Assurance Emprunteur – A mortgage loan can be granted to the borrower for 15, 20 or 25 years. During this period, risks may arise that may make it difficult to repay your loan. To avoid these situations, customers are requested to have creditor’s insurance. Part or all of the compensation can cover unemployment, accidents, or death and accidents for the spouse and heirs. The bank issuing the mortgage loan usually offers the insurance contract itself. The borrower can opt for this turnkey solution or the provision of insurance, which involves concluding a contract with another insurance company. In all cases, the institution provides the borrower with a standard information document (FSI), which provides the features of credit insurance and allows borrowers to know the exact terms and prices of the insurance.

Get a special analysis of your loan, free of charge and without obligation, and benefit from special follow-up with a consultant.

Assurance Emprunteur

* Applies to Facilimmo credit only. Flexible options are only available for the first time after a waiting period (between 12 and 24 months after disbursement, depending on your Regional Fund). Discuss the terms and limitations of use with your advisor.

Assurance Emprunteur Et Droit à L’oubli — Maxiassur

Your real estate loan is subject to the acceptance of your file by your regional lender, Crédit Agricole. You have 10 days to consider accepting the loan offer. Completion of the sale is dependent on the loan being received. If it cannot be achieved, the seller must return the amount you paid. To get a loan, you must have a death and disability insurance contract. You have two options: a contract offered by the lender or a contract issued.

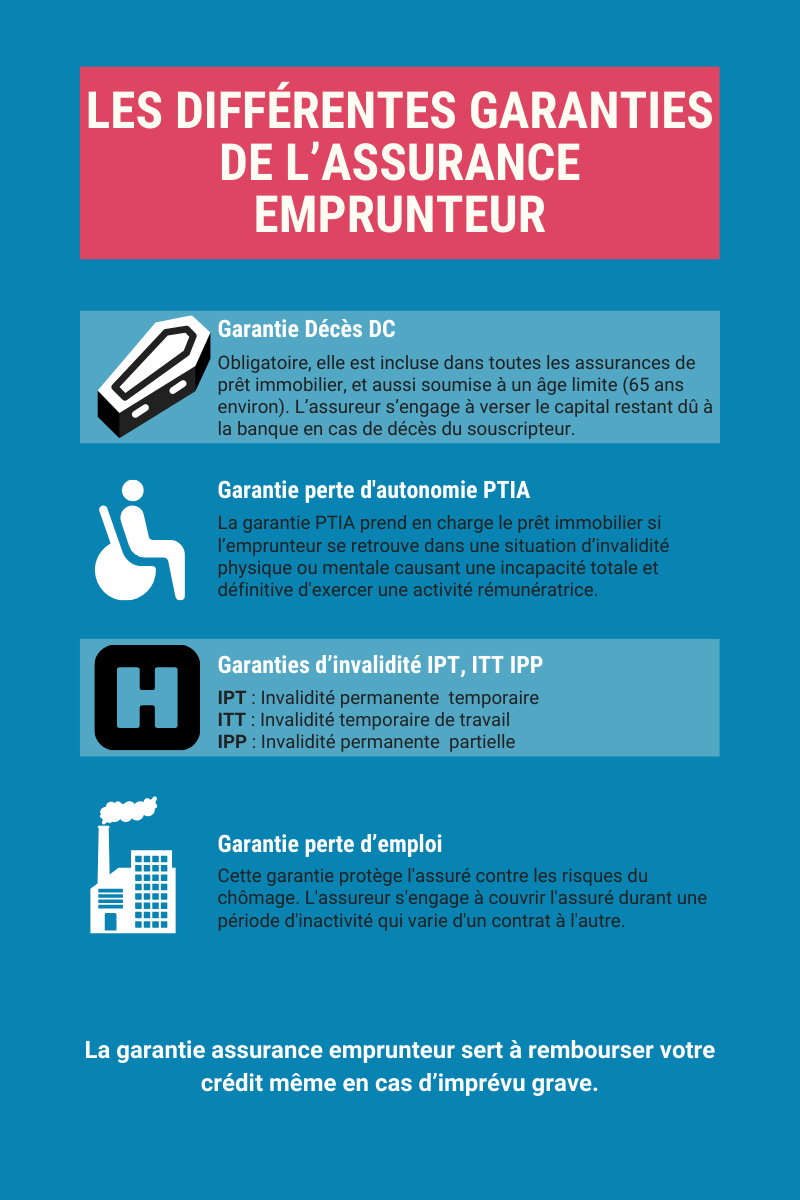

Considering the amount and duration of a mortgage loan, insuring your loan means protecting you and your loved ones. You will be sure that in the event of disability or death, your heirs will not carry the burden of your debt.

It is unlikely that the bank will offer you a “partial” contract in which you negotiate with a company and jointly guarantee the risk. Disadvantages: conditions cannot be set and are the same for everyone. The extra money in addition to the monthly payment is set between 0.35% and 0.50% of the loan capital (or repayment), four depending on the company.

Since 2010, the law of Lagarde and the law of Bourquin allows you to take the credit insurance through another company, if the guarantees offered are not less than the same. Considering their prices, these contracts can be very profitable: from 0.10% to 0.30% depending on the age.

L’assurance Emprunteur, Késako ?

