Difference Between Hmo Or Ppo – Where to Go for Care Ways to Save on Health Care Find Doctors, Hospitals, Medical Equipment and Specialty Services Find a Pharmacy Find a Dentist Find a Vision Provider Urgent Care Gene Therapies Global Options Virtual Visits Guest Membership

Join Achieve Wellness Registered Nurse Health Coaches Nutritional Counseling Preventive Care Maternal Health Resources Discounts and Reimbursement Financial Wellness

Difference Between Hmo Or Ppo

Policies and Guidelines Tools and Resources Claims and Billing Patient Management Become a Provider Provider News Center Contact Us

How To Use Your Insurance Plan For Mental Health Care, Including Therapy — Integrity Counseling Group

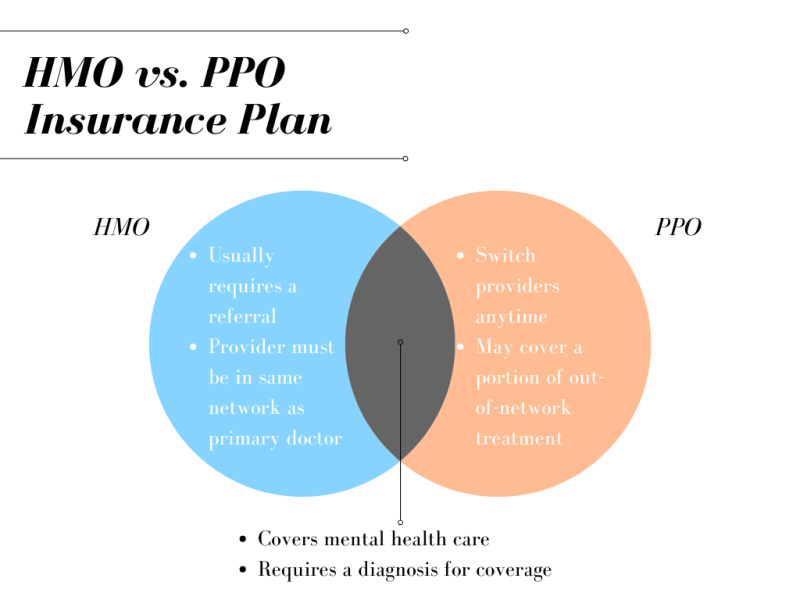

The Basics of Health Insurance The Basics What is an HMO? What is PPO? What is EPO? HMO vs. PPO

If you’re looking for a health plan, chances are you’ve come across the terms HMO, PPO, and EPO. Although there are many different types of health plans, these are among the most recognized. Here’s a brief overview of their features to help you decide which type of plan might be right for you.

Network providers are doctors, other health care providers, and hospitals with whom the health plan has contracted to provide health care to its members. These providers are called network providers or network providers. A provider that does not have a contract with a plan is called an out-of-network provider. Depending on the type of plan you choose, you may need to use in-network providers or you may seek out-of-network care.

A PCP is the doctor you see for most of your basic health care needs. A PCP focuses on preventive care and treatment of common injuries and illnesses and may recommend that you see a specialist when necessary. Depending on the type of plan you choose, you may need to choose (or designate) a PCP to provide and coordinate your care.

Hmo Vs Ppo: Which Is Right For You?

HMO is an abbreviation for Health Maintenance Organization. With an HMO plan, you must choose a PCP. Your PCP will provide checkups and routine care and make referrals when you need to see a specialist. You will need to use doctors and hospitals that are in the plan’s network. Out-of-network services are only covered for emergency care and emergency situations. For more detailed information, read What is an HMO?

HMO plans are generally less expensive than PPO plans. They offer moderate monthly premiums and may have lower out-of-pocket costs depending on the plan.

PPO stands for Preferred Provider Organization. With a PPO plan, you can see any doctor or hospital in or out of network without a referral. You pay less when you use in-network doctors and hospitals, and you pay more when you use out-of-network doctors. For more detailed information, see What is a PPO?

An EPO plan falls somewhere between an HMO and a PPO health plan in terms of cost and flexibility. With an EPO plan, you only have in-network coverage (except for urgent care and emergencies). However, you do not need to choose a PCP or get referrals to see specialists. Read more about EPO. Read What is EPO?

What Is The Difference Between Hmo & Ppo Plans?

Understanding what you need from a health plan and how much you can afford to pay (both in monthly premiums and out-of-pocket costs) can help you choose the plan that’s best for you. For example: When choosing health insurance, you will come across the abbreviations PPO and HMO. These are the two main types of health insurance plans. PPO stands for Preferred Provider Organization and HMO stands for Health Maintenance Organization.

Both types of plans have a network of doctors, hospitals, and other health care providers that agree to provide medical services at predetermined prices and rates.

