How To Apply For Student Loans Without A Cosigner – Determining whether you qualify for student loans in Canada can seem overwhelming at first. However, the process is relatively simple. Let’s go inside.

With the average cost of post-secondary education ranging from approximately $2,500 to $11,400 per year, it’s no secret that continuing education can be expensive. However, these costs should not stop you from changing your career and landing your most desired role.

How To Apply For Student Loans Without A Cosigner

In Canada, there are many different student loan options – with different options for both full- and part-time students – that can be crucial to affording education.

Apply For Financial Aid — Upward Bound Program

But how do you know you’re eligible, and how do you apply? The student loan application process may seem daunting at first, but you can complete it in a few simple steps.

In this guide, we will address student loan eligibility criteria, application process details, and common questions about the loan process.

As the cost of post-secondary education in Canada increases, the number of student loans and student loan debt increases.

Student loans are very common in Canada, and as a result, there are plenty of resources available to help with the process. Keep explaining the eligibility criteria and how to apply.

Student Loan Forgiveness Application Closed After Court Ruling

If you’re wondering what it means to exceed the lifetime loan limit in Canada, don’t worry. We will explain what the loan limits are later in this guide.

Once you have decided whether you are eligible for a student loan in Canada, you can begin the application process. Follow the steps below to receive your application:

The student loan application process varies by province and territory, so you should make sure you follow the steps in your specific area. Click on the link below to access student support information relevant to your region or province:

After you’ve decided how the application process works in your area or province, you can fill out your application.

Infographic: How To Apply For Student Loans

For quick results, the Government of Canada recommends that you complete the application online; However, a paper application is also available.

The amount you will receive will be determined during the application period and you will know how much you will receive after your application is evaluated and returned to you.

Later, we’ll explain how funding is determined so you have a better idea of how much you qualify for.

Deadlines and processing times vary depending on which region or province you’re applying to, so make sure you know when you need to submit your application.

College Ave Student Loans Review For 2023

In most cases, you must submit your application at least six weeks before the start of the program. For most regions and provinces, the cycle opens in May and runs through September.

It is recommended that you apply early in the cycle to ensure you allow enough time for your application to be processed.

Once your application is processed, you will hear whether your loan has been approved or not. The evaluation will come by mail or email, depending on your region or province’s application process. Once you receive this assessment, you will know the details of your loan, such as whether it was approved and how much you received.

The money you get depends on many factors, especially income, location and program. The formula for calculating the student loan amount is given below:

How To Build Credit Without A Credit Card

Additional support is required, which is deducted from the allowable cost. The difference is the estimated dollar amount the student needs.

To get a better idea of how much you’re likely to receive in student loans, consult the student financial aid calculator.

There are three main types of student loans in Canada, each specific to the needs of Canadian students. There are three types of federal student loans in Canada:

Government school loan programs are those that administer loans through the federal government. Two types of government assistance are available:

Refinance Student Loans: Fast, Easy, And All Online

In some cases, you may be able to max out your government student loans but still need student aid. In this case, you can turn to your province or territory for additional loans.

If you’ve maxed out your government-backed loans, another option is to take advantage of private student loans available through various Canadian banks.

These loans allow you to take out a variety of loans to fund your post-secondary program. Some banks in Canada that offer student loans:

You have secured your loan; Congratulations! But, what will happen next? You will receive your loan at least one week before you start your program and you will be responsible for managing your loan while you are studying in Canada.

Best Student Loans In Singapore From Banks And Fis [2022 Updated]

Loan maintenance is exactly what it sounds like: the act of maintaining your debt on your schedule and within your repayment period. This means taking into account the specifics of your loan and loan repayments, such as:

The National Student Loan Servicing Center (NSLSC) will serve as your point of reference once you receive your loan and can help you maintain and update your loan status.

Once your debts are paid off, you can consolidate all your debts into one payment plan, known as debt consolidation.

When the time comes, you will receive your consolidation agreement from NSLSC – detailing your balance, monthly payments, repayment schedule and interest rate on your loan. You must receive this agreement approximately 45 days before your repayments begin.

