Assurance Brokers – Caribbean Assurance Brokers Ltd. (CAB), a name synonymous with innovation, is a diversified insurance broker offering a full range of insurance products and services throughout Jamaica. Through these offerings, we provide our customers with peace of mind to prepare for life’s uncertainties.

The company began operations in 2005 as a retail and personal life, health and personal accident broker operating out of modest office space with 11 employees. In 2006, the company added General Insurance to its portfolio.

Assurance Brokers

From 11 employees, we now boast over 100 with one of the largest portfolios of broker-managed employee benefits, as well as international and personal life insurance. Our general insurance team consists of qualified insurance practitioners with expertise in risk management solutions for all aspects of corporate and commercial business.

Insurance Industry Benefits From Dahlberg’s Independence

Over the years, the company has grown dynamically to include all aspects of its insurance portfolio – international health, life and travel insurance, personal health and life insurance, employee benefits, general insurance and credit union related products.

Caribbean Assurance Brokers continues to use our combined experience, insight, knowledge and commitment to help our clients achieve their risk management objectives, enabling them to explore a wide range of insurance solutions under one roof, supported by first-class customer service. so much joy and satisfaction.

Today, our team has more than four hundred years of experience in the general, life and health insurance business. Our strategic alliances and partnerships with international brokerage operations and insurance providers in the United Kingdom and the United States provide access to all major global insurance and reinsurance markets and are win-win for the company.

Our main global partner is our London correspondent broker, ED Broking LLP, an independent specialist Lloyd’s broker based in the heart of the London insurance sector, trading in all major international insurance and reinsurance markets; and our international health insurance sponsor and their third party administrator (TPA), VirSAG Limited, the first TPA in the English-speaking Caribbean, approved/registered to manage, adjudicate and settle international health insurance claims in Jamaica.

Sunrise Assurance Brokers Limited

Caribbean Assurance Brokers Limited (CAB) is duly licensed and regulated by the Financial Services Commission (FSC) and is authorized to advise and arrange the placement of several classes of insurance business.

On March 9, 2020, the company listed its ordinary shares on the junior market of the Jamaica Stock Exchange, oversubscribing by over 1,500%.

Supporting parts of our mission, which is to consistently delight our customers at every point of contact with this brand, CAB’s commitment to our customers is to consistently exceed their expectations by providing the highest quality service and best value for money.

Constantly delighting our customers at every point of contact with the brand. We provide a challenging and rewarding environment for our employees and actively support their personal development, as they are our greatest asset.

Trending Construction Brokerage Businesses [2023]

To become the BEST insurance broker in the English-speaking Caribbean by investing in our human capital; search for strategic alliances; and maintaining the highest standards of professionalism, integrity and competence.

Successfully address the challenges of the changing insurance industry by being knowledgeable, prepared, solution-oriented and customer-focused.

We value a strong team approach that ensures you benefit from the collective expertise of our diverse experts. Therefore, our philosophy is: “The team is the theme.”

We base our services on the core values of teamwork, experience, professionalism and integrity, always striving to exceed our clients’ expectations by implementing our vision and mission statements.

Caribbean Assurance Brokers Visual Communication

The International Insurance division provides international insurance options in the areas of health, life, disability and travel insurance. With a suite of products designed for individuals as well as groups…

The employee benefits department works with our local insurers to provide a wide range of employee benefits including group health, life, individual pension and group pension.

Our general department handles all general insurance needs of our clients, including but not limited to: property, liability, personal accident, marine, bond and engineering.

![]()

As each of us can fall victim to premature death, serious illness, or live too long without adequate savings, insurance can help provide the peace of mind needed in times of crisis.

Financial Risk Investment Insurance Broker Coverage Protection, Property House Home Assurance, Car Automobile Vehicle Safety Care Stock Vector

Economic loss always worries humanity, but it doesn’t have to when there are ways to deal with such loss. Some people want to avoid such a loss, but it is impossible. Others may want to minimize the loss, but that still doesn’t solve the problem. Therefore, the only way to effectively compensate an individual for the value of lost property or livelihood is to realize that we do not all experience loss at the same time if we all share the same dilemma. That way, we can all pool our resources so that the few who suffer economic losses can benefit from the resources of all contributors. This methodology can work because no one knows how and when a loss will occur. This leads to the theory that the contributions of the many pay for the unhappiness of the few. This is the fundamental position of modern insurance, which insures not only the loss of property, but also the income arising from the loss of human life.