Nearly 33,000 physicians and 158 hospitals work with Blue Cross Blue Shield of Michigan and the Blue Care Network.

So what is the difference between these two types of health plans? Here’s a chart to break it down:

Hmo Vs. Ppo Plans: What’s The Difference & Which Is Better?

Choosing the right type of insurance for you depends on what type of arrangement works best for you and your dependents. You should evaluate your health care needs and financial situation to make the best choice.

For example, if you expect to see your primary care physician only once a year for an annual physical and are on a tight budget, a lower monthly fee for an HMO may make the most sense.

For others who have complex care needs and want to be able to see doctors at any facility, the flexibility of a PPO may be the best option for them.

MI Blues Perspectives is sponsored by Blue Cross Blue Shield of Michigan, a nonprofit, independent licensee of the Blue Cross Blue Shield Association. It’s that time of year again – open enrollment! Open enrollment is a period during the year during which you can apply for or change your health insurance. Open enrollment in Texas has been open since November 1st

Billing Hmo Vs. Ppo Dental Plans

And here is a list of open enrollment dates specific to your state. This is the only time of year you can make these decisions, and you can’t change your benefits outside of this open enrollment period unless you have a qualifying event like the birth of a child, wedding, divorce, or death. . The options available to you can be overwhelming, so if you want to learn more about how different health insurance benefits can be part of your financial plan, this series is a great place to start.

In this first series, we’ll go over the key differences between a health maintenance organization (HMO) and a preferred provider organization (PPO).

One of the key differences between HMOs and PPOs is the flexibility of network providers. HMOs give you access to doctors within a specific network, and you’re covered if you stay in that network unless there’s a medical emergency or you don’t have prior approval. On the other hand, PPOs provide more flexibility due to fewer restrictions on out-of-network providers.

Another difference between HMOs and PPOs is the primary care physician (PCP) requirement. HMOs require you to choose a PCP to be the primary person to manage your health care needs. If you need to see a specialist, you need to go to your PCP, who will then refer you to someone else if they think it’s necessary. Unless you get a referral from your PCP to see a specialist, the cost is usually not covered. PPOs are much more flexible because they don’t require you to use a PCP and you can choose a specialist while you’re still covered.

What’s The Difference Between Hmo And Ppo Plans?

For both HMOs and PPOs, it is much more efficient to see providers in your network. If you go out-of-network, HMO coverage will be more expensive than if you go out-of-network with a PPO.

Because public postal carriers provide more choice and flexibility, they typically have higher premiums and higher deductibles than HMOs. Depending on your current situation, it’s important to consider the cost and flexibility these plans offer to better help you decide which one is best!

Everyone’s financial situation is different. Don’t hesitate to contact us if you have any questions about how any of these benefits can fit into your financial plan. This information is not intended to replace specific individualized advice and we recommend that you discuss your particular situation with a qualified financial advisor. HMO (or Health Maintenance Organization) plans are usually less expensive, but offer less choice and flexibility in which doctors you see. and when you can see them. PPO (or Preferred Provider Organization) plans give you more choice and control, but are usually more expensive.

With an HMO plan, you will have an in-network primary care physician who is the point person for your health care. If you need to see a specialist, you must first get a referral from your primary care physician. And if you ever need emergency care, you’ll want to go to an in-network hospital to make sure your stay is covered by your insurance.

Hmo Vs. Ppo: Understanding Plan Types

With a PPO plan, you can still have a primary care doctor, but you don’t need a referral if you ever want to see a specialist. And even if it’s cheaper to go in-network, your insurance will still pay something if you see an out-of-network provider.

If you went to the doctor and didn’t have health insurance, you’ll get a bill for the full price of your visit (plus any other tests or services you received).

However, insurance companies do not pay this full sticker price. Instead, they negotiate discounts with certain doctors – much like a discount for buying in bulk. This group of discounted doctors is called the health insurance plan’s “network.”

Therefore, no matter what type of insurance you have, it’s always cheaper to go with doctors who are in-network for your plan.

How To Choose A Health Insurance Plan From An Employer

You may have to choose between an HMO and a PPO plan when you sign up for new health insurance, for example, if you’ve just started working. Of course, each type comes with trade-offs. But an HMO may be right for you if:

And if you’re not happy with the plan you’ve chosen, you don’t have to stick with it forever. You can always change plans the next time you open registration

Difference between hmo & ppo insurance, difference between hmo ppo plan, difference between medicare advantage hmo and ppo, difference between cigna hmo and ppo, difference between hmo vs ppo, difference between hmo ppo pos, difference between hmo ppo epo, difference between hmo and ppo medicare, difference between ppo & hmo, hmo or ppo difference, difference between hmo and ppo blue cross, difference between hmo and ppo medicare plans