Insurance Premiums Adalah – If you have insurance, you may wonder how companies calculate your insurance premiums. You pay insurance premiums for policies that cover your health – as well as your car, home, life and other valuables. The amount you pay depends on your age, the type of coverage you want, the amount of coverage you need, your personal information, your zip code and other factors.

When you have an insurance policy, the company charges you money in exchange for that coverage. This cost is called the insurance premium. Depending on the health insurance, you pay the premium monthly or semi-annually. In some cases, you may need to pay the full amount upfront before coverage begins.

Insurance Premiums Adalah

Most insurance companies offer several ways to pay your bill, including online options, automatic payments, credit and debit cards, checks, money orders, checks and bank drafts. You can receive a discount if you sign up for paperless billing options or if you pay the full amount at once instead of paying a minimum amount.

Property Insurance Costs Surge

There are no fixed costs for insurance premiums. You can have the same car as your neighbor and pay more (or less) for insurance, even with the exact same coverage. It’s worth shopping around and comparing prices and policies.

You pay more for broader coverage. For example, a health insurance policy with a $1,000 deductible will be more expensive than an insurance policy with a $5,000 deductible. Similarly, a car insurance policy with a $0 deductible will be more expensive than an insurance policy with a $500 deductible, all other factors being the same.

However, this doesn’t mean you should automatically choose the cheapest policy just to save money. It is essential that you consider your circumstances (and the likelihood that you will need to use this policy) when choosing which plan is best for you.

Insurance companies consider several factors when calculating an individual’s insurance premiums. Group insurers will also take these factors into account when calculating a group’s premium.

How Does Car Age Affect Car Insurance Premiums?

Insurance companies focus primarily on risk assessment. The higher the risk, the higher the premiums. However, there are ways to reduce your premium.

One solution is to consolidate your insurance policies. For example, if you purchased your car, home and life insurance policies from a single company, you will likely qualify for a discount.

Of course, you can save money if you lower your coverage (for example, increase your deductible). However, this is not always a good choice. Consider your situation and the likelihood of you using the policy before making a decision.

There are other ways to save on your premiums, but they require more commitment. For example, most states charge smokers up to 50% more than non-smokers for health insurance. For example, if you’re a smoker who pays $600 a month for health insurance, you may be able to lower your premium to, say, $400 if you quit smoking.

Average Cost Of Car Insurance (2024)

Another example: You may qualify for lower car insurance rates if you improve your credit score. This is because people with lower credit scores are statistically more likely to file a claim.

Insurance premiums vary depending on the coverage and the person taking out the contract. Many variables play a role in how much you pay, but the most important considerations are the level of coverage you receive and personal information such as age and personal information. For car insurance, this might mean age and driver’s license. For health insurance, this may be based on personal habits like smoking or pre-existing conditions.

Not necessary. Because many variables go into determining your premium, your premium may be higher than someone else’s for the exact same coverage. You will normally pay a higher premium for more comprehensive coverage, such as a lower deductible, or for more additional services, such as roadside assistance or rental car coverage.

The most surefire way to reduce your premiums is to choose a lower level of coverage. If you like the coverage you have, consider bundling (combining different types of insurance) to get discounts on multiple policies. For health insurance, some companies offer incentives for developing healthy habits, such as taking annual health assessments or trying to quit smoking. Some car insurers also reduce your premiums based on a good driving record or credit score.

