Best Interest Rate For Student Loans – Consolidating student loans can save you time and money. Learn how to consolidate and the pros and cons of each entry.

Clicking the button will take you to one of our student loan affiliates. We receive a fixed marketing fee for providing this service.

Best Interest Rate For Student Loans

Together, they borrowed $1.5 trillion to get their degrees, and it wasn’t easy to pay it back. About one in 10 default on their student loans, and while the average repayment time varies depending on the amount owed, it’s safe to say it will take at least 10 years and can be as long as 30 years.

Effective Annual Interest Rate: Definition, Formula, And Example

Members of the Class of 2019 who took out student loans owe an average of $31,172, and their payments are just under $400 a month. It’s a big and unwanted graduation gift, so it’s important to know how to minimize the damage.

If all the money you borrowed was federal loans, you may find easier repayment options by applying for a direct consolidation loan.

If some or all of your student loans were from private lenders, you’ll need to use a refinancing program to achieve similar results.

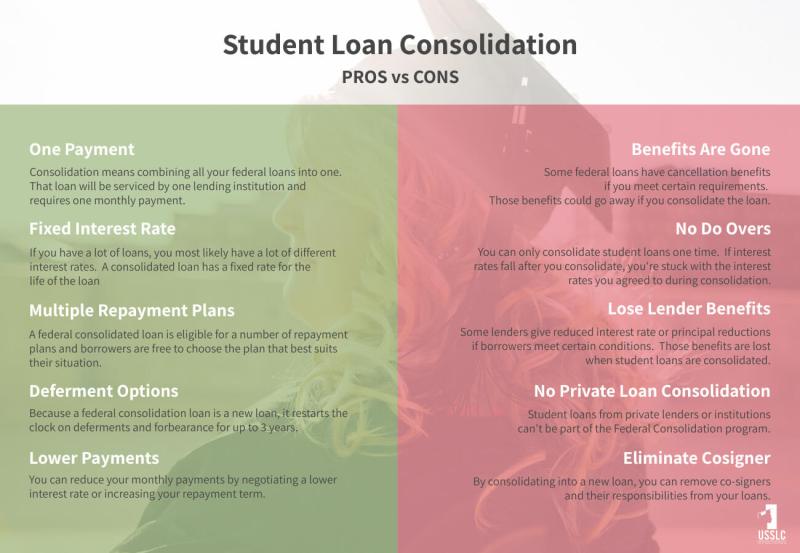

Consolidation is a way to make paying off your student loans easier and possibly cheaper. You combine all of your student loans, take out one large consolidation loan, and use it to pay off all the others. You are left with one payment per lender each month.

Private Student Loans, Pick What You Pay

A typical student borrower receives money from federal loan programs each semester in school. It often comes from different lenders, so it’s not uncommon to owe 8-10 different lenders by the time you graduate. If you continue to borrow for graduate school, add 4-6 more lenders.

Each of these student loans has its own repayment term, interest rate and repayment amount. Keeping track of this type of schedule is difficult and is part of the reason so many have missed out. This is also why student loan consolidation is such an attractive option.

Federal loans can be consolidated in the Direct Consolidation Loan Program. You consolidate all of your federal student loans into one fixed-rate loan. This rate is obtained by taking the average interest rate of all federal loans and rounding the rate to the nearest one-eighth of a percent.

While this method won’t reduce the interest you pay on federal loans, it will preserve all repayment and forgiveness options. Some lenders allow interest rate reductions by paying all at once, or qualify for reductions by paying in installments over a longer period of time.

Best Fixed Deposit Accounts In December 2023

Student loan refinancing is similar to a direct consolidation loan program in that you combine all of your student loans into one loan and make one monthly payment, but there are important differences that you should consider before making the decision.

Refinancing, sometimes called private student loan consolidation, is primarily for private loans and can only be done through private banks, credit unions, or online lenders. If you’ve borrowed from federal and private programs and want to consolidate the entire series, you can only do so through a private lender.

The main difference between refinancing and direct loan consolidation is that with refinancing you negotiate a fixed or variable interest rate that should be lower than what you paid for each loan individually. Lenders take into account your creditworthiness and whether you have a co-signer when determining your interest rate.

