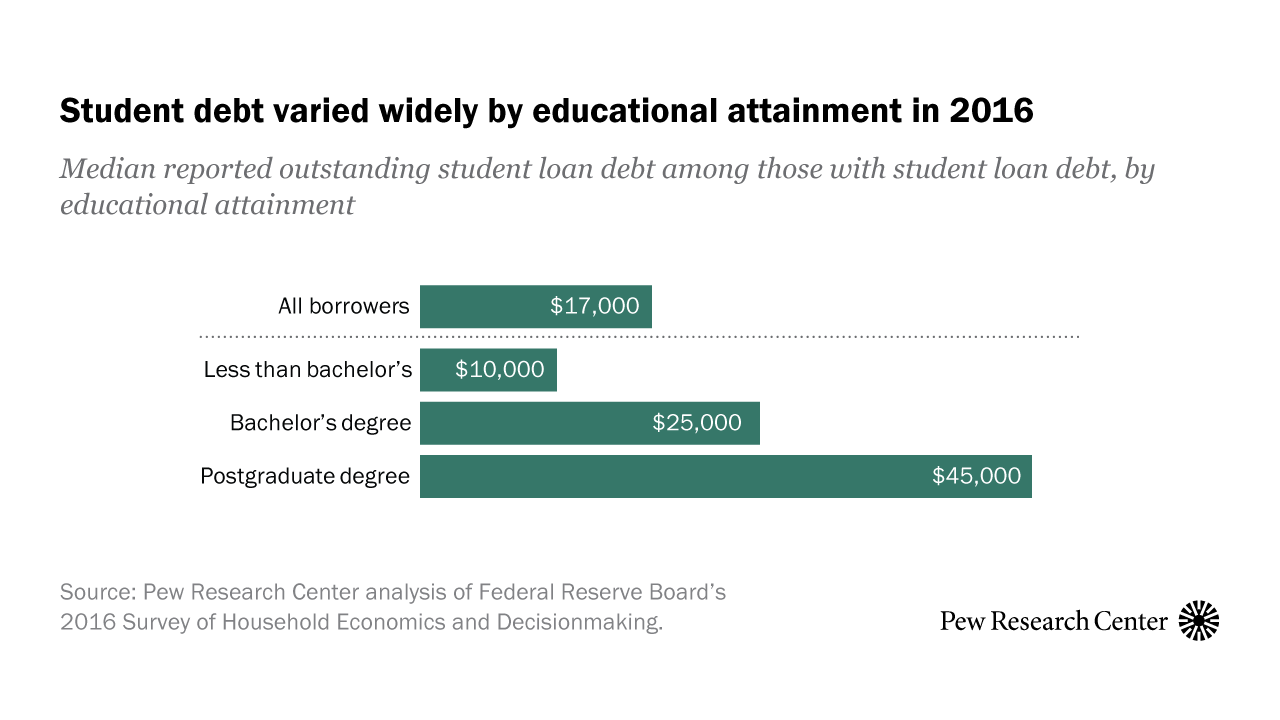

How Graduate Degrees Affect Debt And Credit

© Citizens Financial Group, Inc. All rights reserved. Citizens is a trademark of Citizens Bank, N.A. Member FDIC

Disclaimer: The information provided here is for informational purposes only, as a service to the public, and is not legal advice or a substitute for legal advice, nor does it constitute an advertisement or solicitation. You should do your own research and/or contact your legal or tax advisor for assistance with any questions you may have regarding the information contained herein.

Images of resources or organizations listed in this article do not represent or imply the approval or support of Citizens. Aaron Mitchom learned the art of the alliance from his mother. When he was a child, he and his five siblings watched their mother discuss how to put food on the table.

“He would go to McDonald’s or Wendy’s and say, ‘Hey, look: I have five dollars in my pocket. Let’s make a deal because I have to feed my kids,'” Mitchom recalled. .

Student Loans: High Income Earners Even Struggle To Pay Off Debt

As a child, his first reaction was shame. But as Mitchom approached his teenage years, that embarrassment was replaced by admiration. His mother’s advice worked.

“I said, ‘Mom.’ This is embarrassing. But it’s great that you can make a deal to feed us,'” Mitchom says. I was surprised because I knew he only had $5 in his pocket. Then he told me (and this is what changed my life forever) that he said, “Aaron, this makes a deal.” This is finance. The fact that they can do this on Wall Street every day, but when I can do it to feed my family, it doesn’t make sense to me.

From that moment on, Mitchom knew he would study finance. But later, as his graduation day from Morehouse College approached, he found himself in a situation he couldn’t get out of so easily.

Although he had paid his way by living with his grandmother, who extended her pension to help him, Mitchom realized that his student loan burden was too much to bear. as he expected because of the interest that was beginning to exist at that time. he entered the classroom.

Examining 3 Of The Arguments Of The Student Loan Forgiveness Debate

“I said, wait, I have over $200,000 in debt and I’m 22 years old?” He remembers. “Although I will have a good job because I studied finance, everyone will have a greater advantage than me because of the wealth of products.”

Stay in school. It is an American expression, a path to the so-called American Dream. Or so they tell us.

“What’s the big story that we tell ourselves over and over again, in our political debates, in our national debates? That big story is: If you go to college and take out student loans, you’re going to get a return on those student loans by your degree and the job market,” says Jalil Bishop, co-author of the Education Trust’s report “Jim Crow Debt.: How Black Borrowers Got Student Loan Loans” and author- a member of the National Black Student Loans Study.

Discover student loans graduate, ascent graduate student loans, graduate student loans no credit check, graduate student loans for bad credit, private graduate student loans, private student loans bad credit, best graduate student loans, bad credit graduate student loans, post graduate student loans, student loans with bad credit, graduate student loans, pnc graduate student loans