Best Student Loans With Cosigner – By TJ Porter By TJ PorterArrow Top Contributor, Personal Finance TJ Porter is a columnist with eight years of experience in finance. TJ writes on a range of topics, from budgeting tips to bank account reviews. TJ Porter

Edited by Aylea Wilkins Edited by Aylea WilkinsArrow Senior Student Loans Editor Aylea Wilkins is an editor specializing in student loans. Previously, he worked editing content on mortgages and auto, home and life insurance. For nearly a decade, he has edited professionally across a variety of industries, focusing on helping people make financial decisions and buy with confidence by providing clear and unbiased information. Connect with Islaya Wilkins on LinkedIn Linkedin Islaya Wilkins

Best Student Loans With Cosigner

Founded in 1976, it has a long history of helping people make smart financial choices. We have maintained this reputation for more than four decades by disrupting the financial decision-making process and giving people confidence in what action to take.

Best Cosigner Student Loans In 2023

Adheres to a strict editorial policy, so you can be sure that we put your interests first. All of our content is written by highly trained professionals and edited by subject matter experts, ensuring that everything we publish is objective, accurate and reliable.

Our credit correspondents and editors focus on the points that most interest consumers – different types of loan options, the best rates, the best lenders, how to pay your debts and more, so you can feel confident investing your money.

Adheres to a strict editorial policy, so you can be sure that we put your interests first. Our award-winning editors and reporters create reliable and accurate content to help you make the right financial decisions.

We appreciate your trust. Our aim is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and journalists carefully review editorial content to ensure that the information you read is accurate. We maintain a firewall between our vendors and our editorial team. Our editors receive no direct compensation from our advertisers.

Can My Child’s Student Loan Impact My Credit Score?

The editors write for YOU, the reader. Our goal is to give you the best advice to help you make smart personal financial decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team is not directly compensated by advertisers, and our content is carefully reviewed to ensure accuracy. So, whether you’re reading an article or a review, you can be sure you’re getting reliable and trustworthy information.

You have a question about money. you have the answers. Our experts have been helping you manage your money for over four decades. We are always committed to providing clients with the professional advice and tools they need to succeed in the financial journey of a lifetime.

Adheres to a strict editorial policy, so you can be sure that our content is honest and accurate. Our award-winning editors and reporters create reliable and accurate content to help you make the right financial decisions. The content created by our editors is objective, factual and not influenced by our advertisers.

We’re transparent about how we’re able to provide you with quality content, competitive pricing, and helpful tools, explaining how we make money.

What Rights Does A Student Loan Cosigner Have?

Is an independent ad-supported and comparison service. We receive compensation in exchange for posting sponsored products and services or for clicking on certain links posted on our site. As such, this return may affect how, where and in what order the products are listed, except where prohibited by law in our mortgages, mortgages and other mortgage products. Other factors, such as our website’s own policies and whether a product is offered on your site or on your preferred credit card list, may affect how and where products are displayed on this site. Although we try to provide a wide range of offers, it does not include information about every financial or credit product or service.

About 45 million people in the United States have student loan debt. Although many people think that you are stuck with the original terms of the loan, you can refinance it with student loans. Two-thirds of people who refinanced said it improved their overall finances. Another way to get financing if you have bad credit is to find a co-signer who will take over if you miss a payment and help you get a better rate. There are many lenders that allow co-signers and are willing to work with students to pay off their loans.

When someone signs up for a loan, they agree to make payments on the loan if you stop or can’t keep paying. When someone signs up for a loan, the lender will look at her credit history and financial situation in addition to yours when making a loan decision.

