Difference Between Hmo Ppo Plan – Get 24/7 support via video chat from the comfort of your home or on the go. Join today and experience primary care designed for real life, in the office and in the app.

Most people who have health insurance get it through their employers during open enrollment, but only a small minority understand the intricacies of insurance well enough to feel like they’ve made an empowered choice. This handy guide will help you understand the key differences between PPO and HMO plans and how to make the right choice for you.

Difference Between Hmo Ppo Plan

:max_bytes(150000):strip_icc()/GettyImages-158315060-595d91583df78c4eb612fa42.jpg?strip=all)

The HMO price is set (you only pay your co-payment for covered services), but there are some restrictions; you must see a provider who is in your network and you must choose a primary care provider (PCP). PPOs offer more freedom since you can see out-of-network providers, but the price can vary dramatically depending on a number of variables, including who is seen, whether the visit applies to your deductible, and whether the provider you see is in-network.

Nchealthplans.com Health News » Blog Archive » Hmo, Ppo, Pos

If you have a preferred PCP and/or location, know that you may need to switch if you choose an HMO plan. HMOs require that you designate a PCP with your insurance that is responsible for managing and coordinating your health care. An HMO plan may limit your ability to see doctors you have seen in the past if they are not in network.

PPO plans offer more flexibility in this regard because you can book appointments with providers who are in the PPO network as well as providers who are out of network (although you may pay a higher fee if you choose the latter).

If you have an HMO plan, you’ll need a referral from your PCP if you need to see a specialist, even for routine services like seeing a dermatologist to check a mole. PPO plans often do not require referrals, which means you can book specialist appointments directly without consulting your PCP.

While the freedom of a PPO plan may seem appealing, keep in mind that PCPs play a valuable role in helping you evaluate the best plan of action for your health goals. In addition to evaluating treatment options, your PCP can help you avoid expensive and unnecessary tests and procedures that a specialist might order. So whether you choose a PPO or HMO, we recommend that you make a habit of consulting with your PCP before making any medical decisions.

Medicare Hmo Vs Ppo: Differences And Similarities

Most PPO plans allow you to see a provider outside of your home region with little or no interruption in coverage. HMO plans usually limit where you can be seen, although you may have urgent care benefits in other cities. If you travel often, a PPO plan may be better, as they tend to be more flexible, which can be especially helpful if something unexpected happens and you need to seek emergency care.

HMO plans are great for many people because they can use their plans over time without paying more than one co-payment. There are exceptions to this rule, so it’s important to understand how your coverage works and what services you may need that aren’t covered by your plan.

With a PPO plan, you have the freedom to choose the health care providers and specialists you want to see. But even if you end up seeing the doctor the same number of times as someone in an HMO plan, you may end up paying a lot more to have to cover the costs until you meet your deductible. Most PPO plans require you to meet your deductible before the insurance will pay for your health care.

By considering these decisions when choosing your health plan during open enrollment, you’ll be making decisions based on your lifestyle and approach to health care. If you didn’t think you picked the right plan last year, consider this a learning opportunity to plan ahead for the current open enrollment period so you can feel confident you’re making the right choice this time. The reference guide below can be used to quickly identify which one is best for you based on your preferences.

Hmo Vs. Ppo: Understanding Plan Types

Kevin Potter is a member of the billing team at One Medical Group where he works as an insurance specialist in the New York offices. Kevin spends his time working directly with each insurance company to ensure claims are processed accordingly. When he’s not busy helping to simplify an ever-growing healthcare system, Kevin enjoys giving new names to dogs he sees on the street, napping, debating string theory, and building forts. Learn more about One Medical Group and our convenient locations in San Francisco, New York, DC, Boston and Chicago.

The One Medical Blog is powered by One Medical, a national, state-of-the-art primary care practice that combines 24/7 virtual care services with engaging and convenient in-person care at more than 100 locations across the United States. One Medical is on a mission to transform healthcare for all through a human-centered, technology-driven approach to caring for people at every stage of life.

Any general advice posted on our blog, website or app is for informational purposes only and is not intended to replace or replace any medical or other advice. 1Life Healthcare, Inc. and the One Medical entities make no representations or warranties and expressly disclaim any responsibility regarding any treatment, action or effect on any person following the general information provided or provided on or through the blog, website or application. If you have specific questions or a situation arises where you need medical advice, you should consult a qualified and appropriately trained medical service provider. It’s that time of year again: registration is open! Open enrollment is a time during the year when you can enroll in or change your health insurance benefits. Open enrollment in Texas runs through November 1st

, and you can find a list of open enrollment dates specific to your state here. This is the only time of year you can make this election, and you can’t change your benefits outside of this open enrollment period unless you have a qualifying event like the birth of a child, marriage, divorce, or death. . The choices you have can be overwhelming, so if you want to learn more about how different health insurance benefits can be part of your financial plan, this series is a great place to start.