The prices are valid for 100% of the monthly payment for one person or 50% for two people (in the case of joint debts).

If you want to be the last survivor for free, enter all 100% insurance. The cost of insurance will be doubled: For example, if it is shown that 0.30% of the loan amount, it will increase to 0.60%. Credit insurance, which aims to guarantee the payment of your home loan in cases that prevent life-threatening situations. you from repayment, secure your real estate business.

It may also include Total Impaired Interest (IPT) or Partial Irregularity (IPP) or Total Irregularity (ITT), depending on your farm work. The conditions under which these guarantees can be generated vary from contract to contract.

Proof of job loss is offered if the borrower is an employee under a Permanent Contract. This includes the risk of unexpected job loss in the event of layoff. Again, insurers set their own standards: waiting periods, maximum payout periods, age limits for job loss, etc.

Les Nouveautés Du Contrat D’assurance Emprunteur

Since the Lagarde law of 2010, you can choose two types of contract depending on your situation: partial insurance or insurance provided.

This agreement brings together risks that are distributed fairly among all members, regardless of their background.

Transfer insurance is provided to you individually by an organization other than your real estate lender and must offer an equal or greater level of coverage. than what the lender originally offered.

Individual insurance depends on the background of borrowers, their age, health status, occupation, etc. A specific rate is offered. Therefore, their prices can vary from one borrower to another depending on the level of risk they represent.

Comment Bien être Couvert Par Son Assurance Emprunteur ?

If you opt for qualified insurance, the level of guarantee must be the same as the level of the partial contract that was previously offered.

The 2022 Lemoine policy allows you to cancel your liability insurance at any time for the duration of your contract.

This right to cancel can be used in any way (simple or registered mail, e-mail, request to your customer group, etc.).

The only condition: The warranty level of your new insurance contract must be the same as your new contract.

Changer D’assurance De Prêt Immobilier

To learn more about debtors insurance, download our free Debtors Insurance guide: understand how to choose wisely

Do you want to get a credit insurance offer that is suitable for all aspects of your project and your profile?

Our advisors are there to support you, providing advice and information with affordable prices and guarantees.

Our consultants are available from 9am to 6pm Monday to Friday and 10am to 2pm on Saturdays. Credit insurance is an important consideration when buying real estate, especially when buying from a bank. LP/Jean-Baptiste Quentin

Assurance Prêt Immobilier à L’outre Mer

The big bang has arrived. On the afternoon of Thursday of this week, members of Parliament voted in the bill that provides for the termination within a year, which means the opportunity for individuals to terminate their insurance in the following a time The bill, introduced by Patricia Lemoine (Agir) and supported by the government, was passed almost unanimously (61 votes, one against). “This is great news for France,” said the MP. This law will allow families to save a large amount of money, on average between 5 and 15,000 euros, depending on the duration and amount of the loan. »

It aims to simplify the process and leave “free choice to the customer” in the face of the monopoly of insurance banks, which are often more expensive and use 88% of the market, which is available eat 7 billion billion a year. “This is a great development! We are waiting for a wave. Six million debtors will finally be able to have purchasing power and change insurance companies as they wish,” said the CEO of April Eric Maumy (Acpade), another insurer and founder. the association promotes competition in creditor insurance.

The bank connections look bad. Because of the historically low interest rates on home loans, borrowers’ insurance represents one way to make a profit. “The maintenance of the establishment of the present day of celebration makes it possible to easily carry out contests for the appropriate customer who celebrates first every year and the preservation of this classic example by offering the many offers,” we remind the French Banking Federation. . (FBF) fears the “demutualization” of risks, contrary to the “French model” of insurance.

Until then, changing borrowers’ insurance policies has been a challenge, despite the accumulation of legal writings that have come into play over the past decade. . In 2010, Lagarde’s law gave the borrower the power to conclude a contract with someone other than the bank that issued the loan. After four years, Hamon’s law allows you to change the liability insurance at any time within the first year of the contract with fifteen days’ notice. The amendment of Bourquin, finally used in 2018, establishes the possibility of terminating each day of the contract if the debtor gives notice to his insurer by registered mail to the less than two months earlier.

Comment Changer Son Assurance Emprunteur ?

The senators must review and vote on the law, probably at the beginning of the new year, so that you can change it at any time with a simple register. In this case, there is a one-year delay before enforcement. “I hope that my colleagues in the Senate will understand the conditions of this law, which is about social justice,” insisted Patricia Lemoine, who is afraid of the “strong” bank. Last year, the Palais Bourbon finalized the amendment of the law, which has been approved at any time but was not supported by the government. Astrid Cousin, a spokeswoman for the online insurance company magnolia.fr, thinks banks will “do everything” to adjust this year’s delay. “They will come up with new products or new strategies to prevent or prevent their customers from switching insurance,” he said.

Beyond the termination, the new law also provides for the insurer to announce the possibility to change the contract every year under penalty of penalty. One aspect is also related to the “right to be forgotten”, which is only available to debtors suffering from cancer.

Security assurance, assurance emprunteur cnp, assurance habitation, assurance animaux, axa assurance, intact assurance, service assurance, emprunteur, air assurance, life assurance, devis assurance emprunteur, comparateur assurance emprunteur immobilier