Difference Hmo Ppo Health Insurance – What are HMOs and PPOs? Both HMOs and PPOs are considered managed health insurance plans. But, their difference is something you need to consider when deciding which one is best for your company, HMO or PPO.

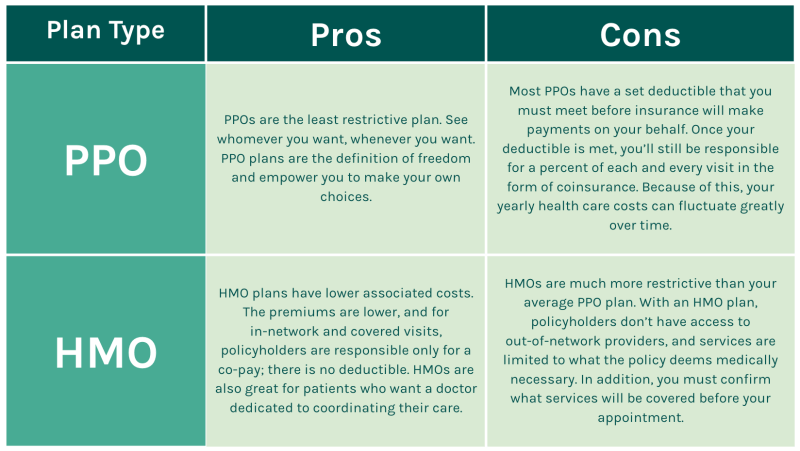

The differences between HMO and PPO insurance plans are most noticeable when looking at network size, ability to see specialists, and coverage of out-of-network services.

Difference Hmo Ppo Health Insurance

So HMO or PPO is better? The difference between an HMO and a PPO is that it depends on network size, ability to see specialists, and out-of-network coverage.

Plan Network Types Explained: Hmos, Ppos, Epos And Poss — Stride Blog

HMO networks are smaller than PPO networks. This means that if you choose an HMO, your employer will be more limited when it comes to choosing a provider. It is important to note the fact that the HMO requires employees to cover 100% of the cost of services except in emergencies if they use an out-of-network provider. You also need to make sure your employees know when they may need to appoint a primary care physician to see a specialist or get a referral to get certain services.

PPO networks are larger than HMO networks, because employees receive out-of-network coverage. To some extent, PPOs are more flexible. Employees can find an out-of-network provider and get coverage, although they may have to pay more. Employees can also see a specialist without going through a primary care physician for a referral. Obviously, if employees want to keep their costs down, they should still choose network providers, even under a PPO.

Both types of plans will connect your employees to a network of providers and different plan options, so before deciding between the two types of plans, you should also consider the cost of each type of plan.

HMO plans are cheaper than PPO plans. They have lower out-of-pocket costs and less expensive games. Employees will have a lower deductible and depending on which HMO plan you choose, if you choose one, you may find that your employees have no deductible. However, these cost-saving measures only apply to internal network providers. Under an HMO, employees are 100% responsible for any out-of-network non-emergency services they receive.

Why Choosing A Medicare Ppo Vs Hmo Is More Than A Price Comparison

PPOs will be expensive. You and your employees will feel higher costs in some ways—you’ll pay higher monthly premiums and employees will have to meet deductibles before their insurance kicks in. One way to reduce premiums under a PPO plan is to opt for a PPO. Programs include a fee.

If it seems that HMOs are a sacrificial choice for cheaper costs and PPOs charge more for freedom and flexibility, you already have a gist of what you can expect from these plans. But, let’s break it down further.

Both plan types use a network of doctors, hospitals and healthcare providers. If you can get higher premiums through a PPO, your employees will appreciate the freedom of choice and the ability to see a specialist without waiting for a referral from their primary care physician. However, if you want or need to save, an HMO is a great option. Check the network in your area to make sure the providers will meet your needs and expectations.

After deciding between an HMO and a PPO, make sure it’s compatible with other benefits like deductibles. You can partner with a provider that offers managed benefits management to make this feature easier to manage. Learn more about Clarity Benefit Solutions passenger benefits. It’s also a good idea to add conflicting products like the Prepare for Life HSA to your benefit line.

Difference Between Hmo And Ppo

We use session cookies on our website to improve your browsing experience. By continuing to use the website, you agree to the use of such cookies. Please take a moment to review our cookies notice for more information.

By clicking “Accept” you agree to the use of session cookies as described in our Cookies Notice. If you do not wish to enable session cookies, please adjust your browser settings accordingly. CoveredCACompare Medical Insurance Plans with CoveredCACompare Medical Insurance Plans CoveredCACompare Medical Insurance Plans with CoveredCA.