Adulting: Understanding Health Insurance

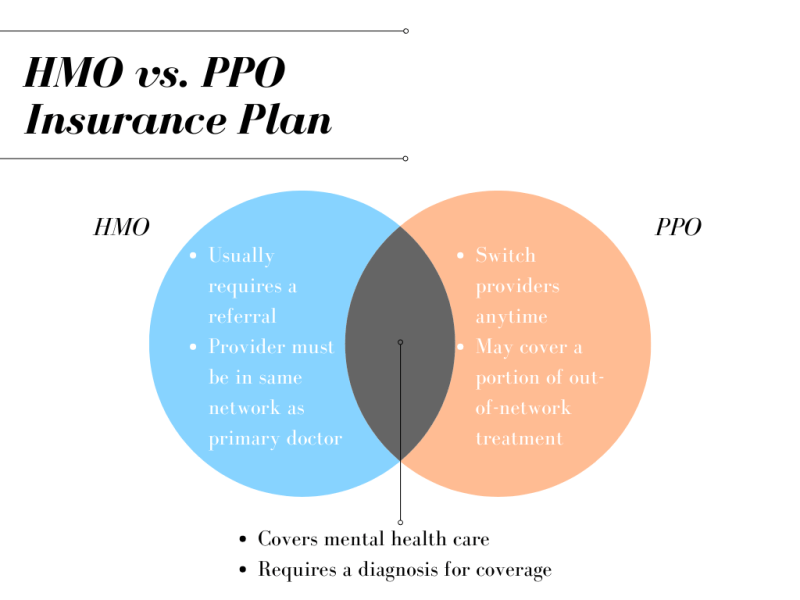

In this first series, we’ll examine the key differences between a health maintenance organization (HMO) and a preferred provider organization (PPO).

One of the main differences between HMOs and PPOs is the flexibility of network providers. HMOs give you access to doctors within a certain network, and you are covered if you stay within that network, unless there is a medical emergency or you have prior approval. On the other hand, PPOs offer more flexibility due to fewer restrictions on out-of-network providers.

Another difference between HMOs and PPOs is the requirement of a primary care physician (PCP). HMOs require you to choose a PCP who will be the primary person to manage your medical needs. If you need to see a specialist, you will need to go to your PCP, who will then refer you to someone else if they think it is necessary. Unless you get a referral from your PCP to see a specialist, the cost is usually not covered. PPOs are much more flexible because they don’t require you to use a PCP, and you can choose a specialist while you’re still covered.

For both HMOs and PPOs, looking at providers within their network is much more cost-effective. If you go out of network, HMO coverage will be more expensive than going out of network with a PPO.

Discover The Differences Between Hmo, Epo, And Ppo Plans

Given that PPOs offer more choice and flexibility, they typically have higher premiums and higher deductibles than HMOs. Depending on your current situation, it’s important to weigh the costs and flexibility these plans offer to better help you decide which one is best for you.

Everyone’s financial situation is different. Please feel free to contact us if you have any questions about how any of these benefits can be part of your financial plan. This information is not intended to replace specific individualized advice and we suggest you discuss your specific situation with a qualified financial advisor. Where to go for care Ways to save on healthcare Find doctors, hospitals, medical equipment and specialty services Find a pharmacy Find a dentist Find a vision provider Urgent care Gene-based therapies Global options Virtual tour Guest subscription

Connect Get Well Nurse Health Coaches Nutrition Counseling Preventative Care Maternal Health Resources Discounts & Refunds Financial Health

Policies & Guidelines Tools & Resources Claims & Billing Patient Management Become a Provider News Center Contact Us

Hmo Vs Ppo

Health Insurance Basics What is an HMO? What is a PPO? What is an EPO? HMO vs. PPO

If you’re shopping for a health plan, you’ve likely come across the terms HMO, PPO, and EPO. While there

Difference between hmo & ppo insurance, difference between medicare advantage hmo and ppo, difference between hmo ppo pos, difference between an hmo and ppo plan, difference between hmo ppo epo, difference between hmo vs ppo, difference between ppo & hmo, difference between hmo or ppo, difference between cigna hmo and ppo, difference between hmo and ppo medicare, difference between hmo and ppo blue cross, difference between hmo and ppo medicare plans