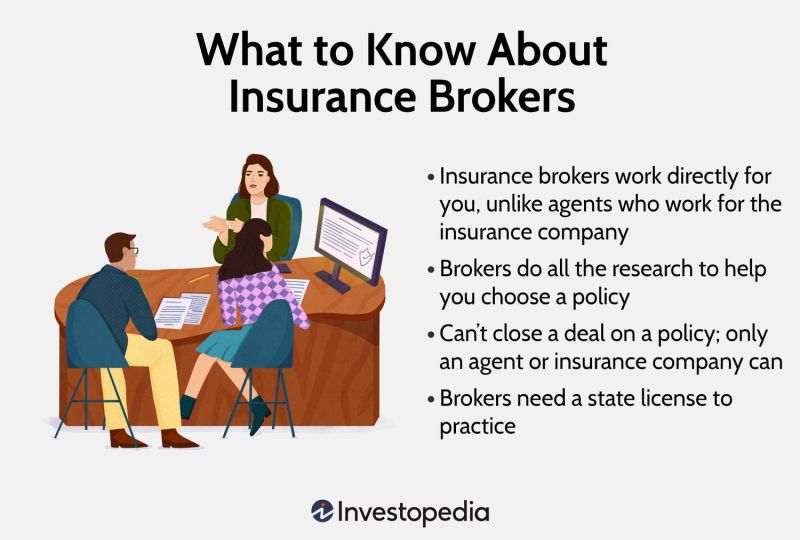

When shopping for insurance, it can be a good idea to get quotes from multiple insurers to find the best price. Everyone might think they can compare rates for themselves, and they probably can. But in some cases, it may be better to have an expert review your options because the expert can provide additional information about the type of coverage those options provide.

An insurance policy is a contract between you (the insured) and an insurance company (the insured) in which the insurance company undertakes to assume responsibility for the financial costs of certain risks. The policy describes what’s covered, the risks you’re covered against, and outlines your rights and responsibilities, along with coverage conditions and limitations.

Under the Motor Vehicle Insurance (Third Party Risks) Act 1941, a minimum level of insurance is required if you wish to drive a vehicle on Jamaican roads. Driving an uninsured vehicle is an offense under Jamaican law. Car insurance is a way to protect yourself and give you peace of mind as it provides coverage in the event of an accident, which can lead to unnecessary financial hardship.

Vertical Assurance Broker De Asigurare

A number of factors can affect the cost of your car insurance – some of which you can control and some of which are beyond your control. The type of car you drive, the purpose of the car, your driving record, where you live and how you store the car can affect the cost of your car insurance.

You can use your car for business purposes as long as your insurance company has been notified of the change. This cover attracts an additional premium.

This is a discount offered by some insurance companies, mostly general insurance companies. The benefit is provided by the individual without loss/accident for the insurance period. Usually, your NCD increases every year you are insured and have no claim. However, there is usually a maximum set by the relevant insurance company.

Homeowner’s insurance covers loss or damage to your property caused by a variety of “perils” such as fire, hurricanes, earthquakes, floods, and broken plumbing. Homeowners insurance also covers your personal liability as an insured, as it covers your liability to third parties in the event of your negligence. Homeowner’s insurance is often required by the lender to qualify for a mortgage loan.

Times Insurance Brokers

If you insure your home for less than full replacement value, in the event of a partial loss you are subject to the Average Clause (also known as the Average Clause). Under this condition/clause of the insurance policy, if your property is insured for less than full replacement value, you will only be compensated for part of the damage you suffer. To take full advantage of property insurance, it is important that the sum insured is equal to the replacement value of the property you are insuring (the full replacement value of your property).

The excess/deductible is the first part of the claim you pay when you file your claim. It is usually expressed as a percentage of the sum insured, but can sometimes be a flat number depending on the type of policy. The insurance company usually pays excess amounts up to the sum insured.

A term life insurance policy provides policy benefits if the insured dies within a specified period of time.

“We were very impressed that CAB acted so quickly to resolve the matter in our favor…” Karimed – Dennis Grant

Facts About Food Brokers

Give us a call or stop by anytime and we’ll try to answer any questions

Assurance insurance brokers, service assurance, air assurance, life assurance, caribbean assurance brokers, intact assurance, life assurance brokers, caribbean assurance brokers limited, assurance habitation, assurance brokers ltd, security assurance, brokers national life assurance company