General Liability Insurance Coverage Limits – A construction insurance program (CIP) is becoming increasingly popular among contractors because it covers different types of insurance policies, such as general liability, workers’ compensation, and excess liability. The insurance program is designed to protect contractors against potential risks and financial losses that occur during construction. However, understanding the limitations of CIP insurance coverage can be confusing for contractors, especially those new to the industry.

1. CIP is a comprehensive insurance policy that covers all contractors and subcontractors working on a particular project. This means that not every contractor needs to purchase their own insurance policy, saving costs for all parties involved.

General Liability Insurance Coverage Limits

2. CIP insurance typically provides higher coverage limits than individual insurance policies. This is because the insurance company can spread the risk between different parties rather than just one contractor.

General Liability Insurance Quote

3. CIP insurance cover may vary depending on the specific policy and project. It is important to review the policy carefully to understand what is and is not.

4. Contractors may still need to purchase additional insurance policies beyond CIP insurance to fully protect themselves against all potential risks. For example, if a contractor uses special equipment that is not covered by CIP insurance, they will need to purchase a separate policy.

By understanding the basics of CIP insurance, contractors can make informed decisions about insurance coverage and ensure they are properly protected during the construction process.

One of the most important aspects of CIP insurance for contractors is the coverage limits. It is important to understand the coverage limits to ensure that the policy provides adequate protection against potential losses. Coverage rates determine the maximum amount an insurance company will pay in the event of a claim. Therefore, it is important to pay attention to the different types of coverage limitations that are available in CIP insurance. Different types of coverage limits are designed to protect against different risks, so it’s important to choose the right type of coverage limit for your specific needs.

Saxe Doernberger & Vita, P.c. Project Specific Commercial General Liability Insurance

1. Occurrence Limit: This is the maximum amount that the insurance company will pay for a single occurrence or loss. For example, if the accident limit is $1 million and the damage costs $1.5 million to repair, the insurance company will only pay $1 million.

2. Aggregate Limit: This is the maximum amount that the insurance company will pay for all losses during the policy period. For example, if the total limit is $5 million and there are five claims totaling $6 million, the insurance company will only pay $5 million.

3. Completed Transaction Limit: This is the maximum amount that the insurance company will pay for claims arising after the transaction is completed. For example, if a contractor installs a roof and it leaks two years later, the completed operations limit applies.

:max_bytes(150000):strip_icc()/combined-single-limits.asp_final-fe49d66723914686a274e629bdd4b541.png?strip=all)

4. Products and performed operations limit: This is the maximum amount that the insurance company will pay for losses arising from products sold or work performed. For example, if a contractor installs a faulty HVAC system that causes an injury, product and performance limitations apply.

Exploring The Types Of Claims Covered By Ae Liability Insurance

Understanding the different types of coverage limitations in CIP insurance is important for contractors to make informed decisions about their insurance needs. By choosing the right coverage limits, contractors can ensure that they are adequately protected against potential losses.

When it comes to contractors insurance coverage, it’s important to understand the general coverage limit. Aggregate limit is the maximum amount that the insurer will pay for all claims arising during a particular policy period. This limit is usually set for the entire policy period and does not apply until the end of the policy period. Contractors should understand this limitation to ensure sufficient coverage for their business needs.

From the insurer’s point of view, the aggregate limit is a means of limiting their risk. Insurers are in the business of making money and they don’t want to pay more in premiums than they have to. Setting an aggregate limit helps insurers manage their risk and protect their bottom line.

From a contractor’s point of view, a general liability limit is a way to ensure that they have enough coverage for their business needs. Contractors should be aware of this limitation and ensure that their policies provide sufficient coverage for their operations. If the contractor exceeds their total rate, they may be responsible for paying any additional costs out of pocket.

