Insurance Certificate Adalah – When you buy insurance, they give us a contract signed by both parties – you and your insurer. We shall hold this Agreement in full confidence, as it is the legal basis for claims and contractual obligations. However, when you want to show the insurance policy to others, it is not the best idea to reject your contract. That is why an insurance certificate is also provided, which serves as proof.

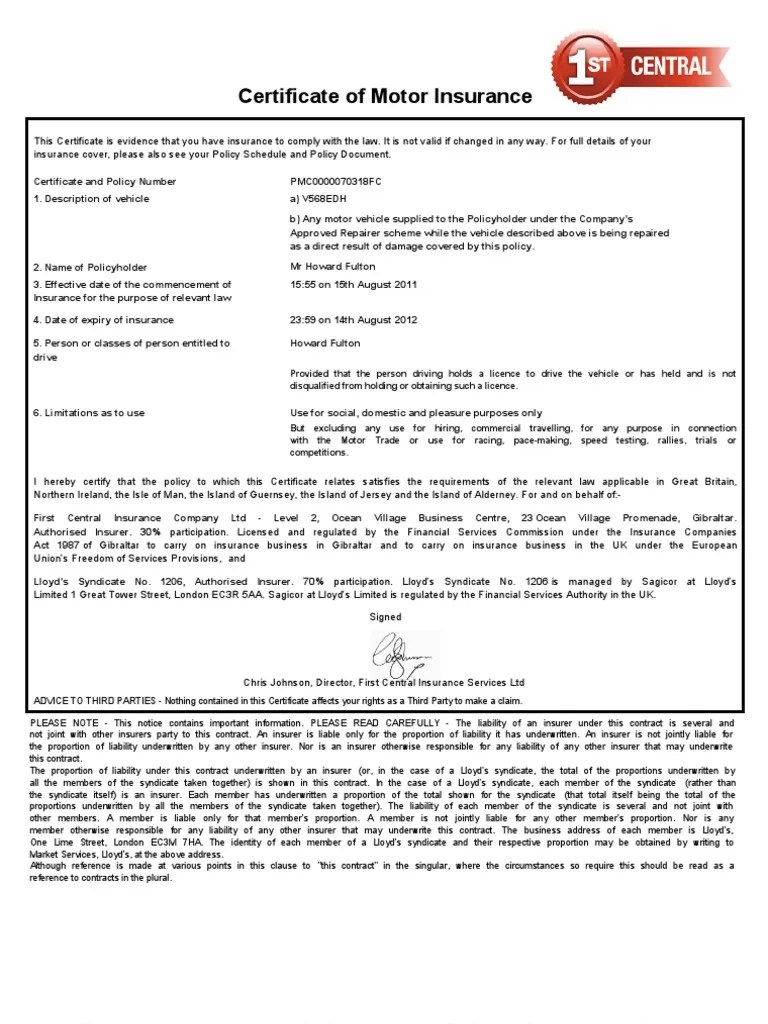

A certificate of insurance is a document that provides details of insurance coverage. It acts as proof of insurance validity, and includes other information such as:

Insurance Certificate Adalah

The insurance company provides the insurance documents to the insured and is a reliable way to confirm the details of the contract. They usually require one party to the contract to ensure that the other party has adequate coverage. This is a good example for contractors before an insurer issues a contract.

What Is A Certificate Of Insurance (coi)? When You Need One

The insurance policy is like a summary of the contents of the actual contract. It can be trusted as truth because the insurance provider provides it through the user. However, it is still only a guarantee and not an insurance contract. They always state the truth of the guarantee.

Insurance is a direct proof of insurance. This is its main purpose and why it exists. It is treated as your own insurance contract. Instead of showing your insurance contract as a form of proof, you can present your insurance document.

A certificate of insurance is especially useful in cases where there is a high risk of loss. As in the previous example we used, for most contracts or large grants, contractors must show proof of insurance. This protects the interest of the company offering the contract and eliminates the risk of loss. A good example of contractor’s insurance is liability insurance for worksite injuries and accidents.

Many companies pay contractors only to forget about damages and injuries they have suffered on the job or because of poor work.

Explaining The Certificate Of Insurance In Medical Contracts

As with insurance, you should ensure that the policy issued by the insurance company contains correct information. This is important because companies request insurance documents directly from the insurance company instead of the contractor (insurance). Information such as policy coverage dates and customer names should be consistent with the company’s expectations.

When purchasing insurance, we must request a valid insurance policy and your insurance policy. It is especially important for contractors and their relationships with other clients. Although valid and legally binding, a policy of insurance is not a contract and is very different from an insurance contract.