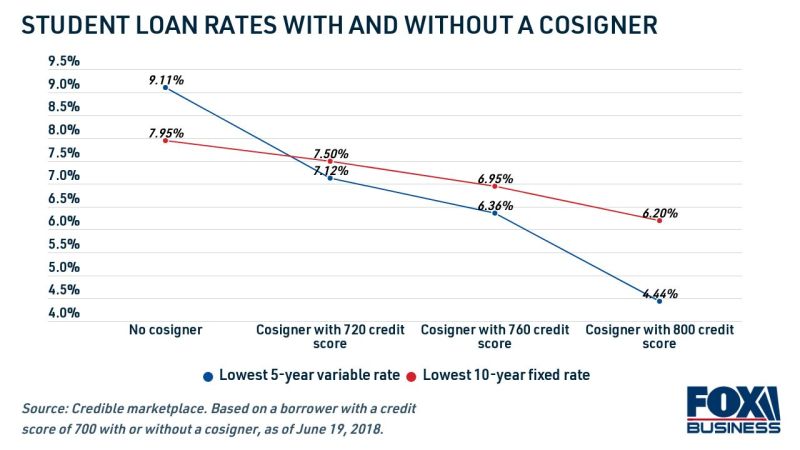

Finding a willing co-signer with solid credit can make getting a loan easier. Lenders are more likely to approve an application because they will see that a person with good credit is willing to lend money. A strong co-signer can mean a lower interest rate, which means a lower monthly payment and less interest accrued over the life of the loan.

How To Remove Your Name From A Co Signed Loan

There are many student loan companies out there, but not all of them will allow you to refinance with a cosigner. Here are some of the best lenders that let you add someone to your loan.

SoFi is an online lender that started with student loans but now offers a variety of financial products. Borrowers can add a cosigner to their loan by logging into their SoFi account and adding the cosigner’s name and email address. SoFi will send the co-signer an invitation and proceed with the application.

SoFi is known for its member benefits, including speed discounts and professional services. It also does not charge fees even if the payment is overdue.

SoFi allows the co-signer to be released after 24 months of full principal and interest payments, pending underwriter approval. Borrowers should keep in mind that adding a cosigner adds a week or two to the repayment process, so SoFi may not be the best option if you need to repay quickly.

Co Borrower Vs. Co Signer In Student Loans

Navy Federal Credit Union (NFCU) is another great lender for students looking to refinance their loans. It has low interest rates and the ability to choose three payment terms. It also offers quick co-signer release, which allows you to remove your co-signer after twelve consecutive on-time payments.

The main benefit of NFCU is that you must be a member of the credit union to be eligible. You can only join if you are a member of the armed forces or the Department of Defense, or if you are a citizen of the Department of Defense or have an immediate family member who is a member of the armed forces.

Ave College is an online lender that specializes in student loans and refinancing. The site has a simplified program and provides many resources and educational content to learn more about student loans and how loans work. The lender also boasts eleven different loan terms for its repayment product, making it easy to customize your loan and monthly payment to fit your budget.

However, the lender doesn’t have clear eligibility requirements, which means you’ll need to enter your information to see if you and your co-signer qualify for the loan. There is also a $300,000 refinancing limit for medical, dental, pharmacy or veterinary degrees and a $150,000 limit for all other degrees.

Are There No Credit Check Student Loans And Which Are The Best?college Raptor

LendKey is an online lending platform that connects borrowers with various lending partners. This makes it an attractive solution for borrowers who want to get multiple quotes to find the best deal, as their inquiries will be compared against the needs of multiple lenders. Loans offered through LendKey have terms ranging from five to 20 years and have no origination fees.

Another big downside is that LendKey doesn’t appear on its loan, so a lot of the details about your loan depend on which lender you end up with. LendKey’s marketing rates and terms are representative of all its partners, so you may find a lender with high fees or poor payment terms.

Laurel Road Loans offers students a wide variety of loan terms and extremely low interest rates. In addition to the standard automatic payment discount, you can get a discount on the interest rate by registering a checking account with the company. Laurel Road also allows students to pay off their loans early in their last semester of study.

While Laurel Road renews most types of loans, it should be noted that most associate degrees are not eligible. Borrowers with advanced degrees must complete a degree in a health-related field to qualify for financing.

What Is Cosigner Release On Private Student Loans?

When someone cosigns a loan, they agree to make payments on the loan if you stop or can’t continue to pay. When someone signs up for a loan, the lender will look at her credit history and financial situation in addition to yours when making a loan decision.

Finding willing co-signers with solid credit can make it easier to qualify

Best student loans with a cosigner, private student loans with cosigner, cosigner release student loans, no cosigner student loans, best private student loans with cosigner, refinance student loans with cosigner, student loans with no cosigner, student loans with cosigner, student loans with cosigner release, discover student loans cosigner, best student loans without cosigner, best student loans no cosigner