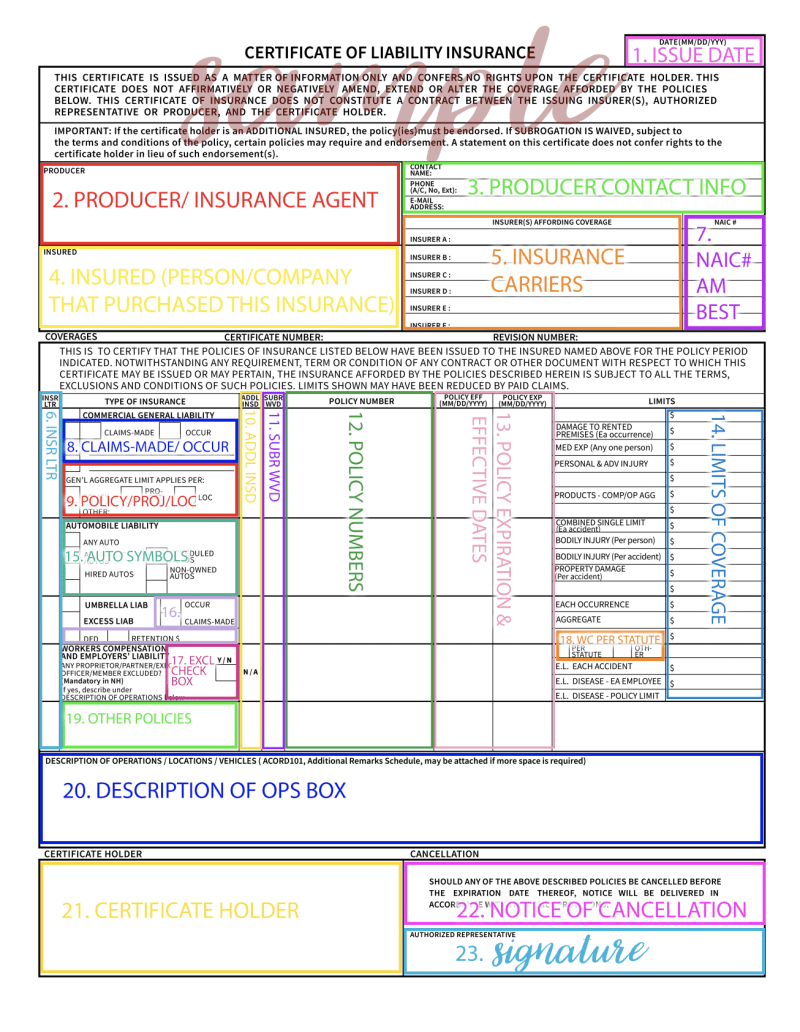

Extracting Data From Certificates Of Insurance

1. Total Total Limit is the maximum amount that the insurer will pay for all losses during a particular policy period.

2. The limitation applies to all claims made during the policy period, regardless of the number of claims and the type of claims.

3. Once the aggregate limit is reached, the insurer will not pay any more claims for the remainder of the policy period.

.png?strip=all)

4. Contractors must have sufficient coverage to meet their business needs and protect themselves from potential liabilities.

What Is General Liability Insurance Coverage?

For example, let’s say a contractor has an aggregate limit of $1 million for a one-year policy period. If the contractor submits two claims during the policy period, one for $800,000 and one for $500,000, the first claim will be paid in full and the second claim will be paid only up to the policy’s $1 million limit. This means the contractor will be responsible for paying the remaining $300,000 out of pocket.

When it comes to contractors insurance coverage, it is important to understand the general coverage limit. Contractors should make sure they have enough coverage to meet their business needs and protect themselves from potential liabilities. By understanding the general limits, contractors can make informed decisions about insurance coverage and ensure the protection they need.

When it comes to interpreting insurance coverage limits for contractors in a CIP, the concept of total project limits can be a bit difficult to understand. But simply put, the aggregate limit per project is the maximum amount of coverage for all claims related to a particular project. This means that if multiple claims arise from the same project, the combined project limit applies to all of them together.

From the contractor’s point of view, it is important to consider the limit of one project package when submitting a project. If the limit is too low, it may not provide enough coverage for multiple claims. On the other hand, if the limit is too high, it may result in unnecessary costs for the contractor.

The 1% Rule: Why Insurance Premiums For Municipalities Are Soaring

From the owner’s perspective, it is important that the total project limit is high enough to ensure adequate project coverage. This can be achieved by requiring a certain level of coverage from the contractor and providing appropriate confirmation of the scope of the project in line with the coverage limit.

To better understand how cumulative project limits work, here are some key points to keep in mind:

1. The cumulative project limit applies to all claims related to a particular project, regardless of the number of claims or the number of claimants.

2. If the cumulative limit for any project is exhausted, no further coverage will be available for that project.

Aggregate Limit Of Liability: Definition, How It Works, Example

3. The cumulative limit for each project is separate from other limits, such as the per-event limit or the overall total limit.

4. The total project limit may vary depending on the project type and risk level. For example, a high-risk project may require a higher rate per project than a low-risk project.

5. To ensure that the total limit for each project is appropriate for the project, it is important to review the insurance policy carefully and consult with an insurance professional if necessary.

For example, suppose a contractor is working on a construction project with a total limit of $1 million per project. If a claim arises from a project and results in a loss of $500,000, the remaining coverage is reduced to $500,000 for any additional claims related to that project. The contractor is only covered up to the remaining $500,000 and they are responsible for the remaining $250,000.

Why General Liability Insurance Is Important For Construction

Overall, understanding how total project limits work is an important part of managing CIP insurance coverage for contractors. By carefully reviewing the policy and adhering to the appropriate limit for the project, contractors and owners alike can rest easy knowing that they are properly protected in the event of any claim.

When it comes to commercial insurance policies (CIP) for contractors, there are coverage limitations that you should be aware of. One such limitation is the limitation of coverage of products and transactions performed. This is that

Insurance liability coverage limits, general liability policy coverage, auto liability coverage limits, business general liability coverage, general liability insurance coverage, general liability insurance coverage cost, commercial general liability insurance coverage, general liability business insurance coverage, cheap general liability insurance coverage, personal general liability insurance coverage, commercial general liability insurance limits, general liability coverage limits