Get Insurance is a digital resource that provides information on the general nature of insurance so that you are well-informed about the types of insurance available and what to consider when choosing appropriate, affordable and effective insurance to minimize losses. , damages or other unforeseen events. We are a company incorporated and operating from the British Virgin Islands and we focus on providing insurance information for African countries.

The information provided on this site will help you know what to expect or questions/options to consider when looking for the right insurance for you, your family and your business. COI is an issued document. of the insurance company or broker. The COI checks the existence of the policy and summarizes the relevant sections and conditions of the policy. For example, a standard COI lists the policyholder’s name, the policy’s effective date, the type of coverage, policy limits, and other important information about the policy.

Third Party And Certificate Of Insurance Guide

Without a COI, the company or contractor will find it difficult to secure customers, as they will not want to assume the risk of any liability incurred by the contractor or supplier.

A Certificate of Insurance (COI) is used in situations where liability and loss are of great concern and a COI is required, which is the case in many commercial situations. A cover letter is used to showcase the cover.

Small business owners and contractors often have a COI that shows they have insurance that protects them from liability for workplace accidents or injuries. When you buy liability insurance, the insurance company usually issues a policy.

Without a COI, it can be difficult for a business owner or contractor to win a contract. Since many companies and individuals hire contractors, the customer wants to know that the business owner or contractor has liability insurance to avoid potential risks.

Certificate Of Insurance Currency

Companies hiring contractors or other companies for work should obtain a copy of their COI and ensure it is up to date.

Typically, the consumer requests the certificate directly from the insurance company rather than the business owner or contractor. The customer should confirm that the name of the insurer on the certificate is the same as the company or contractor they are considering.

Also, the customer should check the policy coverage date to ensure that the effective date of the policy is current. If the policy is set to expire before the end of the contract, the customer must keep a new certificate.

Insurance policies have different sections for different types of liability coverage such as general, auto, umbrella and workers compensation. The term “insured” means the legal entity, person or entity in the certificate covered by the insurance policy.

Cyber Insurance Certificate

In addition to the level of coverage, the certificate details the policyholder’s name, mailing address, and services performed by the insured. The address of the insurance company is listed, as well as contact information for the insurance agent or person contacting the insurance company. If multiple insurance companies are involved, all names and contact information are listed.

When a customer requests a COI, they become the certificate holder. The customer’s name and contact information appear in the lower left corner, along with statements indicating the insurer’s responsibility to notify the customer of policy cancellation.

The certificate briefly describes the policies and limitations provided for each type of insurance. For example, the general liability section groups the six limits the policy provides and indicates whether the coverage applies to a single claim or occurrence. Because state laws determine the benefits awarded to injured workers, workers’ compensation insurance shows no limits. However, the amount of workers’ compensation coverage is listed.

If you request a COI from a contractor or business, they should be able to obtain it from their insurance company or provide you with their insurance company’s contact information, so you can request that the certificate be sent to you immediately. However, if you ask your seller to give you a COI, be careful. There have been reports of contractors submitting fraudulent COIs.

Certificate Of Insurance

Simply put, if you’re hiring a contractor or independent business for work on your home, you’ll need a Certificate of Insurance (COI). If you’re a contractor or business, you’ll need a COI to show your customers that you have insurance.

It’s best to hold on to any COIs you receive forever, as you never know if there’s a problem with work being done on your home or if you write off someone else’s. Keeping evidence of the COI will help resolve any issues at the time.

You must request a COI before anyone works on your home or property. If you have a written agreement, it should contain coverage requirements, including COI-approved coverage and coverage requirements.

You may need a Certificate of Insurance (COI) in many cases. Typically, a customer will request a COI directly from your insurance company to prove that you have appropriate coverage. If you’re hiring a contractor, consider getting a COI from their insurance company, even if you’ve worked with them before, as their coverage may vary.

Extracting Data From Certificates Of Insurance

Contributions shown in this table are reward-earning partnerships. This refund will affect how and where listings appear. Not all offers on the market are included. When applying for a position in a medical institution or signing a medical service contract, physicians must request and verify the “certificate of insurance” for the clinical program. Unfortunately, the wording of the certificate of insurance (sometimes called “certificate of insurance”, “certificate of liability” or “certificate of insurance”) can be difficult to interpret. Below is a description of the parts of a common certificate of insurance (COI) for medical malpractice insurance used in medical contracts and some important factors to consider when reviewing a COI. To view a larger .pdf version of the Health Insurance Certificate, click this link.

The first part of the COI prohibits you from relying on the information in it

Insurance adalah, certificate of insurance software, vendor certificate of insurance, certificate of business insurance, commercial insurance certificate, subcontractor certificate of insurance, cargo insurance certificate, ssl certificate adalah, insurance certificate software, certificate of insurance cost, liability insurance adalah, certificate authority adalah