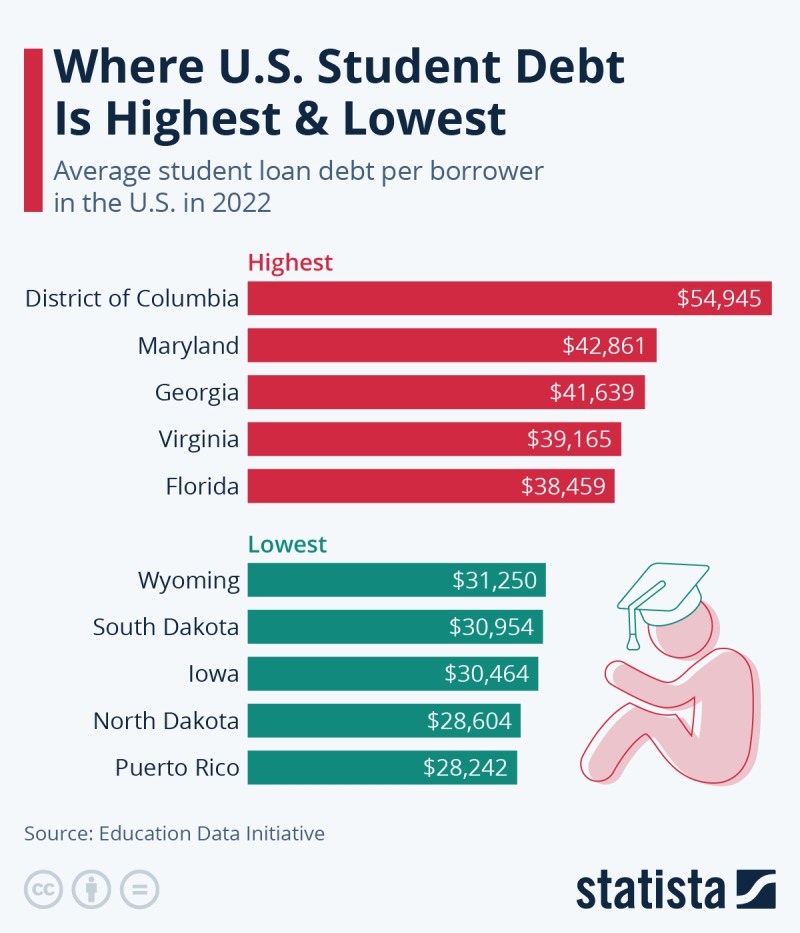

Chart: Where U.s. Student Debt Is Highest & Lowest

As your loan matures, you’ll enter a repayment cycle, but that doesn’t mean you can expect to pay off your loan immediately. Once your loan is paid off, there are a few ways to repay and you can choose the option that works best for you.

Immediately after the loan expires, you enter a six-month grace period on your loan. During this period, you will not have to pay any interest on your loan – meaning if you repay your entire loan during this period, you will not be charged any interest at all.

You can sometimes repay your loan without any interest. Two situations that allow deferred repayment include:

For federal loans, loan limits are specified by year and lifetime. Loan limits are set based on a number of weeks rather than a dollar amount. This means that when you reach your loan limit, you have used up federal loans for a certain number of weeks.

Limited Waiver For Student Loan Forgiveness Ends October 31

For lifetime credit, the maximum number of weeks is 340, except for students in doctoral programs (400 weeks) and students with disabilities (520 weeks).

Your annual loan limit depends on the program you’re part of; However, if you exceed your annual limit, you can use the time within your lifetime limit.

Still wondering how the student process works in Canada? Here are some common questions and answers about student loans in Canada. If you can’t find the answer to your question below, feel free to contact our admissions team to learn more.

You should submit your student loan application as soon as possible. For most regions and provinces, the application cycle begins in May and ends in September.

Student Loan Forgiveness Application: How To Apply Right Now

To ensure your application is processed before your program starts, you should try to submit your application earlier in the cycle.

If someone else is paying off your student loans, you can add their banking information through your online portal. After that, the recipient can make an additional payment through your account.

You can also give someone else a power of attorney, which means they can handle your student loans on your behalf.

Student loans are interest-free only during a six-month non-repayment period or deferred repayment if you qualify under certain circumstances.

When And How To Apply For Student Loans

If you need help applying for a student loan, our team at Robertson is here to guide you through the process. We can help you:

Once you take the first step, one of our student admissions advisors will contact you to better understand your future goals. Aside from buying a home, paying for college can be one of the biggest expenses for a family. It is best to start preparing before the big day arrives. Of course, saving upfront will help you cover some expenses without taking out a loan. Check out NY’s 529 College Savings Program or New Jersey’s 529 College Savings Plan. Still, many students must finance at least part of their college education. In this guide, we’ll explain the different types of student loans, how they work, and what you need to apply for.

Before starting the application process, you need to know the two types of student loans available to students and parents.

U.S. The Department of Education offers direct subsidized and unsubsidized loans to graduate students. The grant means the Department of Education will pay the interest accrued on the loan at least half the time you are in school and up to six months after you graduate.

Can International Students Apply For Student Loans In The Usa? Answered

Direct unsubsidized loans are available to graduate students. Parents can also take a Direct PLUS loan to pay for their child’s education.

As with all federal student loans, there are annual limits on how much you can borrow and the total loan limit.

Private student loans are available from credit unions like Palisades as well as other lenders. Undergraduate and graduate students, as well as parents, can get private student loans to pay for college. If federal aid isn’t enough, private loans can help you

Apply student loans without cosigner, apply for private student loans without cosigner, discover student loans cosigner, student loans without cosigner, student loans to apply for without cosigner, best student loans to apply for without cosigner, how to apply for student loans without a cosigner, best student loans without cosigner, student loans for daca without cosigner, refinance student loans without cosigner, where to apply for student loans without a cosigner, discover student loans without cosigner