Keep your favorites safe. Learn more about life insurance: Term vs Whole Life – What’s the Difference?

Compare and shop for health insurance. Our carriers: BlueShield, Anthem Blue Cross, Kaiser, Oscar, Sutter Health, HealthNet, Cigna, VHP, Sun Health Advantage and more.

How To Choose A Health Insurance Plan That’s Right For You

Find the right employee benefits package for your employees. Whether you are a small business owner with 1 employee or over 100 employees – we can help

Personal dental insurance can be tricky. We can make it easy! Learn about dental PPO, HMO plans and compare different options!

You made a reservation six months ago. You’ve packed everything you need for your vacation, from flip-flops to sunglasses. But even the best-planned trips can be thwarted by circumstances beyond your control. Learn how to protect yourself and your family during the holidays.

Vision insurance is designed to help you cover ongoing vision care expenses such as regular eye exams, prescription glasses, and contact lenses. Plans start as low as $15 per month and you can save up to $193 per year.

Hmo Or Ppo? Which One Is Best For You? Ppo, Hmo, Epo, Or Pos?

Compare the different medical insurance plans available for 2023 side by side. Compare bronze, silver, gold and platinum plans and get information on health insurance companies: BlueShield of California, Kaiser, Oscar, HealthNet, VHP, Sutter Health, Cigna, Sun Health Benefits, etc.

(We have the answer to all these questions on our YouTube channel and more materials. Please visit us and subscribe to YouTube and be updated about this information)

Can I get CoveredCA subsidized health plans if my employer also provides health insurance as an employee benefit?

Do I have to pay a penalty if I don’t have health insurance in 2018 or 2019? Do I need a Form 1095-A?

Comparing Medicare Advantage Hmo And Ppo Plans

Please contact us anytime by phone or email with any questions you may have. Office visits are by appointment only

Schedule a 15-minute one-on-one phone consultation. We spend most of our time on the phone and we don’t want to miss your important call. So instead of calling us and coming to us during the meeting, try something new! Set up a phone consultation that works best for both of us!

Help Insurance Company, Inc. is an insurance company located in the San Francisco Bay Area with clients throughout California. The agency was founded in 2013 (reformed in 2018) with one purpose – to serve the community by understanding their health insurance coverage options. We fully understand that shopping for health insurance can be a confusing, frustrating, and most importantly, complicated process – especially now, with the changes brought about by the Affordable Care Act (ACA). We will work with you to educate you about how health insurance works – from getting a plan to understanding your plan benefits, and how to use it to pay medical expenses. Finally, we hope to educate you on the current market and give you the information you need to choose an insurance plan that meets your financial and medical needs.

Insurance Center Helpline, Inc. What makes us unique is that we only focus on the needs of our customers. we hear We speak. We choose a health insurance product that works and fits your personal, family or small business needs.

Hmo Vs Ppo: Which Is Right For You?

We know that no two people, families or businesses are the same – and the type and level of coverage you need will be equally unique. We will help you get the best possible plan for comprehensive coverage at the best possible price.

We will help you find a health insurance plan that will allow you to access top doctors, hospitals and clinics

We work with all insurance carriers in California, so you can shop around and compare different options. We also work with CoveredCa and will be happy to help with your enrollment, renewals and issues.

If you have questions about health insurance, PPO, Co-Pay, Coinsurance, Deductible, HSA, FSA, etc. or want to learn more about personal finance, contracts, businesses, etc. Please subscribe to our YouTube channel. Educational videos

Hmo Plan Basics: About Health Maintenance Organizations

EU cookie law – We use cookies to provide a personalized experience to our users. By continuing to use this site, you accept our use of cookies. Get 24/7 care over video chat from the comfort of home or wherever you are. Join today and experience premier care designed for real life, office and in-app.

Most people who have health care insurance get it through their employers during open enrollment, although few understand the intricacies of insurance well enough to feel like they’re making a powerful choice. This handy guide will help you understand the key differences between PPO and HMO plans and how to make the right choice for you.

The HMO price is set (you only pay your premium for the services you cover), but there are some restrictions; You should see a provider in your network, and you should choose a primary care provider (PCP). PPOs offer more freedom in which providers you can find outside the network, but the price can vary dramatically.

Health insurance ppo vs hmo, difference between hmo ppo epo, hmo and ppo plan difference, hmo ppo difference, ppo vs hmo insurance difference, difference between hmo & ppo insurance, hmo ppo pos difference, difference in hmo and ppo health insurance, difference between hmo or ppo, difference between ppo and hmo health insurance, what is the difference between hmo and ppo health insurance, hmo ppo health insurance