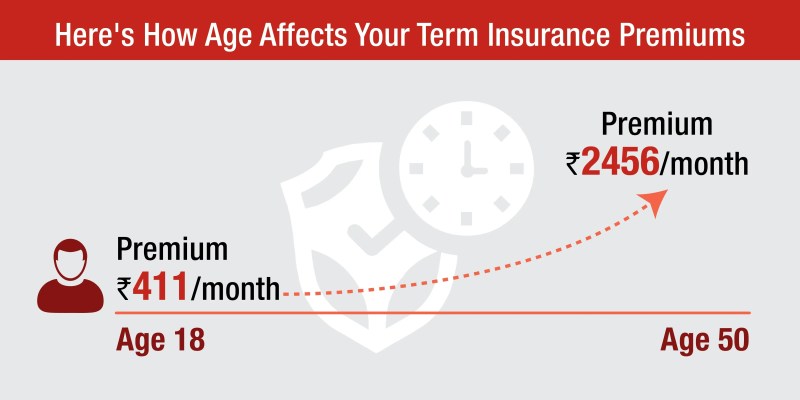

What Affects The Cost Of Life Insurance Premiums

Several parameters go into the price of an insurance premium, including age, state and province of residence, and the amount of coverage. You obviously can’t change your age, but you can take advantage of incentives to reduce costs, such as quitting smoking or improving your credit score. Whether or not you’re bundling your insurance, changing a health habit, or improving your financial situation, it always pays to shop around. This way, you can find the best insurance at an affordable price.

Requires writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where necessary, we also refer to original research from other renowned publishers. You can learn more about the standards we follow to produce accurate and unbiased content in our editorial policy. Insurance is a type of financial agreement between two parties to protect you against possible financial losses, usually due to loss or damage. Insurance protects an individual or business against the financial burden of loss or damage, by paying regular insurance premiums in exchange for limiting one’s own liability in the event of loss or damage, which which could be even more expensive. The policyholder agrees to pay insurance premiums so that the insurance company agrees to pay specific losses or damages under circumstances that it accepts and which are specified in the contract. There are of course many different types of insurance, but fundamentally they are all similar in the concept of paying insurance premiums to limit your own liability in the event of loss or damage. Policyholders pay an insurance premium to limit their potential losses in the event of loss or damage. The most common insurance policies are car insurance, home insurance, life insurance, health insurance, and business insurance.

An insurance premium is the amount a policyholder pays to an insurance company to maintain their insurance policy. Insurance premiums are usually paid on a regular basis, for example monthly or annually. Insurance premiums are calculated based on the risk posed by the policyholder, the type and level of insurance, the duration of the contract, the value of what is insured and the level of risk associated with the policy. ‘assured. Insurance premiums vary widely between different types of insurance and their cost can vary greatly, but insurance premiums compensate the insurance company so that they can assume the greatest risk to cover potential costs incurred in reason for loss or damage. These insurance premiums are used to cover potential claims and pay the operational costs of the insurance company so that they can afford to pay out if necessary in the event of a claim. To keep your insurance policy active, you need to keep up to date with your car insurance premium payments. If you do not stay current on your insurance premiums, your policy could be canceled and you may not be able to make a claim against your insurance. The term insurance premium refers to the payment made in advance for the insurance coverage you have agreed to, as you must pay before the coverage period.

An example of an insurance premium is the amount a driver would pay per month to have their car insurance covered in the event of an accident. Depending on the level of coverage, this insurance premium would allow them to be covered for damage to third party vehicles and their own vehicle, as well as any medical expenses incurred. Insurance premiums are usually calculated on an annual basis and then paid monthly, but you sometimes have the option of paying a lower insurance premium if you pay the full amount up front.

Get To Know Insurance Premiums And Their Types

An insurance premium is an amount charged by an insurance company in proportion to the risk taken by the insurance company. If the potential financial risk to an insurance company is higher, the insurance premium will likely reflect this and be higher. There are many other personal details and risk factors to consider, but the price of an insurance premium essentially reflects the price at which an insurance company is willing to insure the policyholder. Insurance premiums may increase or decrease depending on changes in the risk assessed by the insurer. If you have a claim, there is a good chance that your insurance will increase the following year. Insurance premiums are based on actuarial calculations, which determine the likelihood of a claim being filed against the policy, how much that claim would cost, and are largely based on historical statistics.

There are different types of insurance premiums for each different type

Home insurance premiums, cyber insurance premiums, term life insurance premiums, car insurance premiums, workers compensation insurance premiums, medigap insurance premiums, senior life insurance premiums, term insurance premiums, whole life insurance premiums, medicare supplemental insurance premiums, flood insurance premiums, life insurance premiums