However, if federal loans are part of your refinance, you lose the repayment options and forgiveness programs they offer, including deferment and forbearance. The last two points can be decisive if financial complications arise during loan repayment.

How To Calculate Student Loan Interest

The average college student has nearly $8,000 in credit card debt. Let us help you with your credit card so you can save more money for your student loan payments.

There are many good reasons to consolidate with a direct loan consolidation program, not the least of which is that you can live on one of the income-driven plans such as REPAYE (pay as you earn), PAYE (pay as you earn), IBR . (repay as you generate income) and ICR (income dependent repayment).

There are two sides to every story, and this is the other side to consider before starting a direct loan consolidation program:

If you’ve missed payments because it’s difficult to keep up with multiple loan servicers and multiple payment dates, consolidation or refinancing are good options. One payment each month instead of many makes life easier.

Tips To Repay Your Student Loans Faster

You can use a direct loan consolidation program because it allows you to keep the door open to income-based repayment options that result in lower monthly payments.

However, it’s important to know that if your payments are part of a forgiveness program, the clock starts over when you consolidate your s. For example, if you made three years of qualifying payments for public service loan forgiveness and then consolidated your loans, you would lose three years of qualifying payments and the clock would start over.

A big problem for most borrowers is can they afford the monthly payments? That’s what consolidation and refinancing can help with: giving you a payment every month that doesn’t break your budget.

However, if you’re making enough money right away and are very committed to paying off your loan, the fastest and most efficient way is to start with a standard repayment plan and complete it in 10 years … or less!

What Student Loans Can & Can’t Be Used For

Max Fay has been writing about personal finance for the past five years. His expertise is in student loans, credit cards and mortgages. Max inherited a genetic predisposition to be stingy with money and liberal with financial advice. He was featured in every major Florida newspaper while at Florida State University. You can contact him at [email protected] .

Wants to help them understand their finances and equip themselves with management tools. Our information is available free of charge, but the services that appear on this site are provided by companies that may pay us a marketing fee when you click or sign up. These companies may influence how and where the services are displayed on the website, but they do not influence our editorial decisions, recommendations or advice. Here is a list of our service providers. The cost of higher education increases every year, and so does the amount of student loans that students must take out to pay for their education. Total outstanding student loan debt in the U.S. is now $1.6 trillion, with an average debt of $32,731 per borrower, according to the Federal Reserve. With such large sums, it’s no wonder that many students struggle to repay their loans after graduation. One way to save money on student loans is to use payday loans.

Daily interest is the interest that is calculated daily on the loan. By making more frequent student loan payments, you can reduce your accrued daily allowance, which can save you money in the long run. Here are some insights into how per diems work and how you can use them to save money on student loans.

Daily rates are calculated by dividing the loan interest rate by the number of days in a year. This gives you the daily interest rate. For example, if your interest rate is 6%, your daily interest rate is 0.0164%. That means for every $1,000 you owe on your loan, you’ll accrue $0.164 in interest every day.

The Best Ways To Reduce The Interest Rate On Your Student Loans

When making a loan payment, the payment is first applied to all interest that has accrued since the last payment. The remaining amount is then applied to the principal amount of the loan. By making more frequent payments, you can reduce the amount of interest that accrues between payments. This means that more of your payment will go toward paying off the principal, which can help you pay off the loan faster and save you money on interest over the life of the loan.

There are several payment options that can help you use your per diem. One option is to make bi-weekly payments instead of monthly payments. By paying every two weeks, you’ll make 26 payments a year instead of 12. This means you’ll make an extra payment each year, which can help you pay off your loan faster and save you money on interest.

Another option is to round up the payment. For example, if your monthly payment is $300, you can round it up to $350 or $400. This extra amount will be applied to your loan principal balance, which can help you pay off your loan faster and save you money on interest.

Payroll can be a powerful tool for saving money on student loans. Making

Reducing Student Loan Debt: The Power Of Small Extra Payments

Lowest interest rate for private student loans, discover student loans interest rate, interest rate for student loans, average interest rate for graduate student loans, private student loans interest rate, student loans interest rate, interest rate of student loans, average interest rate for student loans, lowest interest rate student loans, refinance student loans interest rate, refinancing student loans for lower interest rate, interest rate for graduate student loans